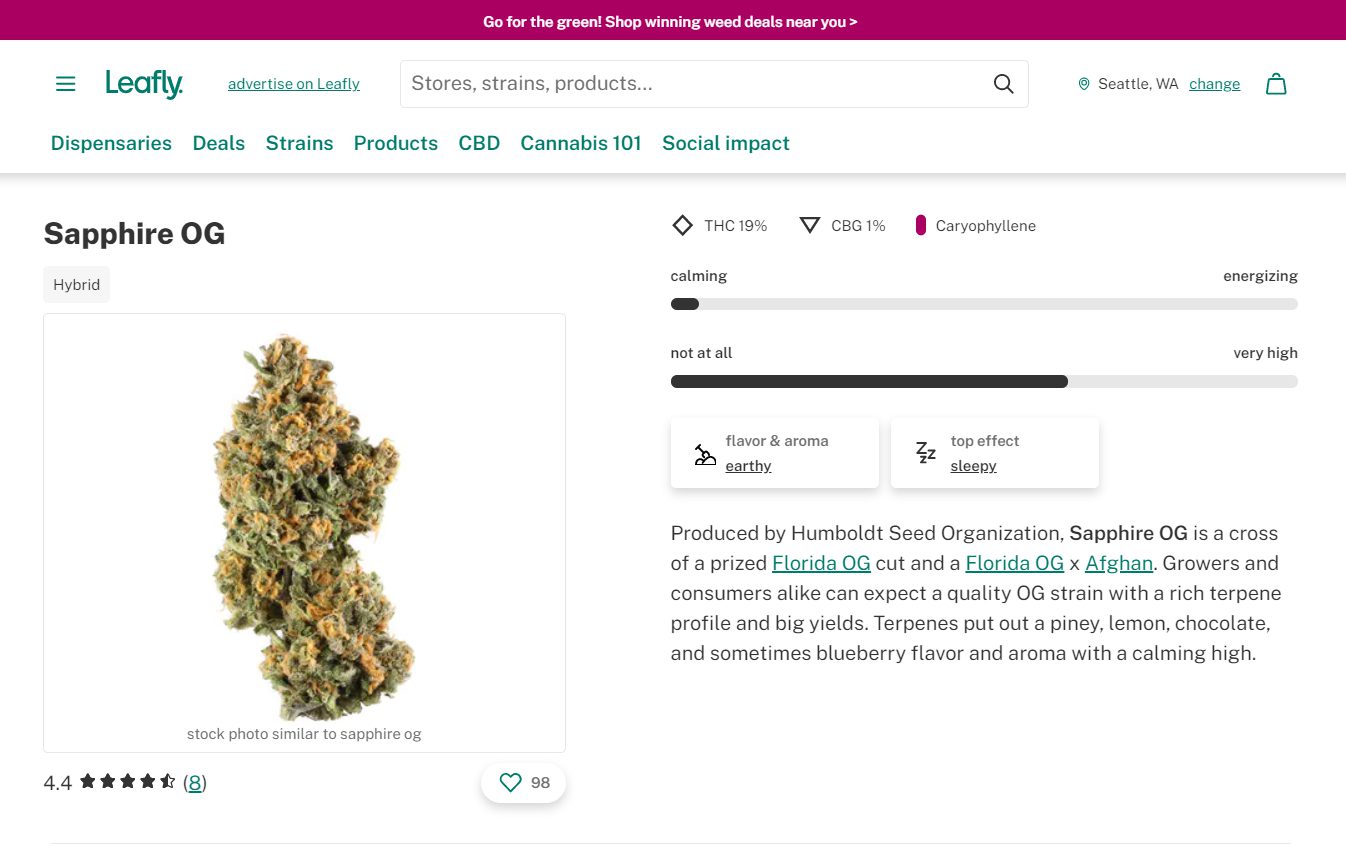

Cannabis media company Leafly has made its initial pubic offering.

On Monday, Seattle-based Leafly Holdings Inc. (Nasdaq: LFLY) started trading under the ticker symbol LFLY, following a merger with shell corporation Merida Merger Corp. I.

Leafly CEO Yoko Miyashita says the listing is a testament to the tireless work ethic of company staff, investor support and the unique value the firm brings to consumers, brands and retailers.

“Now, with access to new capital and momentum across our industry, we are poised to execute our growth strategy and continue making cannabis a force for positive change in our world,” she said in a statement.

Plans to go public were shared in August. At the time, the company estimated a fully diluted enterprise value of around US$385 million and an equity valuation of US$532 million.

Read more: Cannabis media giant Leafly is going public

Peter Lee, former president of Merida Merger Corp. I, will stay on as a member of the board of directors of the combined company.

“Leafly has long been a critical resource in the cannabis ecosystem,” he said in the statement. “With its three-sided marketplace and unparalleled content library, Leafly makes cannabis understandable and accessible for consumers, retailers, and brands alike — driving an incredible flywheel effect and tremendous brand loyalty across the country.”

“Now, with an experienced management team and substantial funding, Leafly is poised to take the next step in its journey, and we are excited to continue to play a role.”

Read more: Leafly to raise US$30M in convertible notes ahead of public listing

Earlier this month Leafly and Merida said they entered into a financing deal worth US$30 million with investors led by Cohanzick Management LLC.

At the time, Miyashita said the funding will help provide additional certainty as the firm goes public.

Leafly stock was up four per cent Monday to US$6.80 on the Nasdaq.

Read more: Cannabis 5th most valuable crop in US, Leafly report shows

Follow Kathryn Tindale on Twitter

kathryn@mugglehead.com