The New Brunswick Electric Power Corporation (N.B. Power) suggested a second refurbishment for the Point Lepreau nuclear generation station may be needed by 2041. The second may be needed even if the present five-year plan to fix problems caused by the first refurbishment is successful.

The crown corporation said on Thursday that the extension isn’t part of a package it submitted to the New Brunswick Energy and Utilities Board for an upcoming hearing about a potential rate hike. N.B. Power is in the early stages of requesting a 20.6 percent power rate increase over two years.

The aim is to rescue its struggling financial results and reduce debt. Some of the newly acquired funds will be necessary to increase spending on Point Lepreau to enhance its performance, which has been disappointing over the past few years.

The plant has experienced numerous issues despite going through a multi-billion dollar, multiple-year refurbishment in 2012.

Originally commissioned in 1983, the station under-produced in its first 25 operational years, which continued over the last decade. The company attempted a major overhaul of its reactor nuclear components between 2008 and 2012, but it failed to fix the problem.

In the 11 years since, Lepreau incurred 400 more days of downtime than anticipated. This resulted in up to $1 billion in lost production and repair costs that have severely impacted the utility’s finances.

Some of the excess downtime resulted from scheduled maintenance outages that extended beyond their planned duration, while approximately half of the downtime was due to “forced loss” days caused by sudden and unexpected breakdowns at the plant.

Read more: ATHA Energy closes C$23.5M financing, continues exploration with stronger balance sheet

Read more: ATHA Energy to acquire Latitude Uranium and 92 Energy, creating industry’s largest uranium portfolio

Production problems blamed on aging equipment

N.B. Power attributed chronic production problems to aging equipment and a range of other issues, including its own leadership failures. It recognizes that addressing these deficiencies will require both substantial financial resources and a significant amount of time.

As part of its efforts, N.B. Power has included a budget for 428 outage days at Lepreau over the next five fiscal years. This allocation comprises 313 days for scheduled maintenance and repairs, as well as 115 days for continuing losses from equipment failures.

This has been a fairly common occurrence all around the world as the older generation of nuclear reactors are decommissioned and dismantled in favour of the safer, newer technology of the next generation.

According to the World Nuclear Association, approximately 60 reactors are currently under construction around the world, with an additional 110 reactors in the planning stages. The majority of these reactors, both under construction and planned, are located in Asia.

In recent years, the commissioning of new plants has been largely offset by the retirement of older ones. Over the past two decades, 108 reactors have been retired, while 97 new reactors have commenced operation.

Even as the government of New Brunswick isn’t exactly willing to give up on its faulty reactor, there are other groups in the province looking into alternative forms of nuclear energy.

Members of several First Nations communities in New Brunswick are investing in small modular nuclear reactors (SMR) in a bid to “protect Mother Earth” and get a return on their investments.

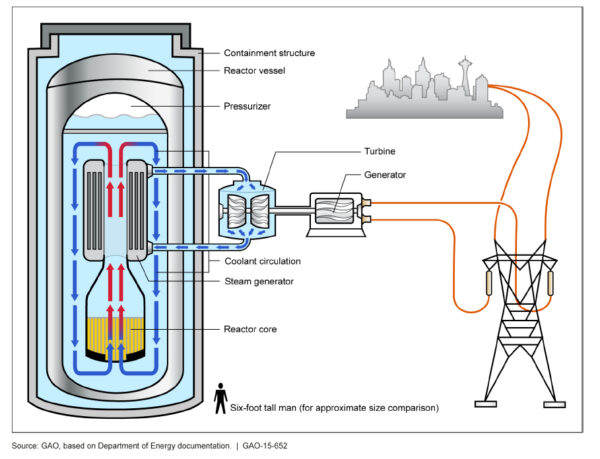

Illustration of a light water small modular nuclear reactor. Image from U.S. Government Accountability Office via Wikimedia Commons.

Read more: ATHA Energy increases private placement offering up to $22.84M

Read more: ATHA Energy aerial surveys over Athabasca Basin reveal strong potential for uranium

New Brunswick First Nations get into SMRs

On Monday, Pabineau First Nations Chief Terry Richardson revealed that the North Shore Mi’kmaq Council and its seven First Nation member communities are making a $3 million investment in SMR technology through two Saint John-based companies.

The communities signed an equity agreement to purchase $2 million worth of shares from Moltex Energy and $1 million worth of shares from ARC Clean Energy.

In 2021, the province provided ARC with $20 million in funding, and Moltex received over $50 million in federal government support. The previous provincial Liberal government had granted each of them $5 million.

ARC’s 100-megawatt liquid sodium-cooled fast reactor is set to become operational by 2029, while Moltex’s 300-megawatt stable salt reactor and spent fuel recovery system are projected to begin operations in the early 2030s.

As the name suggests, SMRs are considerably smaller than traditional nuclear reactors.

