HIVE Blockchain Technologies (TSX.V: HIVE) (NASDAQ: HIVE) (FSE: HBFA.F) produces high amounts of Bitcoin despite the network difficulty being at an all-time high.

The company produced a total of 282 Bitcoin through its ASIC and GPU mining operations, with an average hashrate of 3.09 EH/s, representing an average of 91 Bitcoin per Exahash. HIVE also sold all of the Bitcoin earned from its GPU mining hashrate payouts.

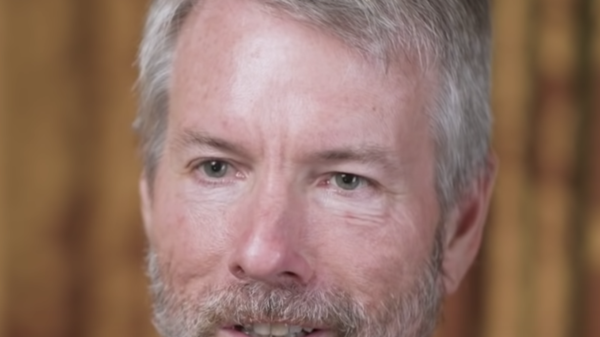

“We have successfully completed our deployment of our first buildout of the HIVE BuzzMiner, and we’ve mined at an average hashrate of over 3 Exahash for the month of March,” said Aydin Kilic, president and CEO of Hive.

“Additionally, our GPU fleet is generating approximately 16 per cent more revenue per megawatt hour than most Bitcoin mining ASICs. We strive to mine for maximum profit, utilizing energy as a resource for cash flow.”

Network difficulty factors are a significant variable in the company’s gross profit margins. The Bitcoin network difficulty was 43.1 as of March 1 and increased to 46.8T as of March 31, reaching an all-time high. Also, T is a shorthand notation used to refer to the current Bitcoin network difficulty. Bitcoin mining difficulty ended the month about 9 per cent higher than the beginning of the month.

Read more: Stablecorp relaunches Canadian stablecoin QCAD

Read more: INX Digital and Greenbriar Capital collaboration lists first regulated tokenized shares

HIVE has been able to upgrade fleet to make mining more efficient

The Bitcoin Network Difficulty is a publicly available statistic that reflects the total number of Bitcoin miners online and is important in analyzing a company’s gross profit margins and number of Bitcoin produced.

As more people mine Bitcoin, the daily Bitcoin block reward gets split amongst more miners, causing each miner to receive a smaller portion of the block reward. Conversely, as Bitcoin prices fall, many miners may lose money and power down, taking their hashrate off the network, causing the network difficulty to decrease. HIVE will reduce part of its operations if the unhedged spot energy prices are uneconomical, leaving part of its total gross hashrate unused.

All Bitcoin miners strive to use the most efficient Bitcoin ASIC chips, and HIVE has been able to upgrade its global fleet during this crypto market downturn. The company’s total Bitcoin production in March 2023 represents a 12 per cent month-over-month increase in average hashrate, and HIVE is focused on mining for maximum profit, utilizing energy as a resource for cash flow.

Comparatively, DMG Blockchain Solutions (TSXV: DMGI) reported mining 78.9 bitcoin with a realized hash rate of 0.88 exahash per second. As of March 31, 2023, the company had a bitcoin balance of 443. DMG has started reporting its mined bitcoin from Terra Pool on a full pay-per-share (FPPS) basis, which means that the February mining results would have been 76.7 bitcoin instead of the previously reported 89.2 mined bitcoin.

On the other end of the spectrum, Marathon Digital Holdings (NASDAQ: MARA) set a record of 825 BTC in March 2023 and a record of 2,195 BTC for the quarter. The company also increased its hashrate by 64 per cent in Q1 2023 to 11.5 EH/s as of March 31, 2023.

Hive Blockchain shares dipped 5.2 per cent on Monday to trade at $5.14 on the TSX Venture Exchange.

Follow Joseph Morton on Twitter

joseph@mugglehead.com