The Valens Company Inc. (TSX: VLNS) (Nasdaq: VLNS) had a lower revenue this quarter due to lower bulk sales as well as cybersecurity attacks on the Ontario Cannabis Store and the labour strike in British Columbia.

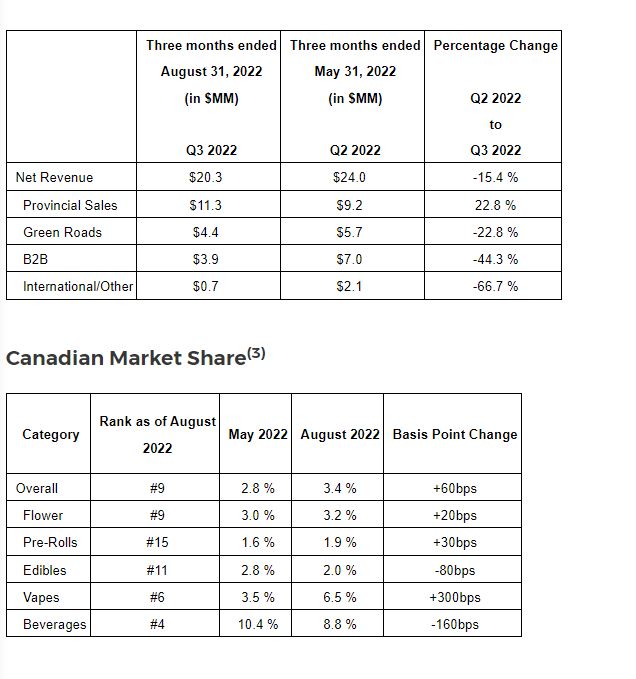

On Thursday, the cannabis producer reported its third-quarter financial results for the period ended August 31 and saw a 15.4 per cent net revenue decrease to $20.3 million from $24 million in the last quarter. Provincial sales –the company’s largest segment– increased by 22 per cent to $11.3 million from $9.2 million in the last quarter.

Valens said that despite its sales being strong it could have achieved a larger growth in provincial sales but its momentum was halted by the OCS attack and the strike in B.C. The loss in revenue was also attributed to a decrease in sales for bulk for its U.S.-based Green Roads CBD subsidiary.

Green Roads revenue decreased by 22.8 per cent to $4.4 million from $5.7 million in the second quarter and it was due because of delays and stock-outs in major products, as well as technical challenges and management changes. Valens says it has done things to avoid the disruptions going forward and will continue to work with suppliers.

Photo via Valens

Read more: Valens enters Mexico via drug supplier to distribute CBD and succulent-based powder

Read more: SNDL and IM Cannabis ship first pot flower batch to Israel under joint agreement

The company saw strong sales of vape products and direct-to-consumer e-commerce sales contributed 54.5 per cent this quarter which is a decline of 1.5 per cent from the last quarter.

Adjusted earnings before interests, taxes and depreciation went up by $6.1 million over the quarter to a negative $9.8 million from $15.9 million in the second quarter. B2B sales decreased by 44.3 per cent this quarter to $3.9 million from $7.0 million driven by lower bulk sales.

The company’s international revenue declined this quarter to $0.7 million by 66.7 per cent from $2.1 million.

Net loss reached a negative $27.8 million, which was a steep decline from negative $160.8 million in the last quarter.

During the quarter, Valens launched Bon Jak in Quebec and secured an exclusive partnership with ColdHaus distribution.

This August, the company announced a $138 million deal to be acquired by leading retailer SNDL Inc. (Nasdaq: SNDL) –formerly Sundial Growers– to create a vertically integrated cannabis platform.

Read more: Valens partners with distributor Coldhaus to accelerate growth in key markets

Read more: Valens to bring medical pot ‘smart kiosks’ to US shopping centers

“Our third quarter results clearly show that we are executing the most important initiative in this environment which is cash flow,” Valens CEO Tyler Robson said.

“We are continuing to realize the benefits of our previously announced Integration Initiatives, with a significant decrease in our cash burn, which not only exceeded our previously stated guidance range but was down approximately 62 per cent quarter-over-quarter, despite lower net revenues.”

“Most importantly, we saw adjusted gross profit margin improve quarter-over-quarter to 24.9 per cent compared to 17.2 per cent in Q2 2022, as we continued to see the benefits of our previously announced Integration Initiatives flow through the income statement,” Robson added.

“During the quarter Valens entered into an arrangement agreement to be acquired by SNDL to create a leading vertically integrated cannabis platform in Canada. With the current market economic headwinds, we believe the pro forma company will be well-positioned to capture market share while also providing our investors with exposure to one of the strongest balance sheets in the industry.”

“Moreover, the pro forma entity will be the largest revenue-generating cannabis company in Canada with a near-term opportunity to become one of the most profitable cannabis companies in Canada.”