i-80 Gold Corp. (TSX: IAU) (NYSE: IAUX) received approval from the Bureau of Land Management and Nevada Bureau of Mining Regulation and Reclamation for 24.49 acres of disturbance, which includes up to 70 more pad locations, at its Ruby Hill Property.

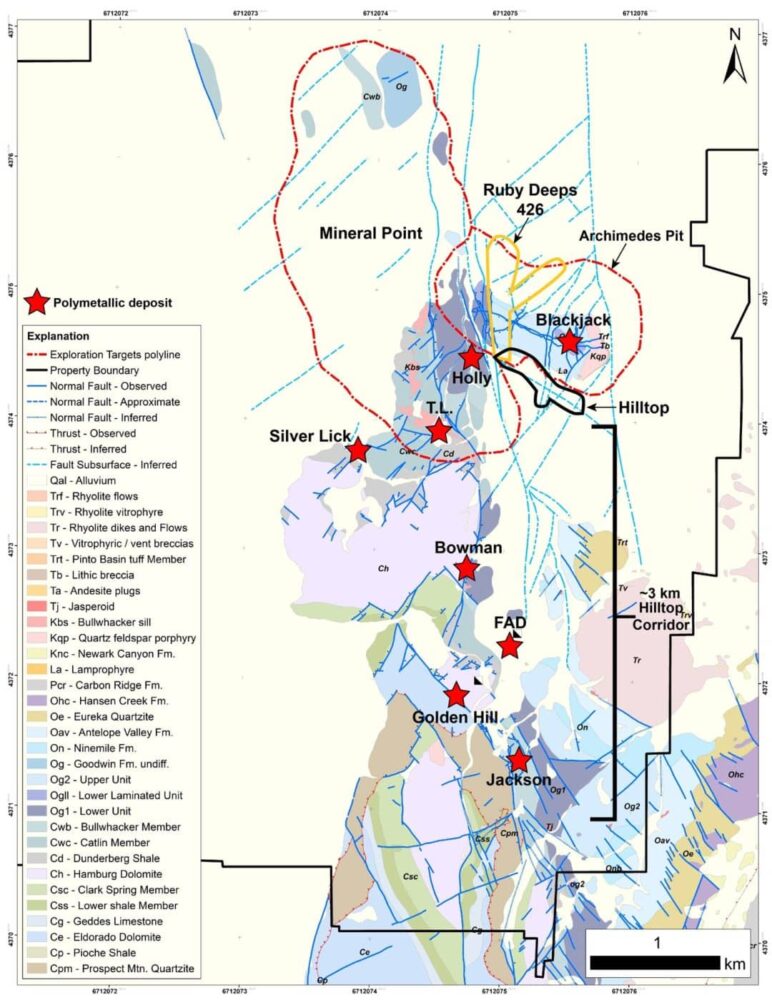

The company said on Tuesday that the approval will let them begin testing the 3 kilometer long structural corridor between the Hilltop deposits and its recently acquired Paycore Minerals (TSXV:CORE) property to the south.

Ruby Hill, one of the core assets being developed by i-80, is known for its valuable Carlin-Type gold deposits and various Carbonate Replacement Deposits (CRD). In the middle of 2022, i-80 made an important discovery at Ruby Hill, identifying multiple zones of high-grade CRD and skarn mineralization near the Hilltop fault.

Continuing their progress, in early 2023, i-80 acquired Paycore for its exploration potential and its FAD deposit, which is recognized as one of the highest-grade polymetallic deposits in North America. This strategic consolidation of the Hilltop Corridor has provided i-80 with a highly favorable structural trend spanning over 3 km. Along this trend, numerous historic mines, as well as new gold and polymetallic deposits, are found, further enhancing i-80’s prospects in the region.

This permitting process will be instrumental in securing improved drill sites that will aid in the characterization and expansion of mineralization at Upper Hilltop. This particular area is part of a collection of high-grade CRD zones situated on the southern side of the Archimedes pit.

Previous drill results here include:

-

515.3 g/t Ag, 28.9 per cent Pb, 10.5 per cent Zn and 0.9 g/t Au over 28.3 m in hole iRH22-43,

-

1.9 g/t Au, 631.3 g/t Ag, 7.4 per cent Zn and 33.0 per cent Pb over 18.3 m in hole iRH22 53,

-

60.2 g/t Au, 908.7 g/t Ag, 1.1 per cent Zn and 15.7 per cent Pb over 10.0 m in hole iRH22-55.

