In recent years, there has been a resurgence in interest in nuclear power as a viable alternative to fossil fuels.

This shift is due to growing concerns about climate change and the need for cleaner energy sources. There’s also something to be said about the growing development of nuclear technology, which is now both safe and more efficient.

All this comes at a time when countries around the world are revisiting their energy strategies. Many are now recognizing the potential of nuclear power to provide reliable, low-carbon electricity generation.

Additionally, nuclear power offers energy security benefits by reducing reliance on imported fossil fuels and mitigating geopolitical risks associated with energy dependence. This has naturally led to a significant increase in the demand for uranium.

Uranium is the primary fuel for nuclear reactors. It has seen a surge in interest from both established nuclear nations and emerging markets investing in nuclear energy infrastructure. This heightened demand has prompted exploration and investment in uranium mining projects worldwide.

The prospect of advanced reactor designs like small modular reactors (SMR) has bolstered confidence in the long-term sustainability of nuclear power. It’s also consequently fuelled anticipation for continued growth in uranium demand.

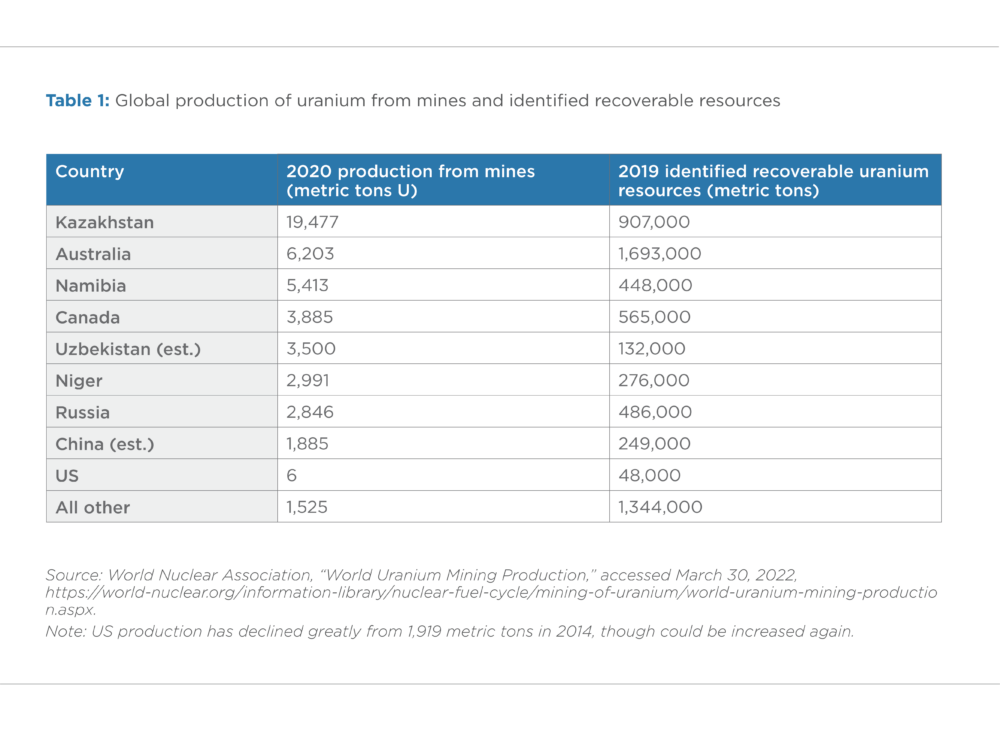

The top three uranium mining jurisdictions in the world are Canada, Kazakhstan, and Australia.

Canada boasts some of the world’s richest uranium deposits, particularly in the Athabasca Basin in Saskatchewan. The country’s stringent environmental regulations and well-established mining infrastructure make it an attractive destination for uranium extraction.

Kazakhstan holds the title of the world’s largest uranium producer, thanks to its vast reserves and low production costs. The country’s uranium industry benefits from favourable geological conditions and significant government support.

