Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA) is advancing plans to refine antimony in the United States, signalling a push to strengthen Western supplies of the critical mineral.

On Thursday, the company said it is in discussions with Glencore Plc (LON: GLEN), Trafigura, Clarios, Nyrstar and Sunshine Silver about potential processing partnerships. Additionally, the effort comes as China restricts exports of antimony, a metal vital for bullets, solar panels and other industrial products.

Perpetua will mine the antimony at its Stibnite Gold Project, located about 138 miles (222 km) north of Boise, Idaho. Last week, furthermore, the US government granted conditional approval for construction to begin, allowing the company to move forward after years of permitting. The mine is expected to become the largest domestic source of antimony, a metal with no current US suppliers.

The company also plans to extract the mineral but not refine it, necessitating partnerships for the next step.

Perpetua intends to issue a request for proposal (RFP) in the coming weeks to evaluate third-party processing facilities. The RFP will assess potential partners based on production capacity, financial stability, environmental performance and transport reliability.

The company also holds estimated reserves of 148 million pounds of antimony and six million ounces of gold. The RFP process will focus on determining the feasibility of processing the portion of these reserves intended for commercial use. A final decision is expected by the fourth quarter of 2025, after careful due diligence.

Read more: NevGold delivers major growth at Idaho gold project

Read more: Antimony recovery results from NevGold’s Limo Butte project exceed expectations

Multiple companies are securing government contracts

Jon Cherry, president and CEO of Perpetua Resources, lamented the lack of America’s secure and robust antimony supply.

“Work has been under way between the US Army and Perpetua to advance downstream processing for defence needs,” Cherry said.

“However, it is now time we also respond to the needs of the US manufacturing and industrial sectors.”

Despite this, though, he said he was encouraged by an emerging opportunities to expand domestic mineral processing in America.

Meanwhile, United States Antimony Corp (NYSE: UAMY), which operates two North American antimony refineries, recently secured a contract from the US Defense Logistics Agency worth up to USD$245 million to supply metal ingots. The deal further demonstrates growing US government interest in securing domestic supplies of this critical mineral.

Perpetua’s Stibnite project has faced legal opposition from Idaho’s Nez Perce tribe, which expresses concern about potential impacts on the state’s salmon population.

The company has also committed to adhering to environmental requirements as part of its development plan. Conditional approval from the US Forest Service includes financial assurance bonding coordinated with the Idaho Department of Lands and the US Army Corps of Engineers.

