Earlier this week, Wonderfi Technologies (TSX: WNDR) (OTCQB: WONDF) (WKN: A3C166), Coinsquare Ltd. And CoinSmart Financial (NEO: SMRT) (FSE: IR) announced a three way combination of their respective businesses to build one of the largest digital asset trading platforms in the world.

The new company will also providing Canadians with products and services that stretch outside the realm of traditional cryptocurrency options. These options will include both retail and institutional crypto trading, staking products, business-to-business payment processing and also sports betting and gaming.

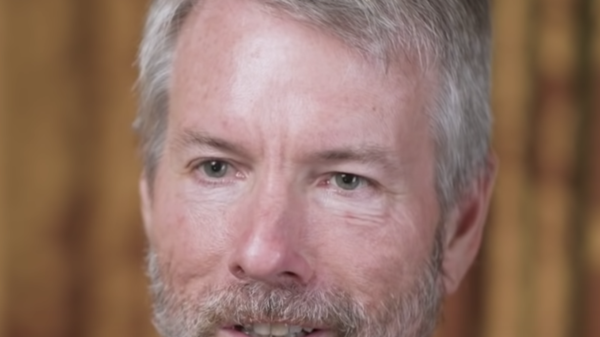

“For years operating a registered cryptocurrency platform was a disadvantage as competitors that provided services without the burden of compliance costs were far more profitable,” said WonderFi strategic investor, Kevin O’Leary.

“Those days are over. Investors that see the tremendous potential of cryptocurrencies to make financial services more transparent, less costly, and more productive are seeking investment opportunities that operate in harmony with their regulators.

The new company will be Canada’s largest crypto trading platform, with over $17 billion in transactions and more than $600 million in assets under its care since 2017. It will also have over $50 million in cash and investments, and no debt, which will be invested across the crypto ecosystem.

The company also brings a shared services model, will be entirely compliant with regulations, and have multi-channel marketing to yield significant cost and operational synergies.

WonderFi Interim CEO Dean Skurka and strategic investor Kevin O’Leary sat down with Brendan Wickens of @traderTVLIVE this morning to discuss the new business combination agreement.

Here's a clip! pic.twitter.com/QbmS0pG01H

— WonderFi (@WonderFi) April 4, 2023

Read more: INX Digital and Greenbriar Capital collaboration lists first regulated tokenized shares

Read more: Deficits in regulation and ‘common knowledge’ culprits in rise of crypto theft: Kaspersky report

New company brings payment processing with international clients

“Canadian investors want to know that their platform has longevity, their funds are safe and secure, and they can access innovative crypto products,” said Martin Piszel, CEO of Coinsquare. “The combination of these 3 leading Canadian brands provides a path to building a profitable, first-of-its-kind multi-asset class platform in Canada.”

The new company wholly owns multiple platforms, including Bitbuy, Coinberry, Coinsquare, CoinSmart, SmartPay, CBIX, and Bitcoin.ca. They’ll consolidate the registered crypto asset trading businesses under Coinsquare’s investment dealer registrant and Coinsquare Capital Markets Ltd.

Additionally, the company brings a profitable payment processing division with international clients, a track record of revenue generation, significant potential upside with digital asset custodian, Tetra Trust, handling custodianship for digital assets, and an entry into regulated iGaming and sports betting in Ontario. They’ll be profitable with no debt, over $50 million in cash and investments, and global expansion opportunities.

Coinsquare accomplished a milestone in October 2022 by being the first Canadian crypto trading platform to register as an investment dealer and secure membership with the Investment Industry Regulatory Organization of Canada (IIROC), which is now known as the New Self-Regulatory Organization of Canada (New SRO).

“We view this combination as a significant and thrilling achievement for all three firms, bringing together Bitbuy’s brand and technology, our global crypto payments solution SmartPay, international OTC capabilities, and Coinsquare’s IIROC registered platform and product offerings,” said CoinSmart CEO Justin Hartzman.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com