Orea Mining Corp.‘s (TSX: OREA) (OTCQB: OREAF) (FSE: 3CG) proposed acquisition in the Montagne d’Or gold project in French Guiana is still waiting for government approval.

Orea provided an update on Friday that the acquisition, which was originally planned to close late February, faced a delay as a result of sanctions imposed by the Canadian government on Nord Gold PLC‘s (FRA: RTSD) Russian controlling shareholders.

Global Affairs Canada (GAC) is a department within the Canadian government that handles matters pertaining to sanctions with the Minister of Foreign Affairs, Mélanie Joly, holding ultimate responsibility for GAC. Orea submitted its sanctions application to GAC on March of this year.

The original application was rejected based on the minister’s interpretation that Orea cannot guarantee that any future payment to Nordgold would not be paid into a frozen account due to sanctions.

Despite the explicit prohibition in the agreement with Nordgold, the minister believes that Orea has the potential to bypass sanctions and transfer $100 million to Nordgold through a non-frozen bank account. Orea has engaged in multiple communications with GAC after the rejection, emphasizing that the contractual terms with Nordgold prevent circumvention of sanctions.

In response, Orea filed a formal reply proposing to amend the agreement terms with Nordgold to indicate that the payment would only be made after all sanctions were lifted against Nordgold and its controlling shareholders.

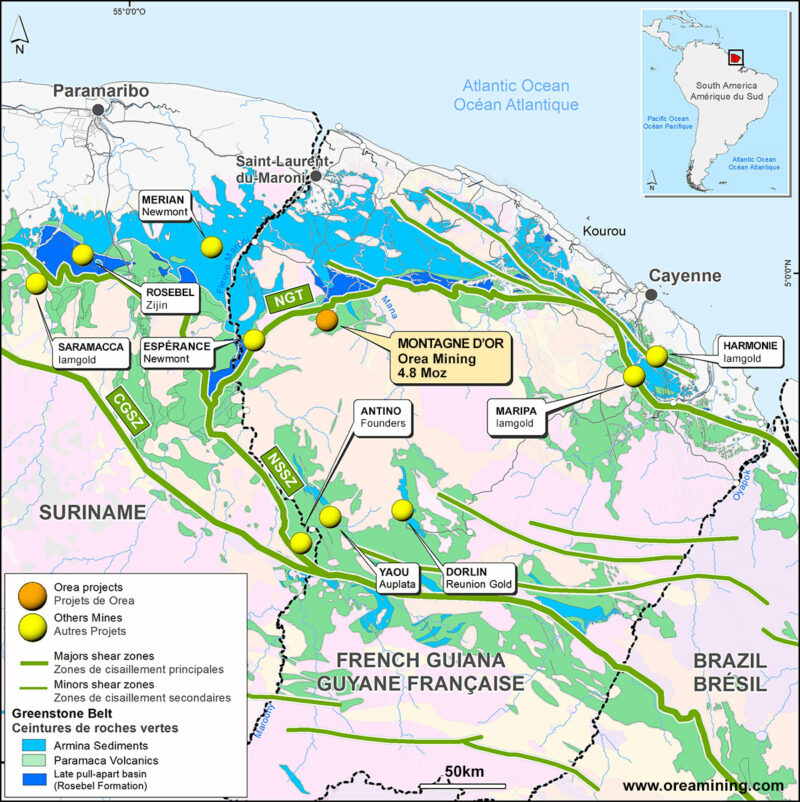

Montaign d’Or site map. Image via Orea Mining.

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

Read more: NevGold finds high-grade gold underneath the surface at Nutmeg Mountain

Orea application rejected by Canadian government as French sanctions expired

Under the present agreement with Nordgold, the $100 million payment is obligated to be made to a frozen account if sanctions remain in effect when the conditions for making the payment are met. Orea is currently awaiting an official decision from the Minister regarding the proposal.

Orea received the rejection from the Canadian government just a few days before its French government sanctions authorization was set to expire. Due to existing European Union (EU) legislation, France is unable to grant an extension to Orea’s expired authorization, and it is uncertain whether any forthcoming EU legislation will allow France to consider an extension or a new authorization.

Presently, EU member states are engaged in negotiations regarding new sanctions legislation. Orea and its legal advisors are closely monitoring these developments in the EU.

According to Orea’s agreement with Nordgold, either party has the right to terminate the agreement by providing written notice. Orea does not currently see any motivation to compel either party to terminate the agreement before observing the progress of developments in both Canada and the EU. However, Orea cannot predict Nordgold’s stance on the matter.

Considering the timing of the rejection from the Canadian government, there is no guarantee that the Acquisition will be completed. The extensive delays in obtaining approval from GAC have led to a significant working capital deficit for Orea, raising concerns about its solvency. Orea cannot provide assurance that it will be able to fulfill its obligations as they come due.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com