Australia ranks among the top uranium producers globally, with sizable deposits found mainly in South Australia, Western Australia, and the Northern Territory.

Read more: ATHA Energy appoints highly-experienced technical advisor into its leadership roster

Read more: ATHA Energy electromagnetic survey results identify high-tier targets

Canada’s nuclear industry has received new life

Canada’s nuclear industry has received new life driven by plans to expand the Bruce Nuclear site and introduce SMRs in multiple provinces.

These SMRs offer a compact, cost-effective, and safer alternative for generating clean electricity. Canada’s active involvement in this sector is required because it presents opportunities to reduce global emissions and create jobs.

Geopolitical tensions surrounding Russia’s conflict in Ukraine and China’s aspirations have increased the role civil nuclear plays in various policy areas. These include energy, security, and technology advancement.

The United States has always played a key role in nuclear technology, aiming to mitigate nuclear proliferation and enhance global safety. But the global nuclear landscape has shifted since the end of the Cold War. A tepid nuclear policy now poses a threat to national security, particularly as China and Russia advance in the civilian nuclear sector.

Canadian companies including Ontario Power Generation (OPG) and Cameco Corporation (NYSE: CCJ) (TSX: CCO) have emerged as key players in countering this trend. OPG has collabored with GE Hitachi and the Tennessee Valley Authority to build an SMR in Darlington. It displays Canada’s leadership potential in the SMR sector.

Additionally, Cameco’s acquisition of Westinghouse demonstrates support for a domestic nuclear export industry. Recent agreements, such as supplying Ukraine’s uranium needs, and cooperating with OPG for commercialization show Canada’s potential for economic and strategic advancement in the nuclear sphere.

Image via Westinghouse Energy Company.

The world is trending towards nuclear

The story doesn’t begin and end with the United States and Canada.

Kenya aims to start building its first nuclear power plant in 2027 in a bid to diversify its energy generation in response to increasing demand and the imperative for zero-carbon energy sources.

At present, the country is prepared to fully embrace nuclear applications. Kenya anticipates its first power plant to be fully operational by 2035. An appropriate site along the Coastal belt has already been identified, and feasibility studies are currently under way.

During the recently concluded UN climate change conference, COP28, officials from the Nuclear Regulatory Authority (KNRA) asserted that, with robust regulation, capacity building, and the adoption of best practices from partners like the International Atomic Energy Agency and the US Nuclear Energy Commission, Kenya is primed to embrace nuclear energy.

“Nuclear energy offers several advantages in the context of addressing climate change,” Edward Mayaka, KNRA Director for Partnerships and Public Awareness, said. “Unlike fossil fuels, nuclear power plants generate electricity through a process that produces virtually no direct carbon emissions. This characteristic alone makes nuclear energy an attractive option for countries striving to reduce their carbon footprint.”

As of 2021, Japan had planned to restart 30 reactors by 2030.

Mayaka observes that world trends indicate a nuclear renaissance, with African countries like Egypt already progressing towards nuclear energy adoption.

Read more: United Kingdom awards C$49M to GE Hitachi Nuclear Energy for SMR development

Read more: Ontario Power Generation initiates uranium fuel contracts for North America’s first SMR

Russia holds a heavy chunk of uranium market

However, widespread energy adoption has hit a roadblock.

Long before invading Ukraine, Russia weaponized civil nuclear exports to bind countries into decades-long energy dependencies. These particularly concerned fuels as around 40 per cent of the world’s uranium fuel supply comes from Russian facilities.

Even as Russia faces unprecedented Western economic sanctions, the U.S. finds itself reliant on Russian imports of enriched uranium. Despite being the largest producer of nuclear energy globally, the U.S. has allowed its civilian nuclear infrastructure to deteriorate since the presidencies of Jimmy Carter and Ronald Reagan in the 1970s and 1980s.

In that time, Russia has steadily advanced and exported numerous reactors, while China has made substantial investments in civilian nuclear technology and expanded its atomic power generation domestically.

