Revenues are stabilizing for The Valens Company Inc. (TSX: VLNS), as the cannabis extractor continues shifting its focus to increasing third-party manufacturing.

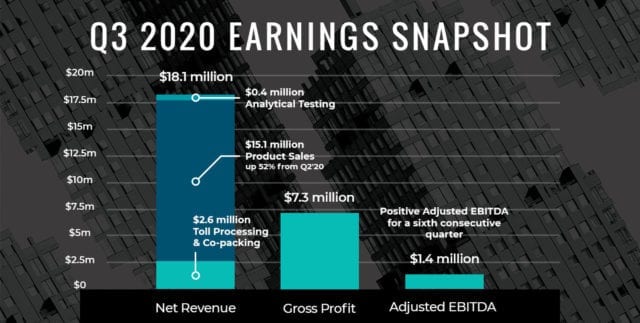

After markets closed Wednesday, the British Columbia-based company reported net revenues of $18.1 million for its third fiscal quarter ended August 31, a 2.8 per cent increase over last quarter.

Since the company’s record sales of $31.9 million in the first quarter 2020 — which is when cannabis 2.0 products came online in Canada — the market has been flooded with a supply glut of bulk resin. That’s because larger operators struggled to scale up production for new product formations in the first months of the pandemic.

Read more: A rough quarter for leading extractor Valens

To address this issue, CEO Tyler Robson said Valens secured a number of new brand partners with white label and custom manufacturing deals.

Sales from those third-party contracts make up 83 per cent of third-quarter revenue, a quarterly increase of 52 per cent. The number of stock-keeping units also increased 56 per cent.

“In the third quarter we saw our pipeline of manufacturing agreements begin to come to fruition, having manufactured a record-breaking 56 SKUs that span four product categories, with formats ranging from disposable vape pens, vape cartridges, oils and oral sprays, to beverages and concentrates,” Robson said in a statement. “We expect to see further product revenue growth in Q4 as we continue to ramp up these manufacturing agreements to bring a wide variety of 2.0 products to domestic and international markets.”

Reported gross profit was $7.3 million, or 39.5 per cent of revenue, compared to $6.3 million, or 35.8 per cent of revenue in the last quarter.

However, the company said its gross profit margins have fallen significantly year-over-year due to the continued pullback in toll extraction sales from larger producers.

Adjusted earnings before interest, taxes, depreciation, and amortization came in at $1.4 million, compared to an adjusted EBITDA of $2.7 million in the previous quarter.

The company says it has a strong balance sheet with $30.3 million in cash as of Aug. 31. Valens also reported a positive net working capital position of $83.5 million.

The company also has access to $40 million of secured-debt financing to bolster its balance sheet, according to the statement.

To offset growing pains in domestic markets, Valens secured its first international oil shipment to Australia via Cannvalate Pty Ltd., the country’s largest medical weed distributor and clinical research organization.

FACILITY UPDATE FRIDAY // Join COO, Chantel Popoff in an update on our K2 Facility Expansions.

Built to service our current and future extraction, white-label, and custom manufacturing needs with the opportunity to receive EU-GMP processing and manufacturing compliance // #VLNS pic.twitter.com/8yMqQDNQ0v

— The Valens Company (@TheValensCo) October 9, 2020

To execute more global supply deals and ramp up its third-party manufacturing strategy, the company said it’s applied for a licence amendment to expand its K2 facility in Kelowna, B.C.

The new 42,000 square foot site was built to EU GMP standards and the company expects licensing approval in the coming months.

Shares of Valens dropped 4.4 per cent Wednesday on the Toronto Stock Exchange.

Top image via Valens

jared@mugglehead.com

@JaredGnam