The White House is making efforts to convince Congress to include a new tax on the electricity consumption of cryptocurrency mining in the upcoming federal budget, with the aim of reducing the industry’s contribution to climate change.

On Tuesday, the Council of Economic Advisors (CEA) proposed the Digital Asset Mining Energy (DAME) excise tax in a blog post on the White House website. The tax would impose a 30 per cent levy on the electricity costs associated with cryptocurrency mining.

Generating electricity by burning fossil fuels is responsible for 25 per cent of the yearly greenhouse gas emissions in the United States, and it also emits harmful air pollutants like nitrogen oxides and particulate matter.

As per a White House report published in September last year, cryptocurrency mining consumes more energy than the total power consumption of Australia. In the United States, where approximately one-third of all cryptocurrency mining operations are located, it is estimated to account for 0.9 per cent to 1.7 per cent of the country’s entire electricity usage.

“Currently, cryptomining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate,” wrote the CEA.

“The DAME tax encourages firms to start taking better account of the harms they impose on society.”

Cryptocurrency mining has significant adverse effects on the environment, quality of life, and electricity grids in the regions where mining firms operate nationwide, according to the blog post.

The high energy consumption of cryptominers disproportionately affects low-income neighborhoods and communities of color, leading to increased pollution from electricity generation.

Read more: New York Attorney General takes aim at unregulated cryptocurrency exchange KuCoin

Read more: Joint European task force takes down darkweb money laundering platform ChipMixer

Cryptomining power consumption raises electricity prices for consumers

Additionally, the excess and erratic power consumption patterns of cryptominers can raise electricity prices for consumers, and place strain on local electrical grids, causing equipment malfunctions, service interruptions, and safety hazards.

Due to the geographic mobility of cryptomining operations and the uncertain stability of the business model, local utilities also face financial risks if they invest in upgrading capacity that may no longer be needed if mining activity stops or relocates.

Even when miners use clean power sources like wind or hydroelectric there’s still some risk of environmental impact. In communities using hydropower, where cryptomining operations are commonly located, the increased electricity consumption means a reduced amount of clean power available for other uses. This raises prices and also raises reliance on less clean sources of electricity.

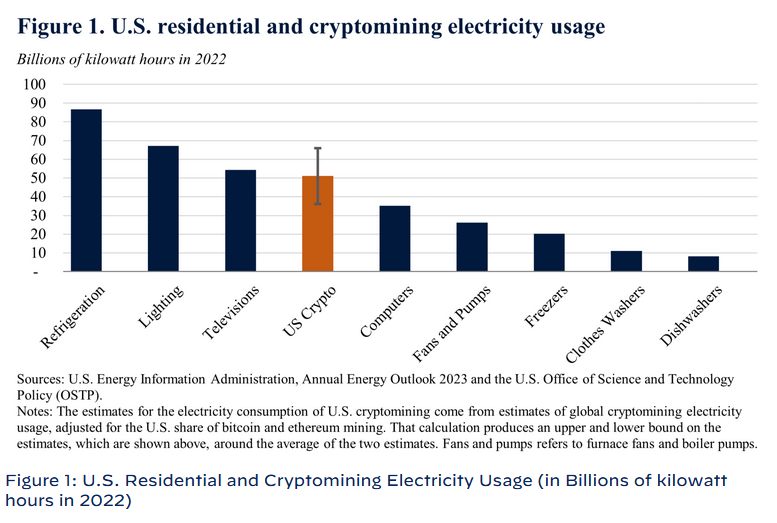

In 2022, the energy consumption of cryptocurrency mining in the United States was comparable to the amount of electricity required to power all home computers or residential lighting across the country.

Image via The White House

Proof of work cryptocurrency mining involves solving complex mathematical puzzles using powerful computers. Miners compete to be the first to solve the puzzle and validate transactions in the blockchain.

This process demands significant computational power, and the miner who solves the puzzle first is rewarded with new cryptocurrency units. However, the energy consumption required for this process is very high, which has led to concerns about its impact on the environment.

Cryptocurrencies like Bitcoin, Bitcoin Cash and Litecoin use Proof-of-Work mining to generate new coins.

Read more: U.S. Treasury latest budget proposal poses 30% tax on cryptocurrency mining

Read more: Africa’s first metaverse and Innovation Africa bring clean drinking water to the continent

New York State signs fossil-fuel powered cryptocurrency moratorium

The energy consumption of cryptocurrency mining is increasing rapidly as the industry grows.

According to the latest available data from the Cambridge Bitcoin Electricity Consumption Index (CBECI), the leading countries in terms of Bitcoin mining by hashrate are as follows: The United States with 35.4 per cent, Kazakhstan with 18.1 per cent, Russia with 11.23 per cent, Canada with 9.55 per cent, Ireland with 4.68 per cent, Malaysia with 4.58 per cent, Germany with 4.48 per cent, and Iran with 3.1 per cent.

These percentages represent the proportion of the total computing power contributed to the Bitcoin network by miners based in each of these countries. CBECI is an ongoing project by the Cambridge Centre for Alternative Finance (CCAF) at the University of Cambridge.

Greenage Generation (NASDAQ: GREE), a crypto mining firm in New York, purchased a decommissioned natural-gas-fired power plant and resumed its operations for powering its mining activities. In response, Governor Kathy Hochul, signed a bill towards the end of last year, imposing a moratorium on the licensing of additional fossil-fuel-powered cryptocurrency mining facilities.

The White House contends that if state or local governments regulate the cryptocurrency mining industry, it could cause the industry to relocate elsewhere. Therefore, it believes that national regulations are necessary, reflecting the social cost of cryptocurrency mining. The proposed tax, which would be implemented over three years, would begin at 10 per cent in the following year and would gradually increase to 20 per cent and then 30 per cent.

The proposed tax on mining cryptocurrency would generate an estimated USD$3.5 billion over 10 years.

Follow Joseph Morton on Twitter

joseph@mugglehead.com