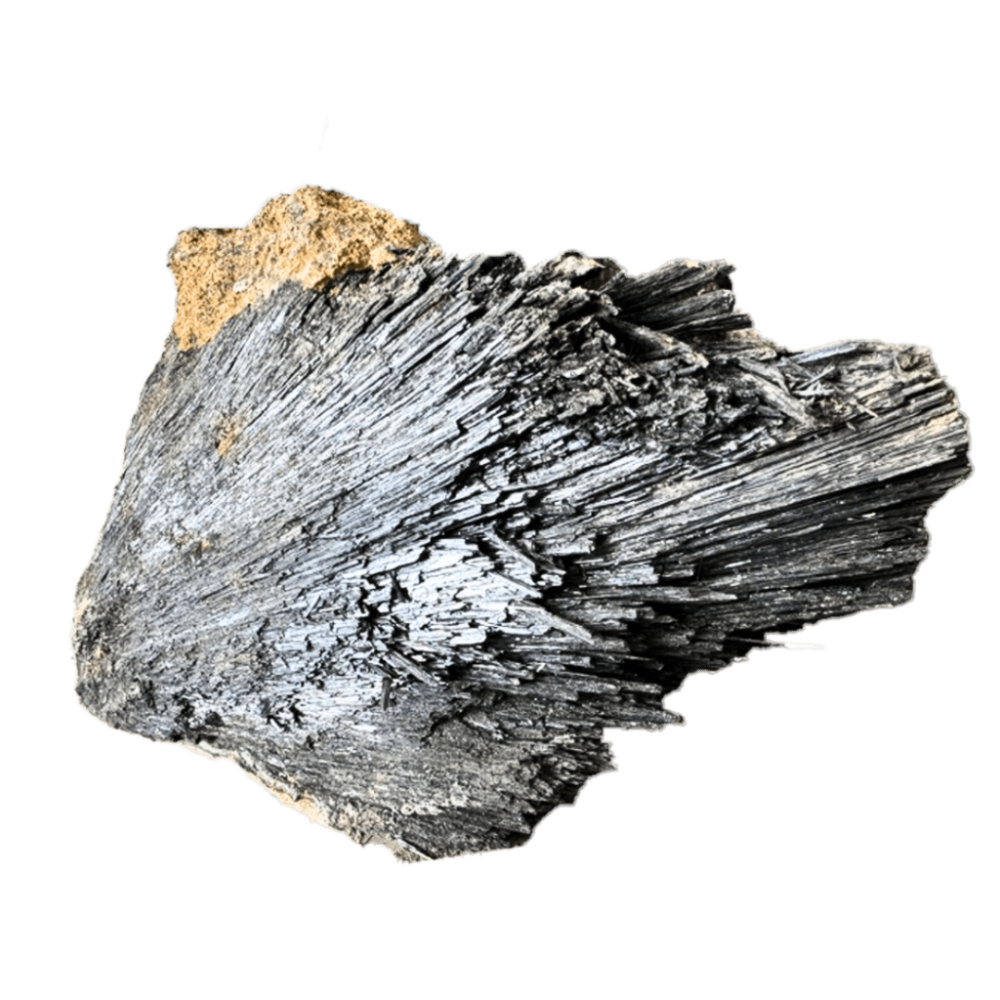

In addition to defense applications, antimony plays an important role in the US industrial sector. The metal is used in bullets, flame retardants, solar panels, batteries and other manufactured goods. Its recognition as a mineral critical to national security by the US Department of the Interior underscores its strategic importance.

The company aims to ensure a reliable domestic supply while benefiting shareholders. Furthermore, the initiative could reduce dependence on Chinese exports, which currently dominate global antimony markets.

Read more: NevGold’s long intervals of antimony & gold mineralization turn heads

Read more: NevGold pulls critical mineral antimony from Limo Butte property in Nevada

FAST-41 helps to accelerate development timelines

The United States is facing a growing challenge securing critical minerals, including antimony, a metal essential for defense, batteries, solar panels and industrial applications.

Supply chains remain heavily dependent on China, which has increasingly restricted exports. Policymakers are also turning to tools like FAST-41, a federal program designed to streamline permitting for projects deemed critical to national security and economic resilience.

Perpetua is among the companies at the forefront of this effort.

Its Stibnite Gold Project in Idaho contains an estimated 148 million pounds of antimony and six million ounces of gold. Furthermore, it has recently received conditional approval to begin construction. Perpetua is now exploring partnerships to refine antimony domestically, reducing reliance on foreign processing. The company plans to issue a request for proposal in the coming weeks and expects a final decision by year-end.

Other companies have already leveraged FAST-41 to accelerate development timelines.

Lithium Americas Corp (TSE: LAC) (NYSE: LAC) (FRA: WUC), for instance, has used the program to push forward its lithium projects in Nevada. These benefit from coordinated federal reviews and faster permitting. Similarly, companies in rare earths and other critical minerals have navigated FAST-41 to shorten approval times while ensuring environmental compliance.

Looking ahead, other US-focused mineral explorers could gain traction under FAST-41. NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50), which operates gold and polymetallic projects in Nevada, may find opportunities to expedite permitting through the program. As demand for domestic sources of strategic minerals grows, FAST-41 offers a pathway for companies to secure critical approvals.

.

NevGold Corp is a sponsor of Mugglehead news coverage

.