The global automotive lithium-ion battery cell market is anticipated to grow by 24.25 per cent per year from 2023 to 2031, with a prospective value of USD$550.54 billion by the end of the forecast, according to a new market report by marketing analysis firm Transparency Market Research.

Released on Tuesday, the report said the market will grow because of the high demand for electric two-wheelers and passenger cars. Urban regions are the primary driving catalyst of global GDP.

Urbanization promotes sustainable growth by increasing productivity and fostering the acceptance of new ideas and technology. The need for lithium-ion battery cells for electric vehicles is being driven by the urban population, which represents a significant customer base for these vehicles.

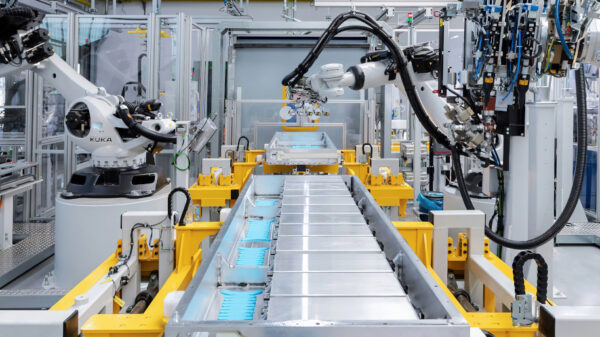

Many of the top players in the automotive LIB cell industry are heavily investing in extensive research and development, primarily aimed at creating excellent services. Future research on the automotive LIB cell market suggests that major competitors plan to employ tactics such as mergers, acquisitions, and expanding their product portfolios.

The prism cell type played a significant role, capturing a substantial portion of the market share. This growth can be attributed to prismatic cell packs, which feature higher lithium content and greater amp-hour storage per cell.

This trend is particularly noticeable in larger battery pack configurations and single cell options offering extended battery ranges. Additionally, prismatic cells stand out for their cost-effectiveness in recycling and ease of maintenance, making them an attractive choice for users.

Additionally, the pouch cell category is expected to gain popularity throughout the projection period, thanks to its enhanced performance and durability.

The Lithium market is rapidly growing with the popularity of #ElectricVehicles and other lithium-powered products. Experts estimate that by 2031, the market will grow to 550.5 billion USD#LIS $LISMF $OROCF $TSLA $ALLI $APHLF #lithium #argentina #Mining https://t.co/9h8Jx05Zqd

— Lithium South Development Corporation (@LithiumSouth) January 2, 2024

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Read more: Lithium South Development updates leadership roster, appoints new director

Lithium ion battery market dominated by lithium cobalt oxide sector

In 2021, the the lithium cobalt oxide (LCO) sector dominated the global automotive lithium-ion battery cell market. The report indicates that dominance is expected to persist throughout the projection period.

LCO’s superiority lies in its high specific energy, making it an ideal cathode for digital circuits. The cell consists of a graphite carbon anode and a cobalt oxide cathode, with lithium ions moving from the anode to the cathode during discharge and reversing during charging. However, lithium-cobalt cells have limitations, including limited load capacity, low temperature stability, and a short lifespan.

To address these challenges and due to the rapid establishment of charging infrastructure or stations, the market share of lithium nickel manganese cobalt oxide (NMC) is steadily increasing.

The high cost of cobalt has prompted major trends in the automotive LIB cell industry, leading battery manufacturers to shift away from cobalt-based lithium-ion battery materials in favour of nickel. Nickel-based systems offer cost-effectiveness, longer cycle life, and superior energy density compared to cobalt-based cells, although they do have a slightly lower voltage.

Read more: Lithium South Development updates leadership roster, appoints new director

China leads multiple segments in global lithium markets

The global market for automotive lithium-ion battery cells is primarily led by Asia Pacific, with China playing a central role due to its extensive production and widespread use of electric scooters and motorbikes.

The adoption of electric cars in China has been further accelerated by a combination of rising emissions and stringent government anti-pollution regulations and incentives, resulting in increased market share within the Asia Pacific region. Additionally, countries like India, Japan, and Taiwan are witnessing a growing trend in the use of electric two-wheeler vehicles.

In 2021, Europe emerged as a significant player in the vehicle lithium-ion battery cell market, driven in part by the presence of important factories and the increased demand for lithium cobalt oxide type batteries in the region.

North America also holds a substantial market share in the global automotive lithium-ion battery cell market, primarily due to the technical proficiency of nations like the United States and Canada, both of which are world leaders in the adoption of innovative technologies.

China leads in other segments of the lithium supply chain as well.

Chinese-controlled mines will boost their output to 705,000 tons in 2025, according to the Institute for Energy Research. This marks a nearly fourfold increase from the 194,000 tons produced in 2022. This substantial increase will elevate China’s share of the critical mineral to 32 percent of the world’s supply, compared to the 24 percent it held in 2022.

Salar de Uyuni, Bolivia: A worker near a pool in the Salar de Uyuni salt fields. Image via Alamy.

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

President Biden looks to allies for aid

The rise in China’s fortunes have caused President Joe Biden to produce the Inflation Reduction Act, a bill intended to relieve the United States of its reliance on China for imports of both lithium and other critical minerals. The bill offers tax incentives to companies in the United States and countries with free trade agreements for lithium production.

The United States has one operational lithium mine run by Albemarle Corporation (NYSE: ALB), and two high potential lithium deposits in Nevada and California, respectively. These efforts are insufficient to challenge China’s dominance, leading the US to seek assistance from its allies and potential allies abroad.

Canada is naturally on that list. Australian-based Allkem Limited (ASX: AKE) has been operating in the James Bay Region, and pending its amalgamation with United States chemical giant, Livent Corporation (NYSE: LTHM), will also extend its reach deep into other countries. One of these countries is Argentina, which isn’t presently on Biden’s list. However, it could be if talks with its new interim president Javier Milei continue apace.

Argentina claims membership in the geographical area called the lithium triangle, which it shares with Chile and Bolivia. It is is the largest lithium bearing deposit in the world. Some of the largest lithium miners in the world are already there. These include Sociedad Química y Minera de Chile (NYSE: SQM) and Ganfeng Lithium Group Co., Ltd. (SZSE: 002460) (SEHK: 1772).

There are also strong, promising juniors operating in the region. These include Recharge Resources Ltd. (CSE: RR) (OTC: RECHF), Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ), and Argentina Lithium & Energy Corp. (TSXV: LIT) (OTC: PNXLF).

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com