According to a Cleantech Group report, small modular reactors and microreactors are gaining momentum worldwide with China and Eastern Europe in the midst of a development boom. Certain SMR models function similarly to conventional pressurized light water nuclear reactors but are smaller, allowing for partial construction in one location and transportation to another.

These reactors provide a nearly carbon-free, stable, baseload energy alternative to renewables like solar and wind. They also offer distinct advantages in regions with limited wind and solar resources.

Microreactors can produce outputs ranging from 1 to 20MW, while SMRs can generate power within the range of 60 to 300MW. Gen III reactors employ pressurized light water technology, similar to traditional plants but on a slightly smaller scale.

Read more: Leading Saskatchewan educational institutions to launch new mining and energy school

Read more: Over half of U.S. citizens support nuclear power: ecoAmerica survey

SMRs require steady supply of cheap uranium

These projects utilize water as a coolant and low-enriched uranium as fuel. According to a report from market statistics firm Statista, estimates indicate that the capital expenditure costs for these reactors can reach up to $5,000 per kW, with a levelized cost of electricity (LCOE) falling in the range of $80 to $90 per MWh.

For comparison, the construction costs for offshore wind projects range from $3,000 to $5,000 per kW, while utility-scale solar projects in the United States typically have costs between $700 and $1,500 per kW.

SMRs can be deployed in areas with limited or unavailable grid or transmission infrastructure, providing stable on-site power. Use cases span from decarbonizing construction sites and coal mines to potential applications in data centers and chemical manufacturing facilities.

Large companies such as Dow Chemical (NYSE: DOW) are exploring the potential of SMR technologies with X-Energy.

However, SMRs and micro-reactors face challenges, including relatively high capital expenditure costs, lengthy licensing timelines, supply and safety concerns, and environmental issues. These require solutions.

Chief among these problems is locating a steady supply of abundant and cheap uranium.

Uranium reached a new record of USD$91 per pound this week, surpassing the triple-digit prices last seen in 2007 and the fallout that followed the 2011 Fukushima disaster in Japan, which led several countries to curtail their nuclear energy plans. The price has risen from approximately USD$50 per lb. earlier in the year.

Furthermore, the spot price keeps climbing, driven by commitments to triple nuclear power generation by mid-century, supply disruptions from producers like Cameco Corporation (TSX: CCO) (NYSE: CCJ), and the impending possibility of a ban on Russian exports to the west.

Read more: China approves construction of 4 nuclear power units amid rising uranium demand

Read more: Standard Uranium joins Aero Energy in uranium project

Supply chain woes presents a silver lining

Meeting the demand has become challenging for suppliers like Cameco, which indicated the possibility of purchasing up to 8 million pounds in the recently concluded quarter to fulfill its contracts. Many utility contracts are long term in nature and supply shortages can amplify price increases in the spot market. Investment bank Morgan Stanley predicts that the price may rise as high as USD$95 per pound by March.

As always, geopolitics complicate the issue even further.

The U.S. Congress is deliberating a ban on Russian uranium imports. It has already been approved by the House of Representatives and presently awaits debate in the Senate even though most Western utilities have been avoiding Russian uranium supplies since the conflict in Ukraine started nearly two years ago.

Implementing such a ban could potentially trigger retaliatory actions. Nonetheless, the Biden administration is on the verge of signing into law a USD$2 billion boost to the country’s nuclear industry.

But with the sky-high uranium price, geopolitical concerns and Cameco’s inability to resolve the supply chain issues, there’s going to be lots of excess demand to go around for uranium.

Read more: Skyharbour Resources reports one of its best drill results at Athabasca Basin project

Read more: SKRR Exploration buys majority interest in Athabasca Basin property

There’s more to the Athabasca Basin than just Cameco

Saskatchewan’s Athabasca Basin is Canada’s principle uranium jurisdiction. While this is Cameco’s primary source of the mineral, it’s also home to a number of other uranium producers.

ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) recently acquired 92 Energy Ltd. (ASX: 92E) and Latitude Uranium (CSE: LUR), thereby establishing the largest exploration portfolio in Canada.

This move includes the addition of a vast expanse of exploration acreage, totalling 7.1 million acres, distributed across the top three uranium jurisdictions in the country.

Meanwhile in early November, Skyharbour Resources Ltd. (TSXV: SYH) (OTCQX: SYHBF) reported that a recently drilled hole at the Grayling zone at the Russell Lake project yielded 0.151 percent U3O8 over a 5.9-meter interval, with an inclusion of 0.366 percent U3O8 in a 1-meter section at a depth of 338.4 meters. The project covers an extensive area of 73,294 hectares.

The Russell Lake project sits between the Key Lake and McArthur River projects operated by Cameco. It also shares a border with the Wheeler River project managed by Denison Mines Corp. (TSX: DML) (NYSE: DNN) to the west.

Skyharbour holds 24 projects within a 1.2 million-acre land package. Ten of these are prepared for drilling.

ATHA Energy Corp. is a sponsor of Mugglehead news coverage