Gold Royalty Corp. (NYSE American: GROY) is set to spend USD$7.5 million for an existing 1.0 per cent net smelter return royalty (NSR) from Endeavour Silver Corp. (TSX: EDR) for portions of the Cozamin Copper-Silver Mine in Zacatecas, Mexico.

Gold Royalty announced the acquisition of the royalty on Monday. Cozamin is owned and operated by Capstone Copper Corp (TSX: CS).

The Cozamin copper-silver mine is an established and cost-effective operation with a successful production history since 2006 and a track record of exploration achievements and mine life extensions.

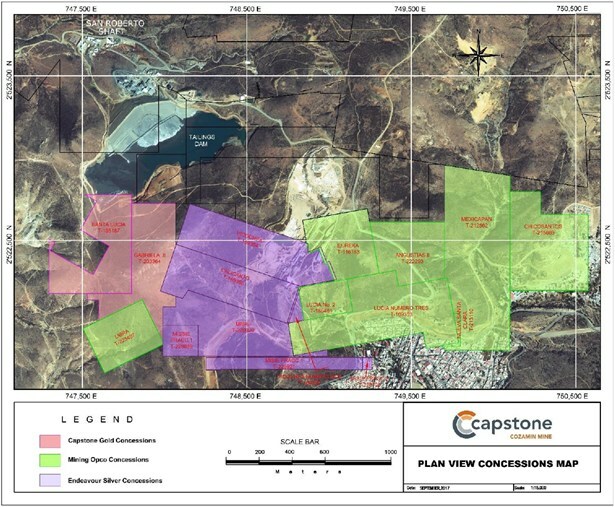

The royalty was established through a 2017 agreement between Endeavour and Capstone. According to this agreement, if Capstone identified a mineral resource estimate with mostly base metals on certain concessions owned by Endeavour, then Endeavour would receive a 1 per cent NSR royalty on those concessions. As a result, the royalty is applicable to two concessions, Calicanto and Vicochea, where the specified base metals threshold was met.

The royalty brought over $1 million in revenue in the past year, and the company anticipates will contribute significant cash flow in the future.

Additionally, it provides an advantageous position in benefiting from rising copper and silver prices over the mine’s lifespan.

According to Capstone’s current projections, the annual production from 2023 to 2030 is anticipated to average around 20,000 tonnes of copper and 1.3 million ounces of silver, with average costs of US$1.51 per payable pound of copper.

The royalty pertains to two concessions covering the Calicanto vein at Cozamin. Gold Royalty has also been granted the option to obtain further royalties on five contiguous concessions south of the existing royalty, subject to payment of up to USD$500,000. The financing for the transaction is planned to come from the company’s existing cash and cash equivalents.

Cozamin is an underground copper-silver mine with a surface milling facility located in the mineral-rich state of Zacatecas, Mexico, just 3.6 km north-northwest of Zacatecas City. The mine, operated by Capstone since late 2006, has demonstrated consistent generation of free cash flow throughout various copper price cycles.

Initially starting with a three-year mine life based on existing mineral reserves, successful exploration efforts have significantly extended Cozamin’s expected life to 2030, relying on those same mineral reserves.

Plan view map superimposing the Endeavour concessions and an aerial photograph of the existing mine workings. Image via Gold Royalty Corp.

Read more: Heliostar Metals reports best drill result to date at Mexico’s Ana Paula project

Mexico tightened its resource regulations in May

In May, Mexico introduced an amendment to its mining law concerning mining and water-related issues.

The amendment impacts both new and existing concessions, representing a significant overhaul of the country’s mining law. It introduces a range of substantial changes to the legal regime governing all mining concessions.

It reduces the duration of mining concessions and replaces the existing grant system with a public bidding process, aiming to enhance transparency and fairness in the allocation of concessions. Additionally, the amendment imposes strict limitations on the extraction of minerals, allowing mining activities only for those minerals explicitly specified in the concession.

It also mandates that prior authorization requests for assignments be submitted, introducing further regulatory requirements for concession holders. The Amendment introduces a set of new social and environmental obligations that must be fulfilled before a concession can be granted.

Gold producers operating in Mexico include Agnico Eagle Mines Limited (TSX: AEM) (NYSE: AEM), which has operations in the state of Chihuahua. Alamos Gold (TSX: TGI) operates the Mulatos mine in Sonora, Mexico. (TSX: TGI) Torex Gold Resources (TSX: TXG) operates the Morelos Gold Property 180 kilometers southwest of Mexico City. Fresnillo plc (LON: FRES) Fresnillo is the world’s largest producer of silver from ore and Mexico’s second-largest gold miner.

Follow Joseph Morton on Twitter

joseph@mugglehead.com