Recent acquisitions have helped psychedelics company Numinus Wellness Inc. (TSE: NUMI) (OTCMKTS: NUMIF) boost its bottom line.

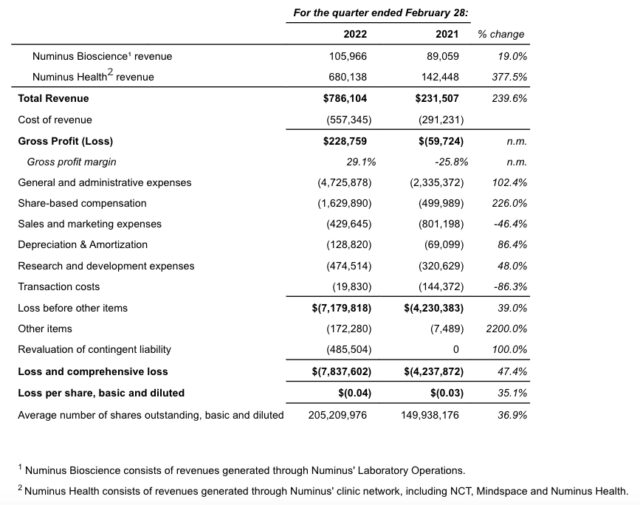

Numinus recently announced its fiscal quarter results for the three and six months ended Feb. 28, reporting that revenues grew 240 per cent year-over-year to $0.8 million for the quarter.

“Numinus’ fiscal second quarter demonstrated the strength of our growing service offering and the efficiency of our operating platform, with gross margin improving to 29.1 per cent during Q2 2022 — compared to 6.5 per cent in the previous quarter,” Payton Nyquvest, Numinus founder and CEO, said in a statement.

The company recently acquired mindfulness training company Mindspace Psychology Services Inc. and the Neurology Centre of Toronto, which offers ketamine-assisted psychotherapy. Those acquisitions were directly responsible for Numinus’ improvement in gross margin.

Read more: Numinus to enter US psychedelics market via $26.2M Novamind acquisition

Read more: Numinus ends fiscal year with revenue up 72% to $1.5M, losses of $19M

The company generated gross profit of $228,759 during Q2 2022, a 349 per cent increase from the previous quarter.

Losses totalled $7.8 million during the second quarter, compared to $4.2 million in Q2 2021. Cash and cash equivalents at the end of the quarter totalled $48.3 million

Revenues during the first half of fiscal 2022 grew 242 per cent year-over-year to $1.6 million while gross margin was 17.8 per cent, compared to -21.2 per cent during the same period last year.

Gross profit during the first half of 2022 was $279,724, a significant increase from the gross loss of $97,859 in the first half of 2021.

Chart via Numinus

Numinus develops and delivers mental health care using psychedelic-assisted therapy. The company recently announced a proposed acquisition of Novamind, a mental health company that enables safe access to psychedelic medicine through a network of clinics and clinical research sites.

Numinus expects the acquisition will bolster its financial performance and grow its annual revenue more than five times.

“Looking forward, our recently announced proposed acquisition of Novamind will be transformational for Numinus as we establish a strong U.S. presence with eight revenue producing clinics located in Utah and Arizona. It also provides two additional clinical research sites and a strong pipeline of clinical research business, which will significantly expand Numinus’ contract research capabilities,” Nyquvest said.

Read more: Numinus gets new biosecurity licence to expand psilocybin research

Read more: Numinus approved to study ayahuasca and San Pedro in Canada

In October, the company revealed it had finalized a study design and protocol for a proprietary naturally derived psilocybin extract called NBIO-01. Since then, Numinus has also discovered an additional drug product candidate, NBIO-03, that is nearing the final stages of development.

The company intends to include NBIO-03 in its Phase q clinical trials alongside NBIO-01 to establish a maximum tolerated dose. Numinus has also started genetic testing on newly acquired psychedelic mushroom species.

Numinus currently has five wellness clinics (one in Vancouver, one in Toronto, and three in Montreal) offering services to clients with a total of 21 treatment rooms. The company also has research clinics in Vancouver and Montreal where psychedelic studies are being conducted.

The company started trading on the Toronto Stock Exchange in December and began trading on the OTCQX Best Market in January.

Company stock fell 2 per cent Tuesday to $0.49 on the TSX.

ryan@mugglehead.com