Shares of Pulmonx Corporation (NASDAQ: LUNG) surged 32 per cent on Friday in response to positive fourth-quarter and full-year financial results for 2024.

Released on Wednesday, the company reported a record-breaking Q4 revenue of USD$23.8 million, a 23 per cent increase year-over-year, surpassing analyst expectations of USD$22.3 million.

For the full year, Pulmonx achieved USD$83.8 million in worldwide revenue, reflecting a robust 22 per cent growth over 2023.

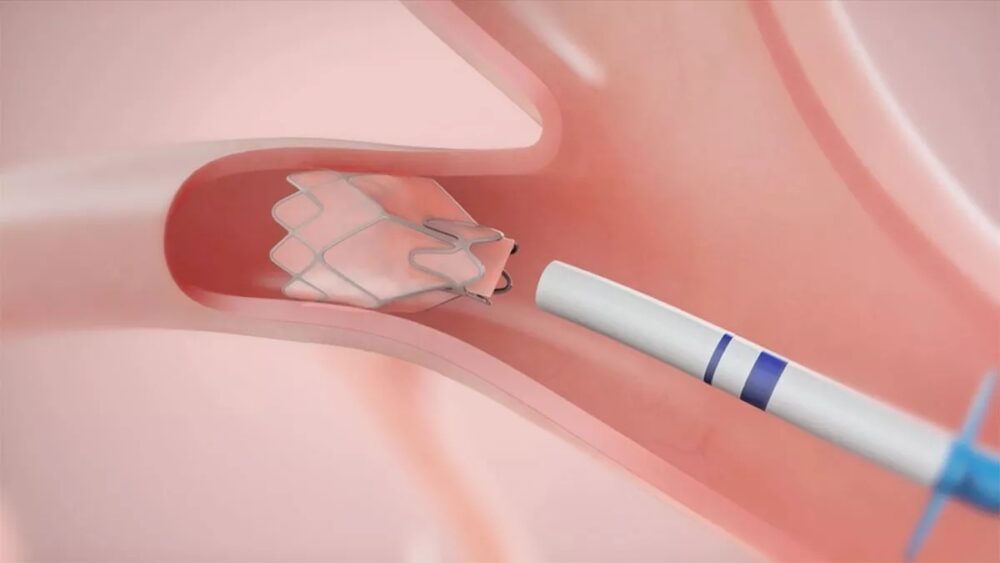

This performance demonstrates the company’s ability to capitalize on growing demand for its flagship product, the Zephyr Endobronchial Valve, used to treat severe emphysema, a form of chronic obstructive pulmonary disease (COPD).

Furthermore, the U.S. market is a critical growth driver, and saw Q4 revenue hit USD$15.9 million and full-year revenue reach USD$56.5 million. Internationally, revenue surged by 42 per cent in Q4, demonstrating Pulmonx’s successful global expansion efforts.

These figures beat consensus estimates and also demonstrated operational efficiency, with an adjusted EBITDA loss of USD$7.5 million. Subsequently this is better than the anticipated USD$11.4 million. Investors are also likely reacting to this strong financial momentum, boosting confidence in Pulmonx’s growth trajectory.

Adding fuel to the fire, Pulmonx provided forward-looking guidance for 2025, projecting revenue between USD$96 million and USD$98 million. This represents a 16-18 per cent increase over 2024 on a constant currency basis.

While this midpoint slightly trails the consensus estimate of USD$97.7 million, analysts from Citi have suggested that this guidance might be conservative, given the company’s recent outperformance. Pulmonx’s track record of exceeding expectations—beating sales estimates 100 per cent of the time over the past year. The market appears to be pricing in the potential for upside surprises, driving the rally.

Read more: Breath Diagnostics pioneers novel lung cancer breath test

Read more: Breath Diagnostics takes aim at lung cancer with One Breath

Analysts display cautious optimism

Following the earnings release, Citi raised its price target for Pulmonx from USD$7.50 to USD$8.00 on February 20, maintaining a Neutral to High Risk rating.

While this adjustment reflects cautious optimism, the broader analyst community remains bullish. With a consensus price target hovering around USD$11.67 to USD$16.00 based on recent updates from firms like Wells Fargo and Stifel, Pulmonx stock offers significant upside potential from its earlier trading levels.

The stock’s 44.3 per cent jump to USD$8.93 on Thursday, as noted by Benzinga, likely carried momentum into Friday.

Pulmonx’s success isn’t just about numbers—it’s about execution. The company has been aggressively expanding its U.S. account base, adding 11 new Zephyr Valve treatment centers in Q4 alone. Its focus on optimizing patient workflows and raising awareness among physicians and patients is paying off.

Additionally, the pilot launch of the LungTraX software platform and ongoing innovation in AI-driven tools could play a significant role. These strategic moves resonate with investors betting on long-term growth.

Beyond fundamentals, technical factors may be at play. Pulmonx stock was flagged as potentially overbought on February 20.

However, strong earnings can sustain momentum even in overbought conditions, as seen with the 44.3 per cent spike on Thursday. Friday’s surge could also reflect short covering, given a short interest ratio of 3.9 days to cover.

Read more: Breath Diagnostics onboards new president and closes critical financing

Read more: University of Hong Kong new AI program helps improve cancer diagnosis accuracy

There are some downsides

Despite all of this Pulmonx remains unprofitable. The company had a net loss of USD$57.1 million in 2024, and its 2025 operating expense forecast of USD$133-$135 million suggests continued cash burn. The stock’s volatility—evident in a 52-week range from USD$7.75 to $14.84—could also invite profit-taking. Yet, with a strong liquidity position and growing revenue, these risks seem overshadowed by the company’s upside potential.

.

joseph@mugglehead.com