Palladium One Mining (TSXV: PDM) announced the acquisition of Thunder Bay based gold and metal explorer MetalCorp (TSXV: MTC) on Monday, expanding its Canadian critical minerals portfolio with two exploration-stage projects and royalty interests in others.

The deal cost Palladium one 0.30 of a Palladium common stock for each share acquired. The exchange ratio implies a purchase price of $0.026 per MetalCorp share, or $3.3million. When the deal closes, Palladium shareholders would hold approximately 88 per cent of the company’s stock, while MetalCorp would hold the remaining 12 per cent.

MetalCorp’s principle assets were the North Rock copper-nickel project, which has had a historical resource ranging from 920,000 grading 1.17 per cent copper to 240,000 tonnes grading 2.08 per cent copper. Also, it gets access to the Big Lake copper-zinc-gold-silver project.

Additionally, Palladium adds five exploration-stage projects to its royalty portfolio, with the principal royalty being the Hemlo Annex property owned by Barrick Gold (TSX: ABX) (NYSE: ABX).

“This transaction advances our strategy of creating value by responsibly establishing a partnership with a senior producer and growing a portfolio of critical mineral assets in Canada in support of North American critical mineral supply chains, and it also increases liquidity,” Palladium One CEO Derrick Weyrauch said in a media release.

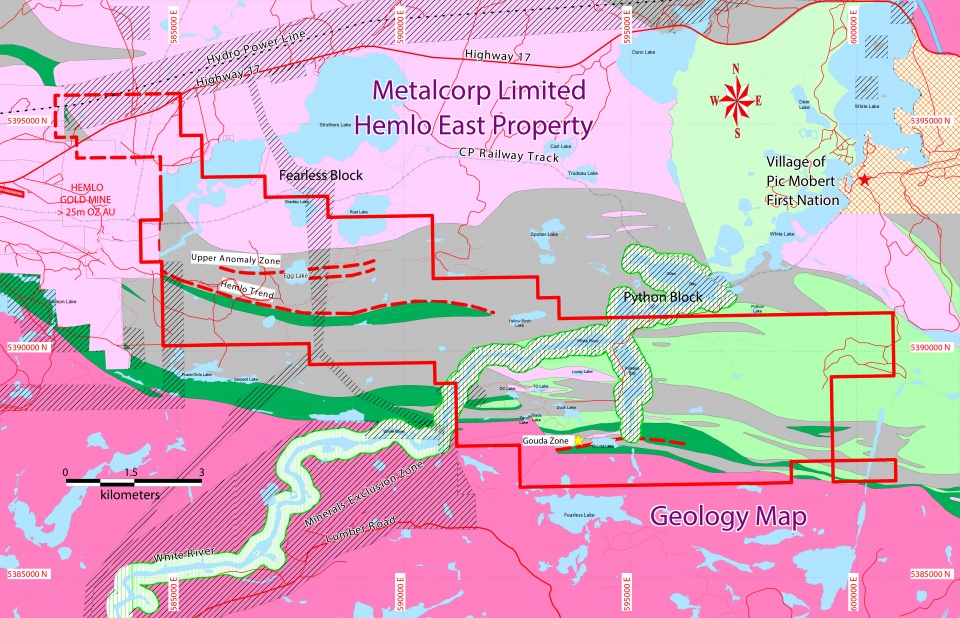

Palladium One will maintain the earn-in agreement favouring Barrick Gold on Metalcorp’s Hemlo East project adjacent Barricks’ Hemlo gold mine.

It’s located 40 kilometers southwest of Palladium One’s Tyko project. So far it’s produced over 21 million ounces to date.

Geology map for Hemlo East. Image via Metalcorp.

Read more: Ontario introduces legislation to strengthen mining sector and critical minerals supply chains

Palladium One collects benefits from other properties

Metalcorp’s assets include two critical mineral projects in Ontario. These are the exploration-stage North Rock copper-nickel project, which is road accessible and fully permitted.

Additionally, Big Lake, which is a copper-zinc-gold-silver volcanogenic massive sulphide-style project. It’s also road accessible and presently in exploration stage.

“Like MetalCorp, Palladium One has an excellent suite of properties including gold, PGEs, copper-nickel and a strong cash position. Based on the TSXV closing prices of each company on the day the agreement was signed, this transaction reflects a 28% premium for MetalCorp shareholders,” said MetalCorp’s CEO Donald Sheldon.

Tyko property map. Image via Palladium One.

Read more: NevGold should be trading at a premium to peers: Analysis

Read more: NevGold starts drilling at Nutmeg Mountain property

Palladium expands into Finland

Palladium One will also benefit from a number of other properties when the transaction closes.

These include massive sulphide, magmatic nickel-copper projects in three strong jurisdictions, including the Tyko nickel-copper-cobalt project in Ontario.

Also, the Canalask nickel-copper project in the Yukon, which is a large-scale ultramafic body with multiple nickel-copper-platinum group element showings.

Lastly, the KS nickel-copper-PGE project in Finland, which has potential for high-tenor sulphide, and three ounces per ton precious metals. This is 10 per cent nickel and approximately 13 per cent copper based on 100 per cent sulphide using metal tonors of the adjacent LK project.

Palladium one also gets the LK PGE-copper-nickel project in Finland, and the North Rock copper-nickel project in Ontario. The North Rock project covers 20 kilometers of the Grassy Portage layered mafic intrusion and hosts four covers of copper-nickel suphide mineralization.

The Hemlo East earn-in agreement with Barrick is next to Barrick’s producing Hemlo gold mine. It’s also 40 kilometers southwest of the Tyko project.

Barrick signed the earn-in agreement in November, 2020. Additionally, on November 26, 2021, Metalcorp announced that Barrick provided a notice of force majeure due to permitting delays. A force majeure is an event or circumstance that renders a party unable to perform its obligations under a contract.

Palladium One is presently trading at $0.085 on the TSX Venture Exchange.

Follow Joseph Morton on Twitter

joseph@mugglehead.com