The Nicaragua and Colombia miner Mineros S.A. (TSX: MSA) had a successful year in 2023, reporting a 33 per cent rise in net profit from continuing operations year-over-year (YoY) to US$74.5 million.

The company released its financial and production results for the quarter and year ended Dec. 31 on Thursday.

Adjusted earnings before interest, taxes, depreciation and amortization rose by 33 per cent YoY as well to US$53.36 million.

The gold producer’s annual revenue increased by 8 per cent to US$447.3 million while its Q4 revenue rose by 24 per cent YoY to US$130.4 million. The company reported a 58.7 per cent drop in its current liabilities from the previous year to US$84.7 million.

Mineros produced 219,708 ounces last year, a 2 per cent decrease from 2022. It attributes the slight decline to a two-week shutdown at its Hemco property in Nicaragua during Q3. The Colombian corporation, incorporated in 1974, met its 2023 production guidance.

The company says it significantly enhanced its tailings detoxification capacity during that temporary suspension at Hemco. Mineros announced last week that it had planted almost 30,000 trees in the country as part of its environmental, social and governance (ESG) measures.

All-in sustaining costs per gold ounce sold totalled US$1,316 in Q4, a 7 per cent increase from 2022. Mineros paid out US$20.5 million in dividends to its shareholders in 2023, an 11 per cent increase YoY.

“We had a strong operational fourth quarter and demonstrated resilience throughout the year,” CEO Andrés Restrepo said. “As we move forward, the company will continue to focus on being a reliable and profitable operator.”

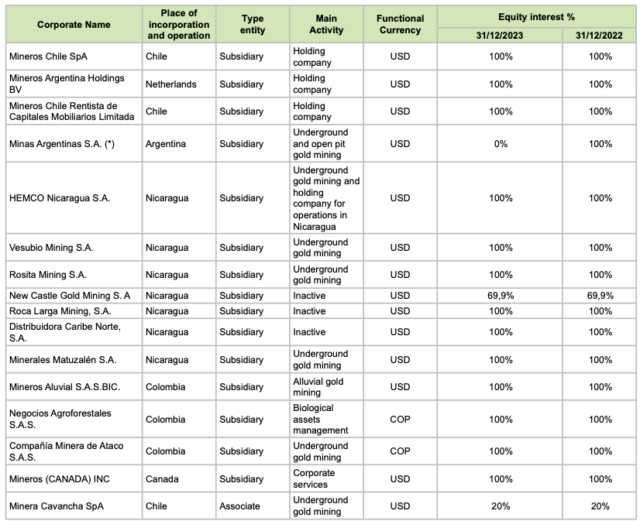

Mineros S.A. is divided into several subsidiaries and interests in associated companies throughout Central and South America. The corporation even has one Canadian subsidiary and another in the Netherlands.

Table: Mineros S.A.

Read more: Calibre Mining’s new core samples highlight strong resource expansion potential at Valentine

Read more: Calibre Mining results at Valentine Gold Mine show project’s strong potential

Other Nicaragua miners report favourable numbers

Latin America is home to many international gold producers. In Nicaragua, companies like Calibre Mining (TSX: CXB) (OTCQX: CXBMF) and Mako Mining Corp. (TSX-V: MKO) (OTCQX: MAKOF) have been succeeding alongside Mineros.

Calibre produced over 75,000 gold ounces in Nicaragua last year and largely attributes multiple financial successes to its operations in the country. The company just pulled a bonanza-grade core sample out of the ground at its Limon Mine Complex in Nicaragua with over 111 grams per tonne.

Calibre is also involved with ESG initiatives in Central America like planting trees and providing assistance to local beekeepers. Nicaragua produces more gold than any other country in North America’s southernmost region.

Mako reported a 134 per cent rise in gold sales in Q4 last year and a 120 per cent increase in its cash balance. The operator just drilled a 3.9 metre core sample with over 51 g/t gold at its San Albino mine there as well.

Nicaragua’s government is supportive of mineral exploration and mining. Condor Gold (TSX: COG), Royal Road Minerals (TSX-V: RYR) and Glen Eagle Resources Inc. (TSX-V: GER) are the other Toronto-listed operators working in the country.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com