IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) is set to acquire Quebec-based gold explorer Vanstar Mining Resources (TSXV: VSR) through a friendly takeover bid approved by the courts.

The company said on Tuesday that the deal would be to consolidate its interest in the Nelligan deposit, presently operated by Vanstar.

IAMGOLD will issue 0.2 shares of its common stock for each Vanstar share it acquires for a value of USD$0.69 per share. The total amount to be paid to Vanstar shareholders will be approximately USD$31.1 million.

Vanstar currently possesses several gold exploration projects at different stages of development. Its primary asset is a 25 per cent interest in the Nelligan joint venture project, which IAMGOLD holds under an earn-in option. It is situated 60 kilometres southwest of Chibougamau, Quebec.

An updated mineral resource estimate originally for Nelligan revealed that the indicated category contains 1.97 million ounces of gold, with 72.2 million tonnes averaging 0.85 grams per tonne (g/t) of gold. In the inferred category, there are 3.24 million ounces of gold, with 114.1 million tonnes averaging 0.88 g/t of gold.

According to the current JV agreement, IAMGOLD can acquire an additional 5 per cent interest by conducting and delivering a feasibility study on the Nelligan project. Vanstar will retain its remaining 20 per cent interest as an undivided non-contributory carried interest until the start of commercial production. After that point, the 20 per cent interest will become participating, and Vanstar will need to cover its share of the development and construction costs. Additionally, Vanstar holds a 1 per cent net smelter return (NSR) royalty on selected claims of the project.

“This transaction consolidates our interests in the highly prospective Nelligan deposit while building our exploration portfolio within Northern Quebec,” said Renaud Adams, chief executive of IAMGOLD.

“Our exploration efforts at Nelligan to date, in partnership with Vanstar, have shown the potential for further resource expansion which we will continue to advance.”

Adams also pointed out that this transaction strengthens his company’s Canadian exploration portfolio, but IAMGOLD’s current priority is to successfully commission, ramp up, and grow Côté Gold in Ontario. The company is targeting the first pour for early next year, with an estimated 18-year project life and an annual gold production goal of 495,000 ounces.

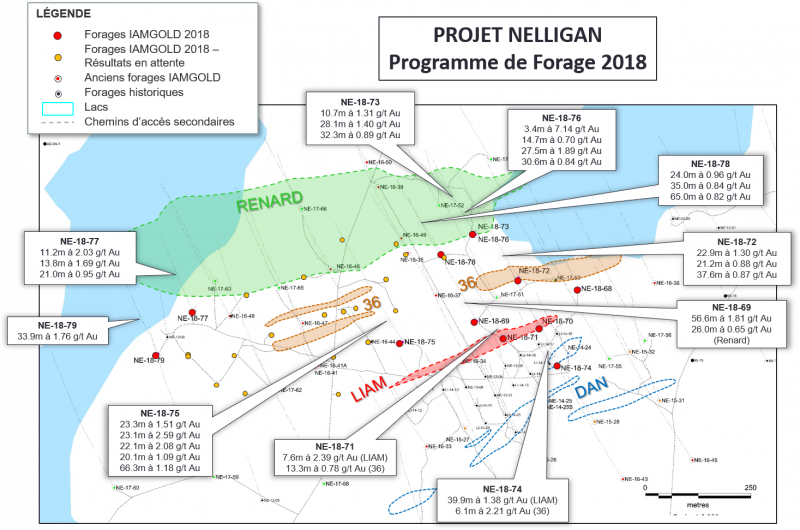

Nelligan Project map. Image via Vanstar Mining Resources.

Read more: Calibre Mining Q3 gold production numbers exceed analyst expectations: Canaccord Genuity

Read more: Calibre Mining’s Nicaragua operations will fuel company growth on all fronts: PI Financial

Côté Gold Project is 90.6 per cent complete

By the end of September, the Côté Gold Project had achieved a 90.6 per cent completion rate in its construction progress, which was approximately 92 per cent complete. The third quarter of 2023 saw project expenditures of USD$317.3 million for the Côté Gold Project.

Since the company started construction, the project has incurred a total of USD$2.54 billion out of the planned USD$2.9 billion in project expenditures. The total expected project expenditures are anticipated to align with the planned amount. The estimated remaining cost to complete the Côté Gold Project, considering the exchange rate between the USD and CAD of 1.35 during the rest of the construction period, stands at USD$425 million. It’s worth noting that a portion of these expenditures is expected to occur in 2024 during the commissioning and ramp-up phases.

IAMGOLD, owning a 60.3 per cent stake in the Côté Gold unincorporated joint venture, is projected to provide funding amounting to USD$325 million during the remaining construction phase.

The company also engaged in a number of sizeable divestitures in the past year.

Vanstar shares up 38% on Iamgold takeover news – https://t.co/z2SflZ7KHG #ResourceWorld #resourceinvesting #miningnews #mining @IAMGOLD_Corp pic.twitter.com/LRpRotfRrh

— Resource World (@ResourceWorld) December 5, 2023

Read more: Calibre Mining’s Nicaragua operations will fuel company growth on all fronts: PI Financial

Read more: Calibre Mining outshines expectations with robust Q3 gold production: BMO Capital Markets

Divestitures follow a similar course

Late April, the company concluded the sale of its Senegal Assets. These assets consist of its 90 per cent interest the Boto Gold Project in Senegal and its 100 per cent interest in the early-stage exploration properties of Boto West, Senala West, Daorala, and the vested interest in the Senala Option Earn-in joint venture. The sale generated aggregate gross cash proceeds of USD$197.6 million.

In October, the company received $32.0 million in deferred consideration resulting from the closure of the sale of Senegal Assets.

IAMGOLD also signed an agreement in October to sell its 100 per cent interest in the Pitangui Project, a greenfield exploration property located in Brazil, as well as its interest in the Acurui Project, to Jaguar Mining Inc. (TSX: JAG) via a share purchase agreement. Jaguar provided the company with 6.3 million common shares valued at an aggregate of USD$9 million. IAMGOLD will also retain a NSR on both projects.

These latest divestitures mirror some of the company’s prior experiences in Nicaragua, when it bought, built and sold the Eastern Borosi Gold-Silver Property to Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF).

Calibre currently holds a 100 percent undivided interest in the property but from 2014 to 2020, IAMGOLD invested over USD$10 million in the property to acquire a 70 per cent interest in the property. Ultimately, Calibre bought the property outright in 2020 for approximately USD$3 million in a mix of cash and shares, and still regularly pays a 2 per cent NSR with Calibre retaining the right to buy 1 per cent of it back, and a right of first refusal on the remaining 1 per cent.

Calibre Mining is a sponsor of Mugglehead news coverage

.