A subsidiary of Wheaton Precious Metals Corp. (NYSE: WPM) (TSX: WPM) is set to buy the Mineral Park silver mine in Arizona from Waterton Copper Corp for USD$115 million.

Wheaton announced the signing of the purchase agreement on Wednesday, adding an average of 0.69 million ounces (Moz) of silver for the first five years of production, and 0.74 Moz of silver per year for the duration of the mine, directly to its balance sheet.

WPMI will make ongoing payments for the silver ounces delivered, which will amount to 18 per cent of the spot price of silver until the uncredited deposit is reduced to nil. Subsequently, this percentage will increase to 22 per cent of the spot price of silver.

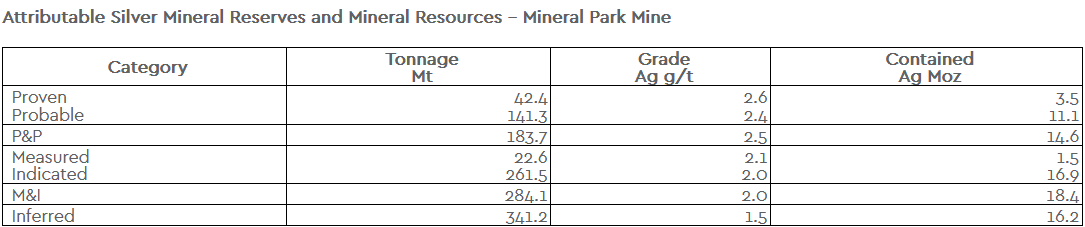

In addition to these payment terms, the addition of Mineral Park will significantly bolster Wheaton’s overall silver reserves and resources. Specifically, it is expected to increase Wheaton’s total estimated Proven and Probable Mineral silver reserves by 14.6 Moz, measured and indicated Mineral silver resources by 18.4 Moz, and Inferred silver resources by 16.2 Moz.

Image via Wheaton Precious Metals.

WPMI plans to provide Waterton Copper with a total upfront cash payment of $115 million. This payment will be distributed in four installments throughout the construction process, consisting of three payments of $25 million each and a final payment of $40 million.

“Our unique understanding of Mineral Park, and its potential, positions us well to assist Waterton Copper in bringing the mine back into production in a sustainable manner,” said Randy Smallwood, Wheaton’s president and CEO.

“As global efforts to transition to a low-carbon economy accelerate, critical metals, such as copper, that are produced responsibly within politically stable jurisdictions, have never been more important.

In addition to the main terms of the agreement will include a customary completion test.

Once the full upfront consideration has been paid, WPMI will provide a secured debt facility of up to $25 million. WPMI has also secured a right of first refusal on any future precious metals streams, royalties, prepay, or similar transactions.

To ensure the agreement’s security, both Waterton Copper and Origin Mining Company, LLC, the direct owner of Mineral Park, will provide corporate guarantees and certain other security measures over their assets. Additionally, Waterton Copper is expected to comply with WPMI’s Partner/Supplier Code of Conduct, which outlines Wheaton’s expectations in regard to environmental, social and governance (ESG) matters.

Wheaton Precious Metals shares remained flat at $59.94 on Wednesday on the Toronto Stock Exchange.

Read more: Calibre Mining Q3 gold production numbers exceed analyst expectations: Canaccord Genuity

Read more: Calibre Mining’s Nicaragua operations will fuel company growth on all fronts: PI Financial

Precious metals continue to draw significant attention

One of the primary draws for investors and mining companies to precious metals is the potential for significant financial gain.

Specifically, both gold and silver have long histories of maintaining their value during economic downturns and times of uncertainty. This intrinsic store of value has made them both attractive assets for investors seeking a hedge against inflation, currency devaluation and global market fluctuations.

The prospect of profiting from rising precious metals prices, coupled with the opportunity to leverage their value, continues to make gold and silver mining an appealing investment choice.

Additionally, specifically gold mining has proven to be a lucrative investment for multitude of reasons, including portfolio diversification and the strong potential for profit.

A few of the biggest players in the gold mining sector include Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX) and Newmont Corporation (NYSE: NEM, TSX: NGT) , but also include other smaller players like K2 Gold Corporation (TSXV: KTO) (OTCQB: KTGDF) (FWB: 23K) and Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF), which recently sold record breaking amounts of gold in Q2 2023 due to its cost-reduction strategies and underground mining operations in Nicaragua and Nevada.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.