NevGold Corp. (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) Ptarmigan subsidiary received access to five different mineral bearing properties as part of an option agreement with Eagle Plains Resources Ltd (TSX: EPL).

Announced on Tuesday, the closure of the agreement came as part of the larger transaction that established the subsidiary in late May, and started the preparations for its eventual public-listing debut.

The mineral bearing properties include two projects involving copper, gold and silver, as well as three projects focused on lithium exploration in British Columbia.

As part of the deal Eagle Plains grants SubCo the rights and option to acquire the option projects in exchange for certain future conditions and net smelter return (NSR) royalties. Additionally, NevGold transferred its Ptarmigan property to SubCo for 25 million SubCo shares.

Under the agreement, NevGold’s subsidiary can issue 5 million shares to Eagle Plains on or before the closing date. Additionally, after 10 days of going public, it must issue an additional 5 million. SubCo is also required to make a minimum investment of $500,000 on the projects before the end of this year and an additional $500,000 before the end of 2024.

After the option is exercised, SubCo will then grant Eagle Plains a 2 per cent NSR royalty with the option to buy down the royalty to 1 per cent by paying $1 million.

As part of the deal Eagle Plains grants SubCo the rights and option to acquire the option projects in exchange for certain future conditions and net smelter return (NSR) royalties. Additionally, NevGold transferred its Ptarmigan property to SubCo for 25 million SubCo shares.

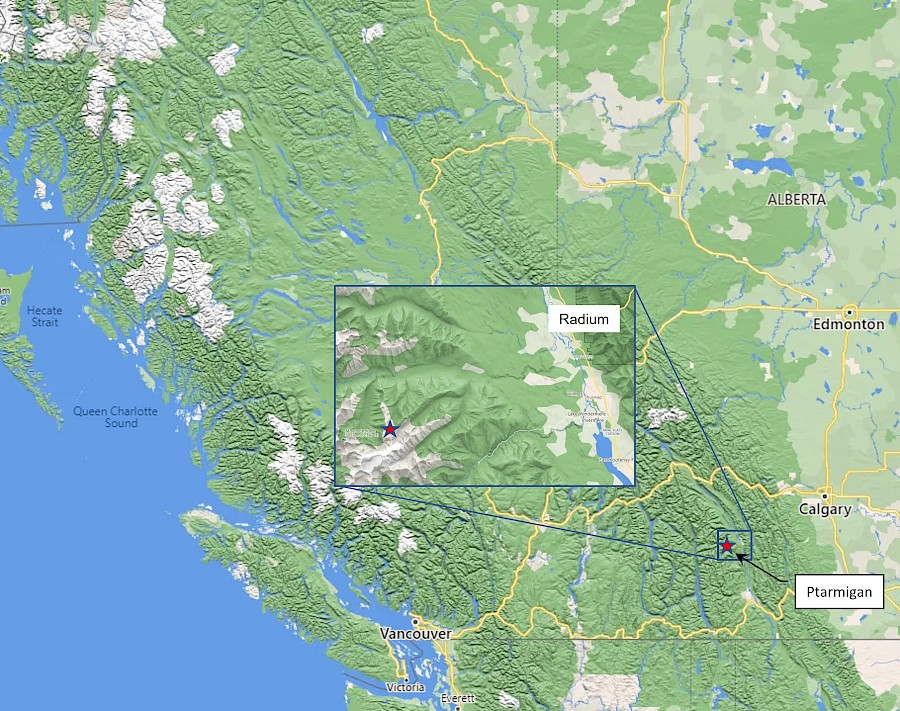

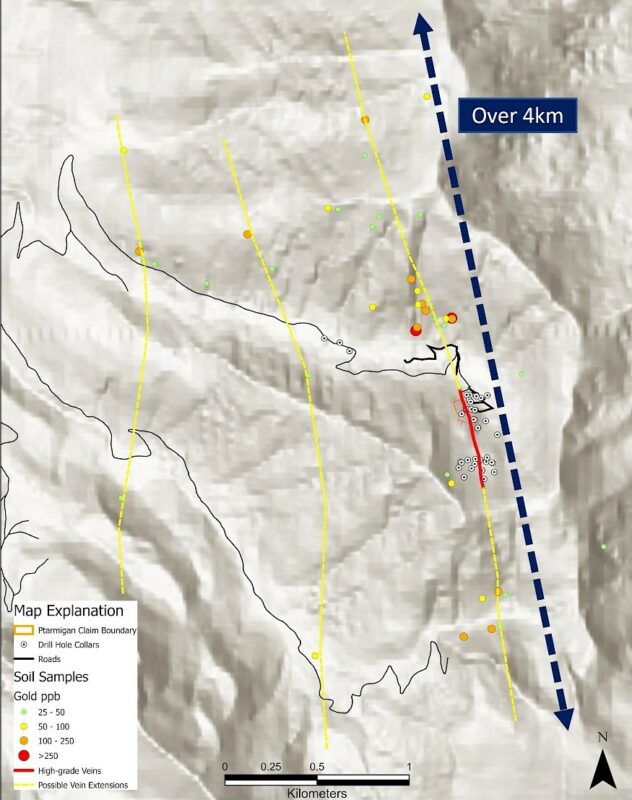

Map showing Ptarmigan deposits. Image via NevGold.

Read more: NevGold forms B.C. subsidiary to focus on Ptarmigan

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

New regions offer significant value to NevGold shareholders

NevGold shareholders stand to benefit from the issuance of 25 million shares of the subsidiary. This move is beneficial for NevGold as it unlocks Ptarmigan’s potential value.

Additionally, NevGold holds substantial land holdings totalling over 310 square kilometers (31,028 hectares) in highly promising regions such as Southeast British Columbia, Toodoggone and Atlin.

NevGold will draw favourable returns from the option agreement due to the Ptarmigan project, which is already under its ownership, but also from Lost Horse and Acacia, which it gets access too via the option project. All three of these projects have drill-ready targets.

The Acacia project is approximately 60 kilometers northeast of Kamloops and has authorization from the province’s mining authorities.

The Lost Horse project is surrounded by mining operations of New Gold Inc. (TSX: NGD). This project boasts numerous potential copper and gold occurrences and has also obtained a multi-year area based permit, further enhancing its development prospects.

The option agreement lets NevGold to concentrate completely on its projects in the Western United States, such as its oxide, heap-leach gold projects in locations such as Nutmeg Mountain in Idaho and Limousine Butte and Cedar Wash in Nevada.

NevGold shares declined 1.4 per cent to $0.36 on Tuesday on the TSX Venture Exchange.

.

NevGold is a sponsor of Mugglehead news coverage

.