US Gold Corp (NASDAQ: USAU) has updated its pre-feasibility study for the CK gold project in Wyoming, which replaces the existing one from 2021 and incorporates work finished while the company was acquiring permits for the property.

Announced on Tuesday, the new study noted that the CK project has a pre-tax net present value (NPV) of USD$459 million with a 36 per cent internal rate of return and a 1.7 year payback period. The project’s new NPV is a 42 per cent increase on the previous estimate while the payback itself improved by 15 per cent.

Furthermore, updated economics reflect a revised mineral reserve base that supports a 10-year mine life at CK, with total production of 680,000 ounces of gold, 208 million pounds of copper, and 2 million ounces of silver, or 1.1 million gold-equivalent ounces (AuEq).

The life-of-mine average all-in sustaining costs (AISC) have increased to USD$937 per gold-equivalent ounce from the previous USD$800 AISC. The initial capital requirement has also risen to USD$277 million, up from USD$221 million.

“With avenues to project financing which preserve shareholder positions through a number of arrangements that avoid overly dilutive equity offerings, we believe that development on the CK asset can proceed in the relative short-term, fulfilling the company’s pivot to development of the CK Gold asset and ultimately allowing the Company to return to exploration in its high-potential exploration portfolio,” said George Bee, president and chief executive officer of U.S. Gold Corp.

Read more: Calibre Mining demonstrates gold standard for principled mining

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

US Gold received air quality permit in November

Excluding reserves, which measure 1 million ounces of gold, 260 million pounds of copper, and 3 million ounces of silver—an increase of 16 per cent from 2021 in gold-equivalent (AuEq) terms to 1.7 million ounces—the CK project also holds mineral resources across all categories totaling 465,000 ounces of gold, 153 million pounds of copper, and 1.6 million ounces of silver (957,000 ounces AuEq).

The PFS work expands on advanced studies with Samuel Engineering, which the company contracted in 2022 to fast-track the project toward a feasibility study. However, the company halted that work until securing the necessary permits. Since then, US Gold has completed the permitting process, receiving the final key air quality permit in November 2024.

Bee said that the new PFS demonstrates “excellent economics,” and the company will continue optimizing the project ahead of the feasibility study, which it expects to complete by year-end without requiring extensive additional fieldwork or major expenses.

Bee added that the company aims to begin construction of the now-permitted CK project as early as late 2025. It’s targeting first concentrate production in 2027 or 2028. The company also sees potential to expand resources at depth and to the southeast of the main orebody. This could extend the mine life or increase production.

The company acquired the project, located in the Silver Crown mining district of southeast Wyoming, from Energy Fuels in 2014. By midday Tuesday, the company’s shares had risen 2.9 per cent, bringing its market capitalization to USD$111 million.

Read more: Calibre Mining’s mineral resource estimate in Talavera gives reasons for optimism

Read more: Calibre Mining demonstrates gold standard for principled mining

Nevada is home to multiple different gold trends

Nevada is one of the world’s top gold mining jurisdictions, attracting companies with its rich mineral endowment, favourable regulatory environment, and well-established infrastructure.

The state’s Carlin Trend, Battle Mountain-Eureka Trend, and Walker Lane Trend host some of the largest gold deposits in North America.

Nevada’s low-tax policies, regulatory environment, and skilled workforce further enhance its appeal.

Additionally, much of its gold is found in Carlin-type deposits, which are known for their high-grade, near-surface oxide mineralization. This is what makes them well-suited for cost-effective heap leach operations.

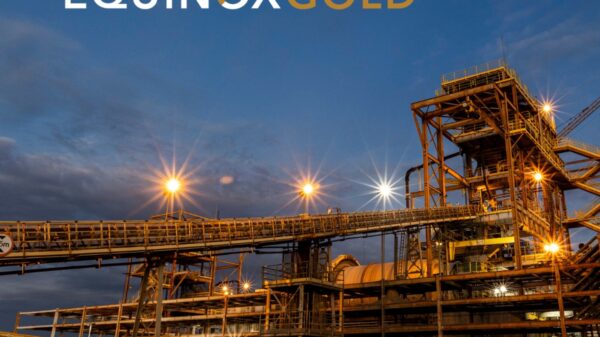

One company active in Nevada is Calibre Mining Corp. (TSE: CXB) (OTMRKTS: CXBMF), which operates the Pan Mine in White Pine County.

The oxide gold deposit is processed using a heap leach operation, a cost-efficient method ideal for the region’s mineralization. Calibre has been optimizing Pan Mine’s performance while expanding its Nevada footprint through exploration and acquisitions.

Another key player is i-80 Gold Corp. (TSE: IAU) (NYSE: IAUX). It owns several advanced-stage projects, including Granite Creek, McCoy-Cove, and Ruby Hill. The Granite Creek Project, located in the Getchell Trend, hosts high-grade underground gold mineralization.

Meanwhile, McCoy-Cove is one of Nevada’s highest-grade undeveloped deposits, with ongoing exploration efforts expanding its resource base. Ruby Hill, near the Eureka mining district, has both gold and polymetallic potential.

With a combination of world-class geology and a supportive regulatory environment, Nevada remains a premier destination for gold miners.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.

joseph@mugglehead.com