Investing is a marathon, not a sprint. It’s solid conservative investing advice from the master himself, Warren Buffet. But lots of people don’t want to take the conservative route. Maybe they’ve got a little more cash and a little less time and their risk tolerance is higher. Small-companies may be the best option in that case.

Small-cap companies typically have a market capitalization ranging from USD$250 million to USD$2 billion. There’s some wiggle room and sometimes the exact range can vary depending on the source or index.

Regardless, in sectors like mining, the classification can be flexible, sometimes including companies near the upper limit or slightly beyond, particularly if they are early-stage or project-focused. Investors often target small-cap companies for potential higher returns during periods of market expansion.

These companies are generally considered to have growth potential but may also carry higher risk compared to larger firms due to limited resources and market presence. But the risk isn’t as high as going in on a start-up or a microcap company, and the upside is larger.

Furthermore, small-cap companies are often considered acquisition targets for larger firms, as their growth potential and high-quality assets make them attractive opportunities.

Here are five noteworthy companies operating at the small-cap level.

The Stibnite Gold project. Image via Perpetua Resources.

Perpetua Resources Corp

Boise, Idaho based Perpetua Resources (NASDAQ: PPTA) (TSE: PPTA) is a mining company with a market capitalization of approximately USD$674 million.

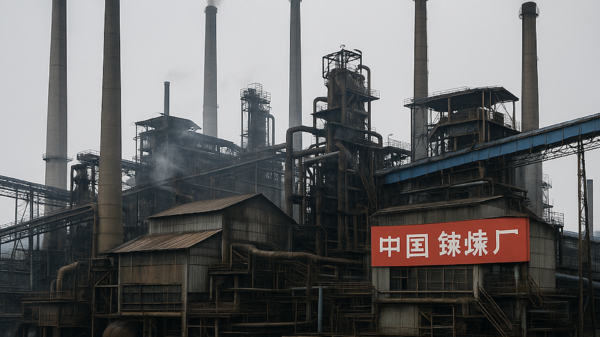

The company is dedicated to advancing the Stibnite Gold Project, which encompasses both gold and antimony resources. Its objective is to become a domestic supplier of these critical minerals, contributing to national security and the clean energy transition.

In recent developments, the Biden administration issued the final mining permit for Perpetua’s Idaho antimony and gold project on January 3, 2025. This decision aims to boost U.S. production of antimony. Antimony is a critical mineral essential for various applications, including weapons, solar panels, and flame retardants.

The permit’s approval follows an extensive eight-year review process, reflecting the project’s strategic importance amid global trade tensions, particularly with China’s recent export restrictions on antimony.

Once operational, anticipated by 2028, the Stibnite Gold Project is expected to supply over 35 per cent of the annual U.S. antimony demand. It also anticipates producing approximately 450,000 ounces of gold each year. The project has an estimated cost of USD$1.3 billion and has garnered financial backing, including nearly USD$60 million from the Pentagon. Additionally, the U.S. Export-Import Bank has shown interest in providing a loan of up to USD$1.8 billion to support the project’s development.

Despite these advancements, the project has faced opposition from local groups, including the Nez Perce tribe of Idaho, due to environmental concerns. Perpetua Resources has engaged in extensive consultations and made multiple design modifications to address these issues.

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

Read more: High grades in Nicaragua expected to raise Calibre Mining’s mineral resource

Skeena Resources Limited

Skeena Resources Ltd (NYSE: SKE) (TSE: SKE) is a Canadian mining exploration and development company with a market capitalization of approximately CAD$1.09 billion.

The company is focused on revitalizing the Eskay Creek gold-silver project, located in British Columbia’s Golden Triangle. Historically, Eskay Creek was one of the world’s highest-grade gold mines, and Skeena aims to restart operations to tap into its significant remaining resources.

In recent developments, Skeena has made substantial progress toward bringing Eskay Creek back into production. In June 2024, the company secured a USD$750 million project financing package. This will provide the necessary capital to advance the project through to production.

This financing includes an equity investment, a gold stream, and a senior secured loan, ensuring that Skeena is well-funded for the project’s development.

Additionally, in December 2024, Skeena received approval for a bulk technical sample at Eskay Creek, marking a significant milestone in the project’s regulatory progress.

This approval allows the company to conduct further on-site activities essential for the project’s advancement.

Skeena has also been actively engaging with local communities and Indigenous groups. The company is working towards an impact-benefit agreement with the Tahltan First Nation government, demonstrating its commitment to responsible and inclusive development practices.

Looking ahead, Skeena plans to commence construction at Eskay Creek in 2026, with production targeted for 2027. Skeena anticipates it will produce approximately 320,000 ounces of gold equivalent annually over an initial 12-year mine life.

Cerro Los Gatos project. Image via Gatos Silver.

