Iris Energy Limited (NASDAQ: IREN) upgraded its GPU chip-set to support its AI Cloud Services business division.

The company announced that it bought an extra 1,080 latest-generation NVIDIA H200 GPUs on Tuesday for USD$43.9 million, and anticipates having them delivered and installed by Q4.

NVIDIA (NASDAQ: NVDA) has played a huge role in driving the AI revolution, particularly through its high-performance GPUs like the H100 and its successor, H200. These chips power AI’s computational needs and support high-performance computing tasks.

They also perfectly align with Iris Energy’s evolving business model. The AI boom fuelled the demand for this processing power, making NVIDIA’s chips a coveted asset for companies eager to harness AI’s potential, which explains Iris’ interest in acquiring them.

“We’re seeing strong levels of demand for new-generation GPUs. Ongoing discussions with NVIDIA and participation in their Cloud Partner Program gives us added confidence in deploying this new capacity,” said Daniel Roberts, Co-Founder and Co-CEO of IREN.

“This purchase is estimated to increase the AI Cloud Services proportion of IREN earnings to 10 per cent by year-end, a proportion we expect to continue growing through 2025.”

The company has also historically leveraged its access to cheap, renewable energy for Bitcoin mining operations. However, Iris is now using NVIDIA’s GPUs in its pivot towards AI and using the infrastructure initially built for cryptocurrency mining.

This shift represents more than just an expansion. It’s a transformation that positions Iris Energy as a provider of AI cloud services. The company’s recent announcements about increasing its GPU count to 816 H100s and adding 1,080 H200s illustrate its clear strategy to become a major player in AI infrastructure.

Read more: Bitcoin mining profits don’t match with hashrate domination

Read more: India goes after big name crypto exchanges for backtaxes and regulatory noncompliance

The shift AI allows to future-proof its business model

The cryptocurrency market’s volatility has taught companies like Iris the importance of diversification. By venturing into AI, the company is not only hedging against the fluctuations of the crypto market but also positioning itself in a sector with potentially more stable and scalable growth prospects. Furthermore, this shift into AI allows the company to future-proof its business model.

Additionally, Iris is repurposing its data centers for AI to make this transition.

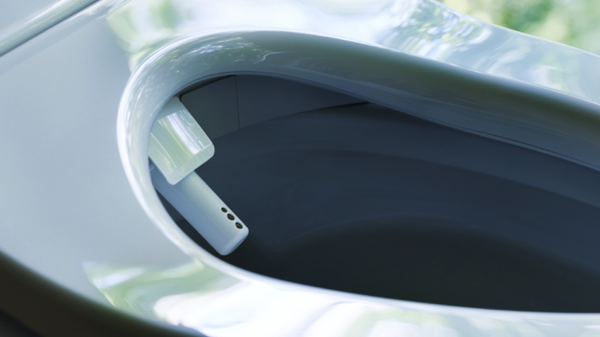

These facilities come equipped with robust power infrastructure and advanced cooling systems. By reusing existing infrastructure, Iris can reduce its time and money overhead for building new facilities.

By acquiring NVIDIA’s high-performance GPUs, IREN taps into this growing demand, offering services for AI model training, which requires immense computational resources. Their existing infrastructure, now enhanced with NVIDIA technology, is well-positioned to handle this increased workload, allowing the company to meet the needs of the AI sector effectively.

This pivot into AI also opens the door for strategic partnerships with tech giants and hyperscalers seeking additional AI computational resources. Iris has hinted at this potential through its engagement with advisors like Morgan Stanley, which suggests the company is actively exploring these collaborations to strengthen its position in the AI market.

That doesn’t mean it’s leaving Bitcoin mining behind, though.

The company presently operates with an installed capacity of 18.8 EH/s at an efficiency of 16.3 joules per terahash (J/TH) and is on track to expand to 20 EH/s this month and 30 EH/s by the fourth quarter of 2024. At 30 EH/s and an efficiency of 15 J/TH, Iris estimates an electricity cost of $20,000 per Bitcoin mined and an all-in cash cost of $31,000 per Bitcoin mined.

.