McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) reported its fourth quarter and full-year results for the period ended Dec. 31, last year showing a 22 per cent increase in gold production at its Fox operation in Timmins, along with a decrease in cash costs per ounce and steady all-in sustaining costs per ounce.

Additionally, McEwen Copper, a subsidiary of McEwen Mining, reached several milestones in 2022, including building a seasoned Argentine management team, improving critical access to Los Azules, advancing technical studies and welcoming investors Rio Tinto Ltd. (ASX: RIO) (LON: RIO)’s latest venture Nuton LLC and Stellantis (NYSE: STLA) (Euronext Milan: STLAM) (Euronext Paris: STLAP).

Following the year-end, a subsidiary of Stellantis invested ARS$30 billion and Nuton LLC increased its investment by $30 million in McEwen Copper. Stellantis and Nuton now own 14.2 per cent each of McEwen Copper, while McEwen Mining owns 52 per cent. These transactions value McEwen Copper at approximately $550 million on a 100 per cent basis.

Company stock dropped by 6.07 per cent on Tuesday to $10.05 on the Toronto Securities Exchange.

Read more: McEwen Copper’s Los Azules drill program continues to show high-grade deposit potential

Read more: Car maker Stellantis and Rio Tinto invest in McEwen Copper Argentinian mine

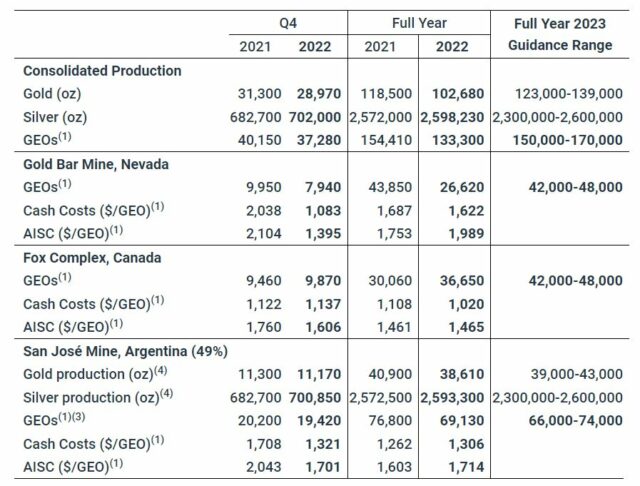

Production and cost results for Q4 and the full year 2022, with comparative results from 2021 and the firm’s guidance range for 2023. Table via McEwen

In 2023, McEwen Mining expects to produce between 150,000 and 170,000 GEOs. Last year, McEwen Copper produced 133,300 GEOs, slightly below the revised guidance of 134,600 to 141,600 GEOs due to lower production at the Fox Complex.

The 100 per cent-owned mines generated a cash gross profit of $19.2 million and a gross loss of $0.5 million.

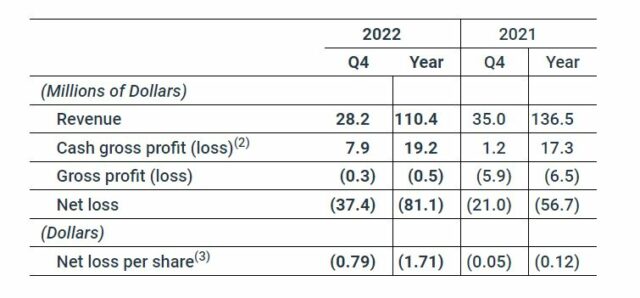

McEwen Mining incurred advanced project expenditures of $41.3 million at Los Azules, contributing to a net loss of $81.1 million in 2022.

Despite the loss, McEwen Mining continued to aggressively invest in exploration, completing over 180,000 feet of drilling at the Fox Complex, 16,900 feet at the Gold Bar Mine and 73,500 feet at the Los Azules project. The production costs per ounce decreased by 12 per cent compared to 2021 for cash costs and increased by 3 per cent for all-in sustaining costs per GEO sold.

McEwen Mining’s cash and liquid assets at the end of 2022 were $46.2 million.

Financial results Q4 & Year ended Dec 2022, compared to Q4 & Year ended Dec 2021. Table via McEwen.

Read more: Calibre Mining broke gold production records with 10% increase in 2022

Read more: Calibre Mining increases mineral resources and reserves at its Nicaragua and Nevada operations

McEwen Mining experienced significant changes last year

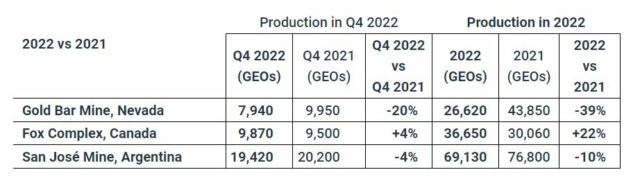

“2022 was an important transition year for McEwen Mining. Our Fox operation in Timmins showed the largest improvement from 2021, with a 22 per cent increase in gold production, 8 per cent lower cash costs per ounce and steady all-in sustaining costs per ounce,” said chairman and owner Rob McEwen.

“Our operation in Nevada has now transitioned production to our Gold Bar South pit, a new mining contractor has been instated, and production is increasing.”

In 2022, McEwen Mining experienced significant changes. The Fox operation in Timmins saw a considerable improvement from the previous year, with a 22 per cent rise in gold production, a decrease of 8 per cent in cash costs per ounce, and stable all-in-sustaining costs per ounce.

Production for Q4 & Year ended Dec 31, 2022, compared to Q4 & Year ended Dec 31, 2021. Table via McEwen.

The Nevada operation transitioned production to the Gold Bar South pit and appointed a new mining contractor, resulting in increased production.

The McEwen Copper subsidiary achieved multiple milestones during 2022 and early 2023, such as establishing an experienced management team in Argentina, improving critical access to Los Azules with a second route to the site, progressing technical studies, and reaffirming commitments to government and local stakeholders.

“And welcoming two strategic investors: Nuton (a Rio Tinto Venture and part of the world’s 2nd largest mining company) and Stellantis, the world’s fourth largest automobile manufacturer and mobility provider,” McEwen added.

Natalia@mugglehead.com