Gatos Silver

Gatos Silver, Inc (NYSE: GATO) (TSE: GATO) is a U.S.-based precious metals production, development, and exploration company primarily focused on silver and zinc. Its flagship asset is the Cerro Los Gatos Mine in Mexico. As of October 2024, Gatos Silver had a market capitalization of approximately USD$1.1 billion.

In September, Gatos entered into a merger agreement with First Majestic Silver Corp. (TSE: AG) (NYSE: NG), a Canadian mining firm with extensive operations in Mexico. The all-stock deal has a value of USD$970 million.

This strategic acquisition aims to consolidate First Majestic’s position in the silver mining sector by integrating Gatos Silver’s 70 per cent interest in the Los Gatos Joint Venture, which owns the Cerro Los Gatos underground silver mine in Chihuahua, Mexico. It also demonstrates the potential many small-cap companies enjoy at this size.

The combined entity is expected to enhance its production profile, targeting an annual output of 30-32 million ounces of silver-equivalent. This will also include 15-16 million ounces of silver. Additionally, the merger is projected to include corporate cost savings and operational efficiencies, thereby bolstering free cash flow generation.

The boards of both companies unanimously approved the transaction, which anticipate it will close in early 2025.

Upon completion, existing Gatos Silver shareholders will own approximately 38 per cent of First Majestic’s shares on a fully diluted basis, positioning them to benefit from the combined company’s strengthened balance sheet, enhanced capital markets presence, and expanded operational footprint in Mexico’s prolific silver mining districts.

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

Read more: High grades in Nicaragua expected to raise Calibre Mining’s mineral resource

Calibre Mining Corp.

Calibre Mining Corp. (TSE: CXB) (OTMRKTS: CXBMF) is a Canadian-listed, Americas-focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland and Labrador in Canada, Nevada and Washington in the USA, and Nicaragua.

The company is focused on delivering sustainable value for shareholders, local communities, and all stakeholders through responsible operations and a disciplined approach to growth.

As of January 2025, Calibre Mining’s market capitalization is approximately USD$1.5 billion, placing it firmly within the small-cap category. The company’s diversified portfolio and strategic focus on the Americas make it a notable player in the gold mining industry.

In recent developments, Calibre Mining announced the discovery of a new high-grade gold vein system at its Limon Mine Complex in Nicaragua. The discovery, named “Panteon North,” has returned significant intercepts, including 15.2 grams per tonne (g/t) gold over 5.1 meters and 12.7 g/t gold over 4.8 meters.

These results suggest the potential for resource expansion and extended mine life. The company plans to continue its aggressive exploration program in the region. The program will further delineate the new vein system and assess its economic viability.

Additionally, Calibre Mining reported strong fourth-quarter financial results, beating its yearly guidance. The company produced 242,487 ounces of gold in 2024, surpassing its guidance of 230,000 to 240,000 ounces. The company announced these results alongside its quarterly financial statements, detailing 207,220 ounces from Nicaragua and 35,267 ounces from Nevada.

Calibre also ended Q4 with USD$186.7 million in cash, comprising USD$131.1 million in unrestricted cash and USD$55.6 million in restricted funds.

Calibre Mining’s strategic initiatives and recent successes underscore its position as a dynamic and growing small-cap gold producer in the Americas.

A grinder at i-80’s Ruby Hill project. Image via i-80 Gold.

i-80 Gold Corp

i-80 Gold (TSE: IAU) (NYSE: IAUX) is a North American gold producer and developer with a diversified portfolio of assets in Nevada, USA. As of January 2025, the company’s market capitalization stands at approximately USD$1.5 billion. This positions it within the small-cap category. i-80 Gold’s is aiming at becoming a leading gold producer in Nevada by advancing its five key projects through various stages of development and permitting.

In October 2024, i-80 Gold reported its third-quarter operating results, emphasizing continued progress at its key projects. The company highlighted the need for increased technical expertise to support the ongoing development of its projects. Furthermore, this included the permitting and construction of its five mines through the next decade. The company implemented Organizational changes to align with this strategic direction, focusing on improving operational efficiency and ensuring long-term growth.

i-80 Gold’s Ruby Hill project has also seen considerable exploration success. In September 2023, high-grade results from drilling at the Blackjack zone revealed significant polymetallic mineralization, enhancing the property’s exploration potential. The Cove project, another key asset, continues to show promise with high-grade results from underground drilling, demonstrating the resource potential of the property.

These recent achievements, along with the company’s robust portfolio and ongoing development efforts, underscore i-80 Gold’s commitment to expanding its resource base and advancing its projects toward production. The company’s position in Nevada, one of the world’s most prolific gold mining regions, offers significant growth potential as it moves toward becoming a key player in the industry.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.

joseph@mugglehead.com