Vancouver’s Stallion Uranium Corp. (TSX-V: STUD) (OTCQB: STLNF) is selling a series of its property assets in the eastern Athabasca Basin deemed no longer essential to its operation.

The uranium explorer announced Tuesday that Glorious Creation Limited (CSE: GCIT.X) would be acquiring the seven claims for 2.5 million shares and C$300,000 in cash. Stallion will retain a 3 per cent net smelter royalty (NSR) on the properties.

Glorious will have the option to purchase half of that NSR for C$2.25 million at any time before commercial production begins at the projects.

“It allows for Stallion to remain focused on progressing our projects in the southwestern basin where we hold the largest exploration land package,” Stallion CEO Drew Zimmerman said.

Stallion and Glorious have drawn up an operating agreement as well. The seller will conduct an agreed-upon exploration program at one or more of the properties through the deal.

“We think this transaction provides both parties significant upside from a committed uranium exploration program in the eastern Athabasca Basin that these projects warrant,” Zimmerman said.

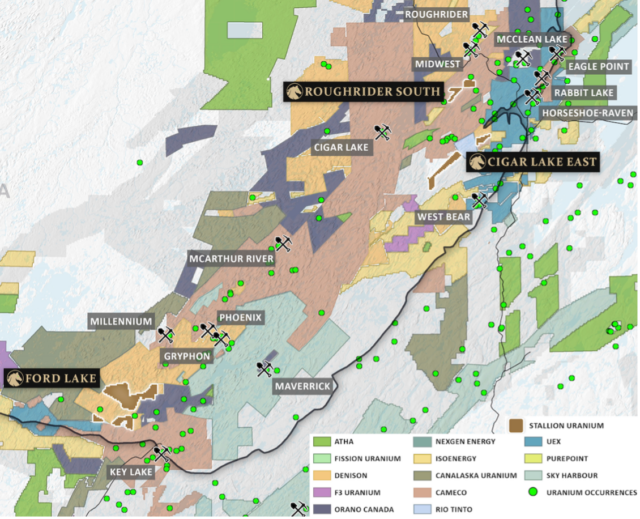

The seven claims are situated within three projects: Ford Lake, Roughrider South and Cigar Lake East. The vast majority of uranium mining occurs on the eastern side of the Basin. The most notable projects there are the Cigar Lake and McArthur River operations.

Projects being sold in brown, eastern Athabasca Basin. Map: Stallion Uranium

Read more: ATHA Energy adds seasoned exploration and corporate affairs managers to its team

Read more: ATHA Energy appoints highly-experienced technical advisor into its leadership roster

Stallion and ATHA have largest project on western side

The uranium explorer and its joint venture partner ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) collectively hold the largest project on the less developed side of the Athabasca Basin.

Last month, Stallion added over 13,000 hectares to its exploration package adjacent to the joint properties. The explorer obtained an exploration permit for its Coffer project in the west the previous month.

$STUD $STLNF @stallionuranium has assembled and is exploring 1200+ square miles of claims in Canada's uranium-rich Athabasca Basin.

Watch as CEO Drew Zimmerman outlines the company's efforts — and why uranium exploration is worth investor consideration.https://t.co/sNv0Qe6PyF pic.twitter.com/Ve0xLDxzYv

— CFN Media (@CFNMediaNews) February 12, 2024

In a recent interview with local media in Saskatoon, Cameco Corporation’s (TSX: CCO) (NYSE: CCJ) Chief Executive Officer Tim Gitzel discussed how the uranium industry is in an upswing following a 10-year decline after the Fukushima disaster.

He said the company plans on completing development work at Cigar Lake to extend the mine’s life until 2036. The eastern Athabasca Basin project produces the highest-grade uranium in the world.

He promoted nuclear power’s ability to fight climate change.

“There are no CO2 emissions that come from it, which are the main cause of global warming,” Gitzel told CJW600.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com