Canada’s international gold producer Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) continues to make steady progress with its newest asset in Newfoundland.

Calibre entered into a pre-commissioning and commissioning contract with Reliable Controls Corporation (RCC) for its Valentine mine’s process plant on Thursday. Meanwhile, Asahi Refining USA has agreed to purchase 27,600 ounces from Calibre’s upcoming production yield. Both companies are based out of Utah.

Reliable Controls is highly experienced with mine and mill commissioning and has worked with major operators like Newmont Corporation (TSX: NGT), Rio Tinto Group (ASX: RIO) and Barrick Gold Corporation (TSX: ABX).

“I am pleased to announce that we have secured RCC, a team of highly experienced commissioning experts to lead pre-commissioning and commissioning of the process plant,” Calibre chief executive Darren Hall said.

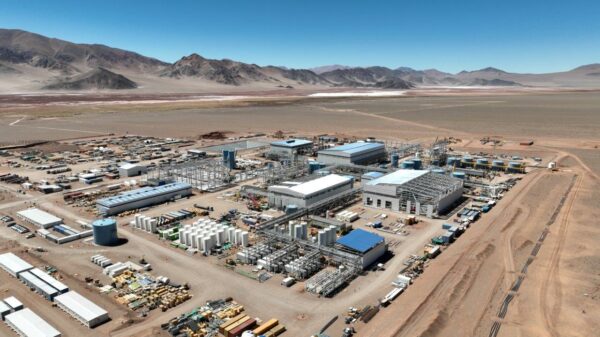

The Valentine project’s plant site on Saturday. Photo: Calibre Mining

Asahi has provided Calibre with US$40 million upfront through the gold prepayment deal and will pay an additional US$20 million in mid-April. The American company will start receiving 2,300 ounces of gold for 12 months this May.

Asahi’s Canadian subsidiary recently obtained Responsible Jewellery Council certification for its ethical standards. The company has a series of precious metals refinery operations throughout North America and one in Japan.

“Given the strong gold price environment, and continued investment across our portfolio of assets,” Hall said, “we have executed a US$60 million 12-month gold prepay as part of our cash flow management strategy.”

Calibre is on schedule for first gold production at its newly acquired Valentine gold project during the first half of next year.

We’ve got a long track record of growth through strategic expansion, with the Valentine Gold Mine being the latest acquisition to drive us forward and level us up to mid-tier gold producer status.

And we couldn’t be more excited to make the leap. 📈https://t.co/e8mEECoaBR pic.twitter.com/QtoNJ5IM1x

— Calibre Mining Corp. (@CalibreMiningCo) March 27, 2024

Read more: BMO underwriters agree to invest C$100M in Calibre Mining

Read more: Calibre Mining added to VanEck Gold ETF

Calibre gets US$100M from BMO bought deal; secures listing on VanEck gold ETF

Underwriters from BMO Capital Markets recently agreed to purchase almost 60 million Calibre shares at a fixed price of C$1.68 apiece. The deal is expected to be finalized mid-way through next month.

Calibre was also recently added to the list of companies on the VanEck Vectors Gold Miners ETF (NYSE: GDX). The exchange-traded fund is comprised of operators like Newmont, Wheaton Precious Metals Corp. (TSX: WPM), Barrick and Franco-Nevada Corporation (TSX: FNV) as well.

The price of gold has shot up by about 11 per cent since mid-February. It is currently worth over US$2,200 per ounce. The renowned American bank JPMorgan Chase & Co (NYSE: JPM) has predicted that it will hit US$2,300/oz next year.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com