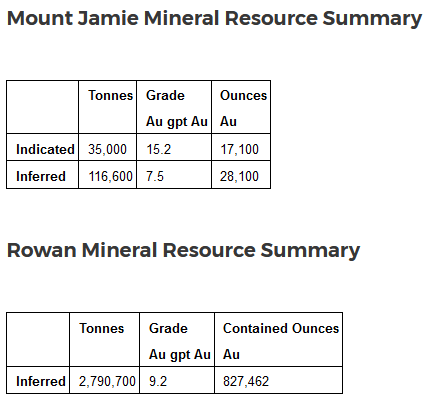

West Red Lake Gold Mines (TSXV: WRLG.V) filed a National Instrument 43-101 technical report on its West Red Lake Project containing a mineral resource estimate (MRE) on the Mount Jamie Mine, Pipestone Bay Gold deposit and Rowan Mine Project today.

The report was called “Technical Report and Resource Estimate on the West Red Lake Project.” It employed a 3D block model using an inverse distance squared method to extrapolate grades.

The company used Dassault Systemes, Geovia GEMS version 6.5 as the software for all geostatistical analysis and computation. The estimates are from October 31, 2022 and were created with a series of parameters in mind. These include the price of gold at USD$1,600 with the exchange rate between USD and CAD being CAD$0.78. Also, the report included a block cutoff rate of 3.8 gpt Au.

Image via West Red Lake.

The project is 3,100 hectares, with three former gold mines and 145 contiguous patented, leased and staked mining claims. It’s located 16 kilometres west-northwest of Red Lake, Ontario.

The company owns the Mount Jame mine and Red Summit mine properties, and shares the Rowan Mine in a 69 per cent to 31 per cent joint venture split with Australia-based Evolution Mining.

The West Red Lake property covers a 12 kilometre strike along Pipestone Bay St. Paul deofrmation zone, and the company is still exploring the property both along strike and to depth.

Read more: Orea Mining acquires Nordgold’s 55 per cent stake in French Guiana gold mine

Read more: Two B2Gold employees dead after off-site robbery incident in Mali

West Red Lake uplists to TSX Venture exchange

This is the company’s first action since its business combination late last year. West Red Lake Gold Mines Ltd and DLV Resources combined into a common company for 0.1215 of a WRL common share in the dying days of 2022.

The shift included a board shuffle involving the resignation of the existing directors and a reconstitution of the board to include Tom Meredith, John Heslop, Ryan Weymark, Susan Neale and Rob van Egmond. Additionally, Tom Meredith assumed the role of CEO.

Furthermore, the company changed its name from DLV Resources, and graduated to Tier 2 of the TSX Venture Exchange as of today. Additionally, all existing shares of RLG have been delisted from the Canadian Securities Exchange as of today.

Follow Joseph Morton on Twitter

joseph@mugglehead.com