Furthermore, valuable high-grade CRD and skarn mineralization has been uncovered beneath alluvial cover in the East Hilltop region. Due to the scarcity of available drill platforms, adequately testing this target has posed challenges. Nonetheless, notable mineralization has been observed, such as 12.3 per cent zinc over a length of 39.4 meters in hole iRH22-61, and 226.1 grams per tonne of silver, 9.7 per cent zinc, and 10.0 per cent lead over 8.4 meters in hole iRH23-10.

Hilltop Corridor Surface Plan. Image via i-80 Gold.

Read more: Gobsmacked by Calibre Mining’s high grades from Palomino, Nevada: Haywood Securities

Read more: Calibre Mining assays at Palomino property in Nevada may improve mineral resource

i-80 prior discoveries confirm Ruby Hill potential

In the latter half of the 2022 exploration campaign, i-80 made significant discoveries in the Hilltop area while investigating one of several generative exploration targets identified near the Blackjack deposit. These discoveries served as confirmation for i-80’s belief that the Ruby Hill Property has the potential to host various types of mineralization and multiple large-scale deposits.

Building upon their earlier success, additional high-grade CRD findings have been made in 2023, effectively extending the presence of mineralization along the Hilltop fault by approximately 750 meters. The recently obtained permitting will not only enable the company to conduct more comprehensive assessments of the mineralization along the Hilltop fault but also facilitate the exploration of new targets generated through drilling or geophysical surveys.

The acquisition of Paycore holds significant importance for i-80 as it consolidates the most productive section of the Eureka District, resulting in the addition of 3,627 acres to the company’s existing land package. This strategic move strengthens i-80’s position in the region and enhances their overall operational potential.

The FAD deposit, which boasts a historical resource not compliant with the 43-101 standard, contains an estimated 3.5 million tonnes with grades of 5.14 grams per tonne of gold, 196.46 grams per tonne of silver, 8.0 per cent zinc, and 3.8 per cent lead.

Geophysical surveys conducted at Ruby Hill have revealed the presence of several highly promising anomalies that are believed to hold the potential for additional massive sulfide targets. As part of the upcoming 2023 drilling program, several of these anomalies will be thoroughly examined and tested.

Moreover, additional geophysical surveys, including high-resolution magnetics and magnetotellurics, are presently underway to cover the southern extension of the Hilltop Corridor as well as the FAD Property. These surveys aim to provide detailed insights into the geological characteristics of these areas, further enhancing the understanding of their mineralization potential.

i-80 Mining shares dipped 2.6 per cent on Tuesday to $2.67 on the Toronto Stock Exchange.

Read more: Calibre reports high-grade results from Talavera deposit in Nicaragua

Read more: Calibre Mining’s discoveries at Eastern Borosi hold promise for extended lifespan

Nevada offers abundance of mineral resources

Nevada’s thriving mining industry can be attributed to two key factors.

The state boasts an abundance of mineral resources, including gold, silver, copper, lithium and more. This rich mineral wealth attracts mining companies eager to capitalize on the extensive reserves available.

Secondarily, Nevada provides a favorable environment for mining operations with its well-established mining regulations that promote responsible extraction and environmental protection. Also, the state’s robust infrastructure, including transportation networks, power supply, and mining-specific services and facilities, supports efficient exploration, extraction and processing of minerals make Nevada sufficiently attractive for investment.

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) recently released drill results from its Palomino target along the Eureka trend in Nevada, which have garnered positive attention from analysts.

In a research report by Haywood Securities Inc. analysts Geordie Mark and Nicholas Lobo, they express their astonishment at the impressive intervals of gold mineralization encountered during the drilling at the Pan Mine’s Palomino target.

Meanwhile, Allegiant Gold (TSXV: AUAU) (OTCQX: AUXXF) outlined drilling plans for its flagship project at its Eastside project in the highly prospective Walker Lane Trend of Nevada. This strategic drilling initiative aims to enhance the project’s significance within the regional context, ensuring it aligns with other mining endeavors in terms of scale and impact.

Blackrock Silver Corp. (TSXV: BRC) received its core drill and started drilling at its Silver Cloud gold-silver project. The initial drilling is targeting the extension of the bonanza-grade silver and gold intercept in SBC22-020, which was 70.0 g/t gold and 600 g/t silver over 1.5 metres.

Calibre Mining is a sponsor of Mugglehead news coverage

.