Americans were conned out of over USD$506 billion last year through cryptocurrency oriented fraud, according to a recent report from the Federal Bureau of Investigation (FBI).

Released on Monday, the report showed a steep 45 per cent increase in losses since 2022.

Investment fraud schemes like ‘Pig Slaughtering’ and ‘love cons’ emerged as the most common type, responsible for nearly USD$4 billion of the losses. In a pig slaughtering scheme, scammers often build trust with victims over time using dating apps or social media. When the relationship is secure, scammers convince their targets to invest money through fake websites or apps. They will sometimes allow small withdrawals early on to make the scheme appear legitimate.

In some cases, scammers target these victims again, posing as bogus businesses offering to help recover the lost cryptocurrency. FBI officials warn that Americans of all ages can fall victim to such scams and advise extreme caution when considering investment opportunities from people they haven’t met in person.

Victims of financial fraud involving bitcoin, ether, and other cryptocurrencies filed nearly 70,000 complaints with the FBI in 2023.

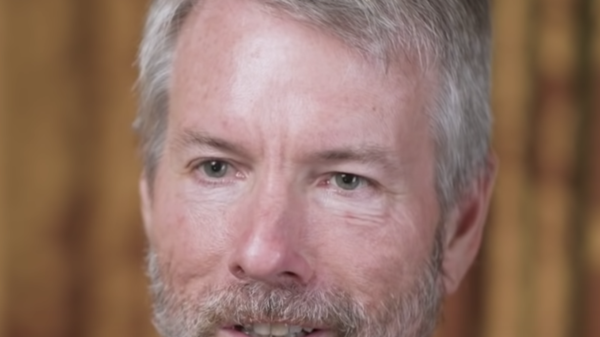

“The decentralized nature of cryptocurrency, the speed of irreversible transactions, and the ability to transfer value around the world make cryptocurrency an attractive vehicle for criminals, while creating challenges to recover stolen funds,” said Michael Nordwall, assistant director of the FBI’s criminal investigative division.

Many individuals have incurred massive debt to cover losses from these fraudulent investments. While individuals aged 30-39 and 40-49 filed the most complaints, those over 60 reported the highest losses, totalling over USD$1.24 billion.

Read more: Telegram CEO calls French charges ‘misguided’

Read more: Riot Platforms plays the next gambit in takeover bid for Bitfarms

Criminals use cryptocurrency advantages for large scale scams

Cryptocurrency operates in a decentralized and distributed manner, offering a secure way to transfer value. Users can now transfer thousands of different cryptocurrencies globally in exchange for goods, services, or other cryptocurrencies. By eliminating the need for financial intermediaries to validate transactions, cryptocurrency allows criminals to exploit these features for theft, fraud, and money laundering.

A cryptocurrency transfer can happen anywhere, requiring only a special password or PIN and an Internet connection. These are irrevocable and cannot be reversed. Criminals, operating from any location with Internet access, take advantage of these features to facilitate large-scale, near-instant cross-border transactions without relying on traditional financial intermediaries that enforce anti-money laundering programs.

Cryptocurrency transactions are permanently recorded on publicly available blockchains. This allows law enforcement to trace the movement of funds more easily than with other financial systems. However, challenges arise when cryptocurrency is transferred to exchanges in other countries. US law enforcement may struggle to follow the funds in jurisdictions with weak anti-money laundering regulations.

Although individuals over 60 years old experienced the highest losses, the majority of complaints came from people aged 30-49.

The FBI is actively raising public awareness of these scams and training local law enforcement to recognize the signs of crypto fraud. Efforts are also underway to recover stolen funds, though the nature of cryptocurrency presents significant challenges. While the report focuses on American victims, it highlights the global nature of the issue, with many scams linked to international criminal networks, particularly in Southeast Asia.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com