Ridgeline Minerals Corp. (TSXV: RDG) (OTCQB: RDGMF) (FSE: 0GC0) and Nevada Gold Mines LLC entered into an agreement where NGM can buy interest in Ridgeline’s Carlin-East gold project.

The company said on Monday that NGM can get a 60 per cent share in the project if it spends at least $4.5 million on necessary work over five years. NGM will assume control of the project immediately.

NGM needs to spend at least $1.5 million on necessary work before the end of 2025 and then spend an additional $3.0 million on such work before mid June, 2028. Both NGM and Ridgeline will choose two people to form a team that will look at the project’s spending and work every three months.

NGM will pay back $100,000 to Ridgeline within 15 days of finalizing the agreement. This is to cover Ridgeline’s recent spending on the Carlin-East project.

If both NGM and Ridgeline decide to go ahead with building a mine or related facilities on Carlin-East, NGM will have the option one time to fund or find someone else to fund Ridgeline’s share of the money needed for this work. In return, NGM will get an extra 5 per cent share in the project. This means it could have up to 75 per cent share in the project or 65 per cent if it did not choose the second earning option.

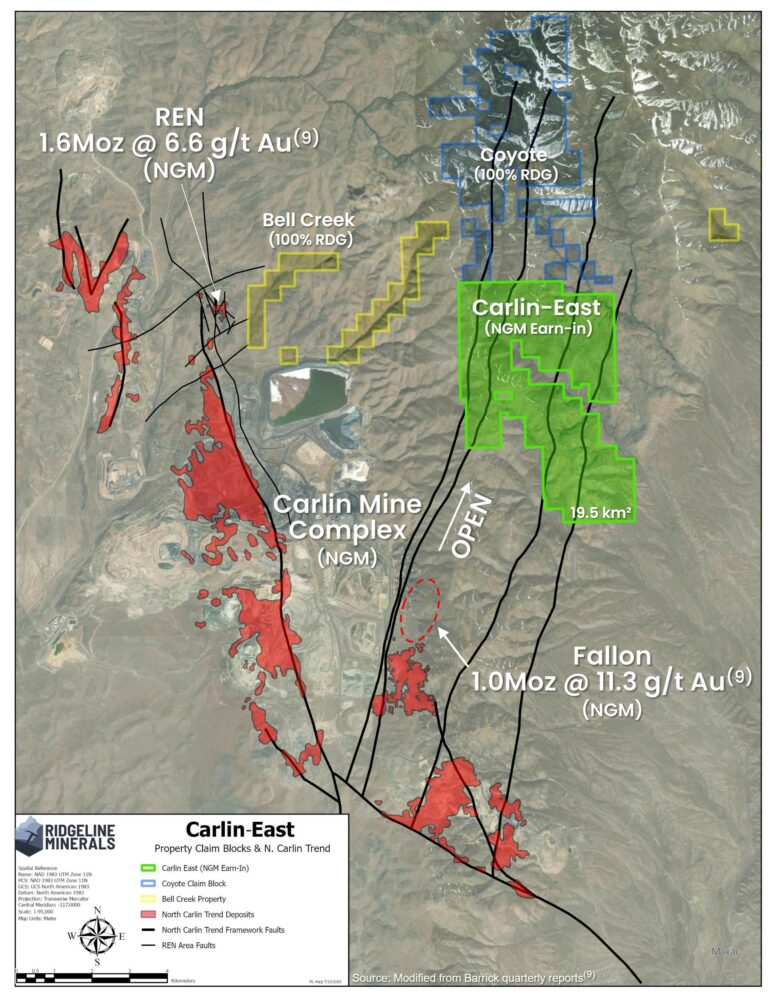

NGM is a joint venture between Barrick Gold (TSX: ABX) (NYSE: GOLD) and Newmont Corporation (TSX: NGT) (NYSE: NEM) and the Carlin-East gold project is a 19.5 square kilometer land package close to NGM’s Fallon discovery north of the Leeville mine in the Carlin-Trend mining district in Nevada.

Carlin-East is a project to explore Carlin-type deposits in a very productive area called the Carlin Trend. It is in the same direction as the Fallon discovery by Nevada Gold Mines, which is believed to have 1.0 million oz. of gold that grades 11.3 g/t. The project is located in Eureka and Elko counties in Nevada. It covers an unbroken series of 243 federal claims, which means it has the rights to 19.5 square kilometers of minerals.

“This deal validates our business model as we continue to exhibit our ability to find and advance exploration opportunities in Tier-1 districts,” said Chad Peters, Ridgeline’s president, CEO and director.

“Our partnerships with Nevada Gold Mines now provide up to US$40 million in total potential exploration expenditures between the Swift and Carlin-East projects, which leverages NGM’s proven track record of discovery while significantly reducing the exploration risk inherent with deep drilling in Nevada.”

Ridgeline Minerals shares were flat at $0.195 on Monday on the TSX Venture Exchange.

Carlin-East map. Image via Ridgeline Minerals.

Read more: Calibre Mining assays at Palomino property in Nevada may improve mineral resource

Read more: Calibre Mining’s Nicaragua operations to accelerate 2023 gold and cash flow: Scotiabank report

Nevada ranked number one jurisdiction in the world for mining

The Fraser Institute has ranked Nevada as the top global location for mining, according to their Investment Attractiveness Index. This index considers two main factors: the policies around mining and the potential for finding minerals. Over the past eight surveys, Nevada has consistently ranked within the top 10 places for investment attractiveness.

One reason for this is Nevada’s strong mining policies. In a survey by the Fraser Institute, over half of the respondents felt very confident that they would receive the necessary permits for mining. The remaining respondents also felt confident. This confidence likely comes from the stability of the laws and rules. The federal Mining Act of 1872, which governs mining policies, can only be changed by the U.S. Congress, so miners can rely on a consistent regulatory environment.

The deal between Ridgeline and NGM is actually the second merger that NGM has been involved with in the past month. The first involved Metalla Royalty & Streaming Ltd (NYSE: MTA) (TSXV: MTA), which closed a purchase and sale agreement with NGM to sell the JR mineral claims making up the Pine Valley property.

In June, investment analyst firm, Haywood Securities Inc released a report on Calibre Mining‘s (TSX: CXB) (OTCQX: CXBMF) Palomino site emphasizing the high quality and consistency of the gold present at the site.

This suggests that there could be a chance to increase and improve the quality of gold at Pan.

According to recent reports by Global Equity Research, which is published by the Bank of Nova Scotia (TSX: BNS), Calibre’s open-pit mining activities in Nicaragua are expected to speed up the company’s gold production and cash inflow for the rest of 2023.

The big bank in Canada’s first report by their experts was generally a little positive about Calibre’s stock. They guessed that each share would earn $0.04 and each share would bring in $0.08 cash, which is close to what Calibre expected. Also, Bloomberg guessed that each share would earn $0.05 and bring in $0.07 cash.

Calibre Mining is a sponsor of Mugglehead news coverage

.