Lithium producer Livent Corporation (NYSE: LTHM) reported a quarterly profit that fell below expectations and revised its annual revenue and earnings forecast downward due to expansion delays in Argentina.

The company reported on Tuesday that its full year revenue for 2023 will be in the range of USD$890 million to USD$940 million, with adjusted EBIDTA in the range of USD$500 million to USD$530 million. These projections represent growth of 13 per cent and 40 per cent respectively at the midpoints compared to last year.

Livent’s Q3 revenue dipped 10 per cent compared to Q2 to USD$211.4 million. It also represented a 9 per cent decrease over Q3 of 2022.

Meanwhile, GAAP net income for the quarter stood at USD$87.4 million, or 42 cents per diluted share, in contrast to the previous quarter’s $90.2 million and the prior year’s quarter, which recorded USD$77.6 million. The company also sports a cash position USD$112.6 million cash position.

The expansion start-up delay is primarily responsible for driving the majority of the reduction compared to prior guidance, as it is now expected that volumes sold in 2023 will be roughly flat versus 2022.

“We are working closely with our customers to meet their growing lithium demand needs as we prepare to meaningfully increase production volumes from our capacity expansions beginning in 2024,” said Paul Graves, president and chief executive officer of Livent.

“Additionally, we remain on track to close our transformational merger with Allkem by around the end of this year and look forward to combining our teams, assets and collective strengths to create a leading integrated global lithium company.”

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Livent and Allkem engaging in merger of equals

Livent and Argentina-based Allkem Limited (ASX: AKE) will be merging into a new company called Arcadium Lithium plc, which will trade on the New York Stock Exchange under the ticker ‘ALTM.’ The two companies have met all the required pre-closing regulatory approvals except for foreign investment screening by the Australian Foreign Investment Review Board (FIRB).

Thus far, the two companies have received approvals, including antitrust approvals in Canada, China, Japan, South Korea and the U.S., along with the completion of investment screenings in the U.K. and the U.S.

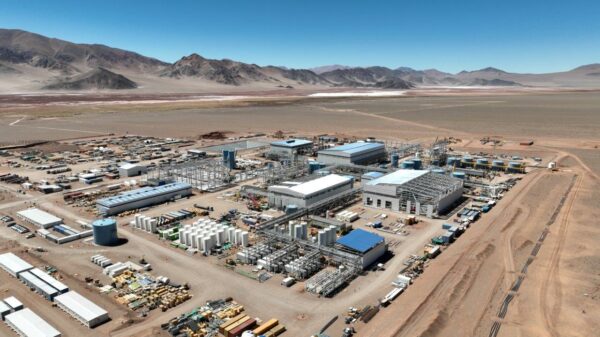

In Argentina, Livent is making progress on its 20,000 metric ton lithium carbonate expansion. It has completed the construction for the first 10,000 metric ton phase, and the company anticipates the first commercial volumes in the first quarter of 2024. As for the second 10,000 metric ton expansion phase, it now expects the first commercial volumes in the second half of 2024.

The lithium hydroxide expansions in the U.S. and China continue to progress as planned. Livent’s new 5,000 metric ton hydroxide unit in Bessemer City in North Carolina has already started producing material and is in the process of getting qualified with relevant customers.

It will gradually increase production alongside the first phase of the lithium carbonate expansion in Argentina. Additionally, construction is underway for the 15,000 metric ton hydroxide facility in the province of Zhejiang, China, with completion expected by year-end 2023. This expansion will double Livent’s production capacity in China and increase its total global lithium hydroxide capacity to 45,000 metric tons.

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Read more: Lithium South Development updates leadership roster, appoints new director

Feasibility study on Nemaska Lithium reveals its strengths

The company has also released a feasibility study in Q3 for its Whabouchi mine portion of the Nemaska Lithium project located in Québec, Canada. The feasibility study supports the viability and appeal of the Nemaska Lithium project.

It also reveals its strengths, including its scale, an asset operating life of over thirty years, a strong relative cost position, a strategic location in North America and a favorable sustainability profile that includes access to low-carbon hydroelectric energy.

The study confirms the project’s previously outlined expectations. The development of the Whabouchi spodumene mine and the integrated lithium hydroxide facility in Bécancour is projected to require approximately USD$1.6 billion in total capital, with Whabouchi accounting for roughly USD$400 million of the total amount.

The project anticipates commencing commercial sales of spodumene concentrate in 2025, which will continue until the lithium hydroxide facility reaches full production. The first production of lithium hydroxide is expected in late 2026.

Livent Corporation’s optimistic projections for 2023, including significant revenue and EBITDA growth, highlight its confidence in the lithium market. The company’s ongoing expansions in Argentina, the U.S., and China, along with its forthcoming merger with Allkem, position it well to meet the rising global demand for lithium and solidify its position as a leading player in the industry.

.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com