Beijing aims to construct 24 new nuclear power plants by 2030, increasing the total to 60 and surpassing the U.S. with its aging reactor fleet.

To provide context, the U.S. currently operates 93 operational nuclear power plants, and during the same period of China’s construction surge, the U.S. added only two, with none currently under development.

However, even with an updated fleet of reactors, the United States would still lag behind Russia in its supply of high-assay, low-enriched uranium (HALEU), which is enriched up to 20 per cent compared to the average 5 per cent of uranium used in current reactors to enable more efficient units to function.

Russian sanctions produce supply roadblock

TENEX, a division of the state-owned Russian nuclear energy company Rosatom, currently controls the commercial supply of HALEU. To strengthen America’s domestic production, the Biden administration has issued a Request for Proposals (RFP) for HALEU enrichment.

Meanwhile, the U.S. House of Representatives passed a motion to ban U.S. uranium imports from Russia late last year. All of this despite the lack of capacity within the US to meet its own demand.

Centrus Energy (NYSE: LEU) is the only licensed American company for refining HALEU. Additionally, one European company, Urenco, plans to commence production in New Mexico. While the RFP will allow numerous companies besides Centrus to bid for the operation of the new plant, actual operation is unlikely to occur until the late 2020s.

Beyond the ability to refine HALEU is the ability to acquire it, which will mean the United States will be looking elsewhere to make up for the shortfalls in the Russian supply chain.

Towards this end, Canada’s Athabasca Basin has emerged as the prime destination for high-grade uranium, boasting grades exceeding global averages by over 100 times.

Canada held the title of the world’s largest uranium producer for many years, contributing approximately 22 per cent of global output. However, in 2009, Kazakhstan surpassed Canada in production volume.

McArthur River and Cigar Lake mines in northern Saskatchewan are the primary sources of production. Both are renowned as the largest and highest-grade uranium mines globally. Canada plays a significant role in meeting future world demand for uranium.

Read more: ATHA Energy applies for listing on TSX Venture Exchange, gives update on 92 and Latitude merger

Read more: ATHA Energy discovers strong uranium mineralization at North Valour-East

The Athabasca Basin could be the answer

The appeal of uranium from the Athabasca Basin lies in its exceptionally high-grade deposits. These grades surpass global averages by a significant margin. These deposits offer unparalleled purity and efficiency in uranium extraction, making them highly sought after in the nuclear energy sector.

Cameco isn’t alone in operating in the basin. There are plenty of other companies that could easily answer the U.S. request.

For example, ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) recently finalized its acquisitions of Latitude Uranium Inc. (CSE: LUR) (OTCQB: LURAF) and 92 Energy Limited (ASX: 92E) (OTCQX: NTELF). Latitude holds an exploration portfolio in Nunavut and Labrador, while 92 Energy manages projects in the Basin. With the acquisitions complete, the combined company now possesses a Canadian land package spanning 7.1 million acres.

In November, ATHA identified 18 high-priority uranium targets in the Athabasca Basin, conducting the largest-ever electromagnetic survey in the region. The company actively participates in a joint venture with Stallion Uranium Corp. (TSXV: STUD) (OTCQB: STLNF) in the same area. Additionally, ATHA holds a 10 percent carried interest in specific portions of the land package owned by NexGen Energy Ltd. (TSX: NXE) (NYSE: NXE).

There’s also Skyharbour Resources Ltd. (TSXV: SYH) (OTCQX: SYHBF) (Frankfurt: SC1P), which is presently embroiled in its 8,000 meter winter drill campaign at its Russell Lake Uranium Project in the central most core of the basin of northern Saskatchewan.

Additionally, Skyharbour is planning 5,000 metres of drilling in ten to 12 holes at Russell before moving the drill rig to its Moore Uranium Project to finish another 3,000 meters of drilling in eight to ten holes.

ATHA Energy Corp. is a sponsor of Mugglehead news coverage