Shares of Spire Global, Inc. (NYSE: SPIR), the space-based data and analytics company that emerged from the 2021 merger with NavSight Holdings, are up approximately 16 per cent, defying a jittery broader market.

With U.S. indices like the Dow and S&P 500 wavering under tariff uncertainties and mixed economic signals, SPIR’s rally stands out.

Formerly known as NavSight Holdings before its special purpose acquisitions company (SPAC) merger, Spire Global has carved a niche in providing satellite-driven insights for weather, maritime, and global security solutions. So, what’s fuelling this Tuesday spike?

On November 13, 2024, Spire Global agreed to sell its maritime business to Kpler Holding SA. However, in February 2025, Spire sued Kpler in Delaware, seeking to enforce the deal. The companies reached a settlement on Sunday, which has had some spillover effects on Tuesday’s market price. The specifics include the release of all claims if the deal closes by April 25, 2025.

The sale itself is part of Spire’s broader strategy to focus on its core satellite and data services business. Furthermore, this involves providing Earth observation data through its satellite constellation. The maritime business sale was initially agreed upon in November 2024. However, the dispute arose when Kpler failed to meet certain obligations, leading Spire to file a lawsuit in early 2025. The settlement now provides clarity for Spire and allows both companies to move forward without the legal baggage.

The stock’s price surge reflects investor optimism about the resolution of the legal issue. It may also indicate confidence in Spire’s strategy moving forward.

Read more: Gorilla Technology Group gets 28% bump on partnership with high level fund

Read more: Nevada Sunrise leverages AI to help find new exploration targets in Nevada

Revenues increased 13% to $11.5M in full year revenue

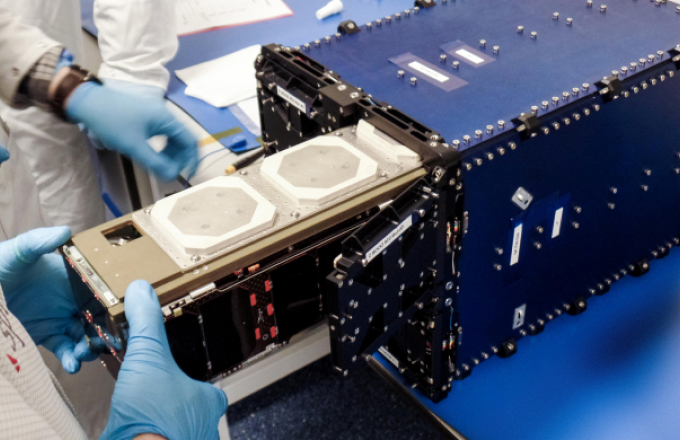

Late last month Spire and Mission Control announced a mission to explore artificial intelligence (AI) in space. Spire will build and operate a satellite with an optical payload to capture Earth images for Mission Control’s AI algorithms to analyze. Spire will manage the entire lifecycle of the 6U satellite, from design to operation.

Sustainable agriculture firm, LatConnect60 selected Spire to help improve its practices by providing Global Navigation Satellite System (GNSS) reflectometry data and Soil Moisture Insights.

Spire’s Soil Moisture Insights uses GNSS-R satellite constellation to deliver high-resolution, daily soil moisture data at 500-meter and six-kilometer resolutions. Accessible via API, the product integrates existing systems, providing precise insights for applications like drought and flood forecasting.

In other recent news, Spire Global reported a 13 per cent increase in full-year 2024 revenue, reaching $110.5 million. Despite growth, the company forecasts a revenue decline for the first quarter of 2025. Projections range from $22 million to $24 million, a decrease of 31 per cent to 37 per cent year-over-year.

Stifel analysts have kept a Buy rating for Spire Global but lowered the stock’s price target from $20 to $18. They cited the company’s recent earnings report as the reason for the change. Analysts believe the ongoing sale of Spire’s Maritime business to Kpler, expected to close by late April, could positively impact the stock.