Magna Mining Inc. (TSX.V: NICU) (OTCQB: MGMNF) (FSE: 8YD) has completed a promising economic assessment for the Crean Hill Project with visions of a 15-year nickel mine in Sudbury, Ontario.

The company said on Thursday that its preliminary economic assessment of the project looked at two scenarios where one presented a long mine life, “modest” upfront capital cost and minimal permitting required before commencing advanced exploration development.

The second one presented the possibility of building a mill at the company’s past-producing Shakespeare project which is 70 kilometers southwest of Sudbury.

The company acquired the mine last November after closing in 2002 following 80 years of operation. Crean hill mine is located in the southwest corner of the Sudbury Basin and less than 45 kilometres from the proposed Shakespeare mill site.

“This Preliminary Economic Assessment demonstrates why we think the Crean Hill Nickel Project has the potential to be the next nickel-producing mine in Canada,” Magna Mining CEO Jason Jessup said in a statement.

“The next technical study will look at further optimization of cut-off grade, stope design and scheduling to maximize revenues during the first years of mine life,” he added.

Jessup said the study will not only incorporate the diamond drilling that Magna has completed on Crean Hill since the acquisition in 2022, but also the economics of a fully integrated mining complex with Magna’s Shakespeare Project.

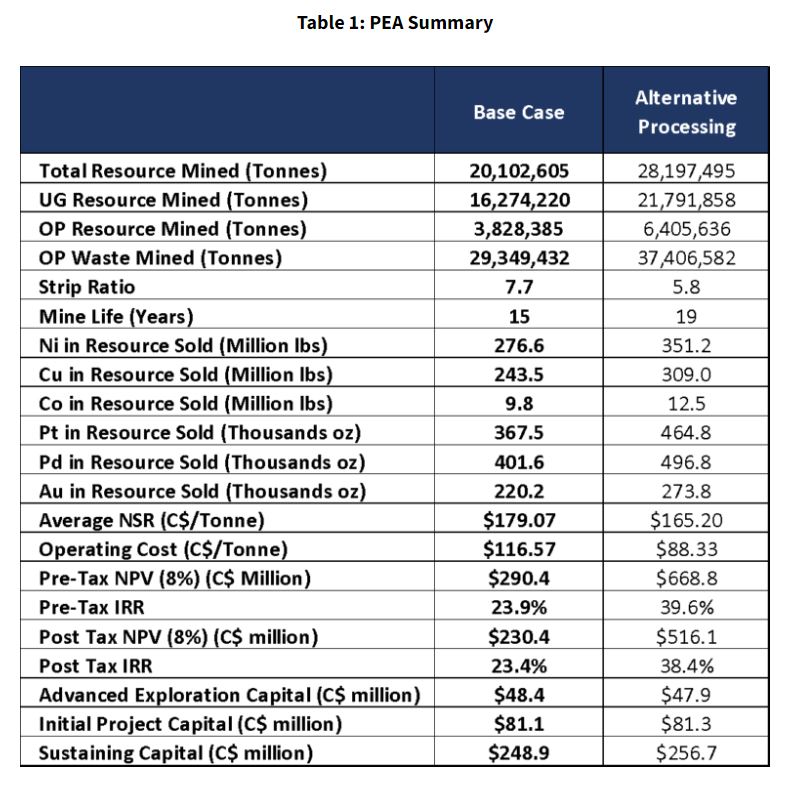

Table via Magna Mining.

Read more: UC Irvine develops cobalt-free lithium-ion batteries utilizing low quantities of nickel

Read more: SPC Nickel drilling campaign in Sudbury produces high-grade copper and nickel

Two scenarios in the PEA

The Base Case scenario envisions a 15-year mine life, combining open pit and underground mining, with resources being sold to a third-party mill in Sudbury. This scenario generates a pre-tax Net Present Value (NPV) of $290.4 million and an Internal Rate of Return (IRR) of 23.9 per cent.

On the other hand, the Alternative Processing scenario explores the economics of processing through a future mill at the company’s Shakespeare Project, resulting in a significantly higher pre-tax NPV of $668.8 million and an IRR of 39.6 per cent.

Shakespeare has major permits for the construction of the mill and for the recommencement of open-pit mining. It also includes a surrounding 180-kilometer square land package that may contain nickel, copper and other rare earth discoveries according to the company.

Magna Mining stock dropped on Thursday by 4.84 per cent to $0.59 on the Canadian Ventures Exchange.

West pit at Shakespeare Project. Photo via Magna Mining.