Canadian mining magnate Rob McEwen has chosen to exercise over 3.5 million share purchase warrants and up his stake in Canadian Gold Corp (CVE: CGC) (OTCMKTS: STRRF) (FRA: 8S8) by 0.9 per cent to 32.9 per cent. He acquired them for C$0.215 apiece, spending a total of C$767,861.

His company, McEwen Mining Inc (TSE: MUX) (NYSE: MUX), currently has a significant holding in the gold project developer as well at 5.7 per cent, according to Canadian Gold Corp’s most recent news release.

Canadian Gold Corp is a development-stage mining company that is currently working on getting the Tartan Gold Mine near Flin Flon, Manitoba back into production. McEwen evidently sees this undertaking as a worthwhile endeavour.

The mine produced 47 kilo ounces of gold between 1987-1989 and is estimated to still hold a 277-kilo-ounce resource, according to an estimate from 2017. Operations ceased in the late 1980s largely because of the low price of gold at the time, valued at only C$550 per ounce. With the spot price on a current trajectory toward C$5,500 per ounce, according to multiple analysts, McEwen has increased his stake at what appears to be an opportune time.

A 7,295-metre drill campaign completed in 2021 returned long intervals of high-grade gold mineralization, including 27.6 grams per tonne gold over 12.6 metres. Earlier this year, Canadian Gold Corp pulled a decent core sample from the site’s South Zone containing 6.1 g/t Au over 6 metres.

Meanwhile, an 8,000-metre drill campaign is currently ongoing at the project aimed at expanding the property’s known gold resource.

Manitoba government has an interest in Tartan

Canadian Gold Corp secured a C$300,000 grant from the provincial government’s Manitoba Mineral Development Fund last month to help the company craft an updated mineral resource estimate and preliminary economic assessment. Both of these are expected to be released once the ongoing drill campaign concludes this summer.

In addition to Tartan, the mining junior holds a trio of greenfield exploration assets in Quebec and Ontario.

McEwen is primarily focused on the gold and copper mining sectors. This is reflected in McEwen Mining’s focus on the Los Azules copper mine in Argentina and investments made in gold mining companies like Goliath Resources Ltd (CVE: GOT) (OTCMKTS: GOTRF) (FRA: B4IF).

Earlier this year, McEwen expressed a significant interest in Saudi Arabia’s copper and gold resources. He was in attendance at the nation’s Future Minerals Forum in January.

“I was honoured to participate in the Future Minerals Forum 2025 in Riyadh, engaging in a high-impact roundtable discussion on the future of mining and mineral investments,” McEwen said at the time. “The dialogue provided valuable insights into fostering collaboration and driving innovation in the global mining sector.”

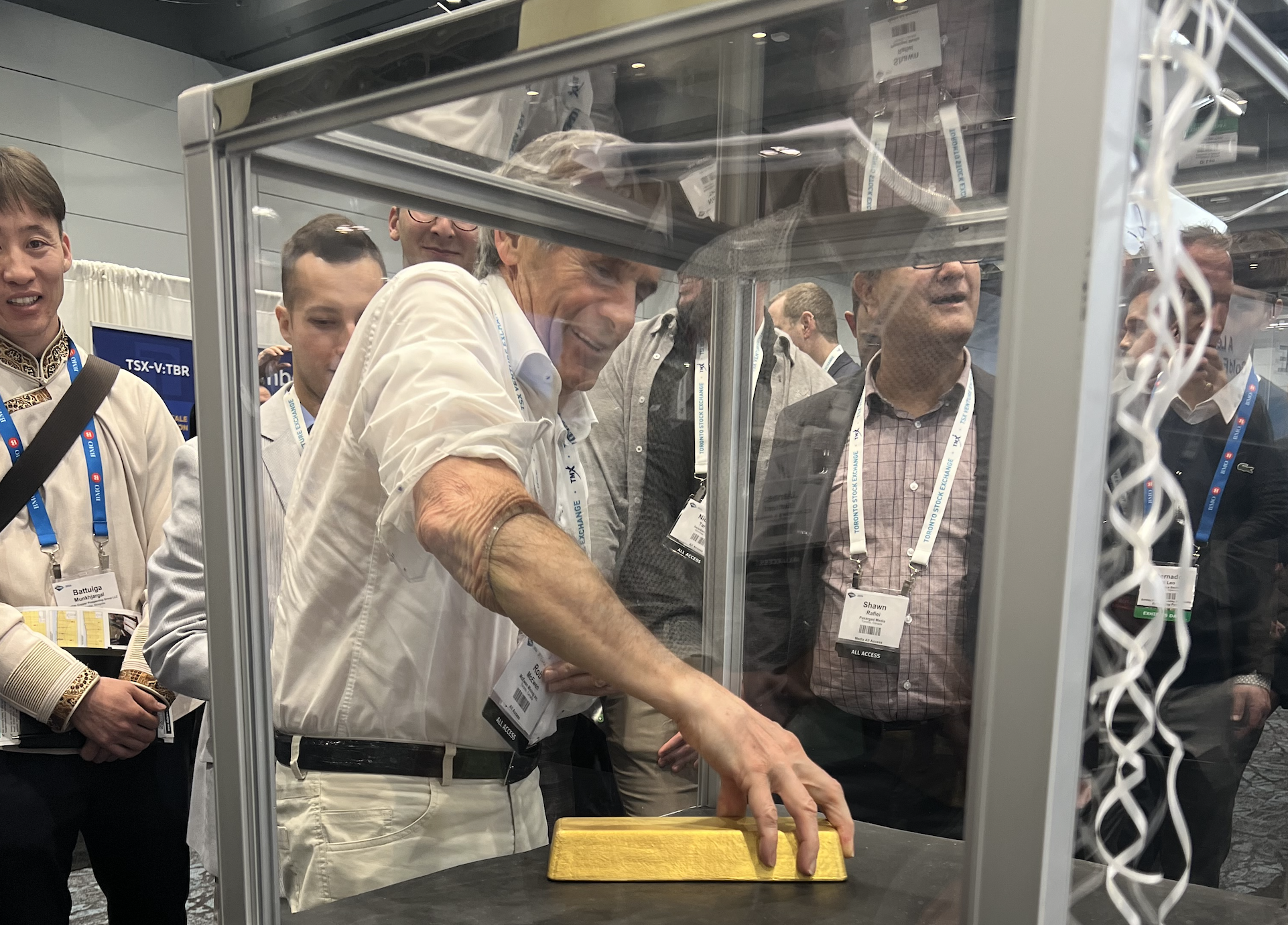

McEwen (centre-left) hurt his ankle or foot recently. Photo credit: X

Read more: Calibre securityholders give assent for Equinox Gold merger

Read more: Calibre Mining shareholders can get 4% higher stake once Equinox Gold merger is finalized

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com