Global Atomic Corporation (TSX: GLO) (OTCQX: GLATF) has signed a letter of intent (LOI) for a new uranium supply agreement with a North American utility company, building on two contracts established last year with other anonymous buyers in the continent.

The Toronto-based company announced the new agreement on Monday and aims to start supplying the utility companies with yellowcake uranium from its flagship Dasa mining operation in Niger within the next three years. Global Atomic says the new LOI represents the supply of approximately 3.5 million pounds of uranium over the course of a multi-year period beginning in 2026.

The company has now allocated approximately 30 per cent of the uranium that the mine will produce within its first five years of operation, representing 1.5 million pounds annually, to these contracts. Global Atomic says the deal is valued at about US$250 million in nominal terms.

“This award adds to the two off-take arrangements we announced in 2022, both of which have been successfully converted into purchase-sale contracts,” said the company’s President and CEO Stephen G. Roman.

“The timing of this agreement demonstrates the credibility that Dasa is building within the uranium market while the company manages its project development amid recent political restructuring in Niger,” he added.

Read more: Denison Mines and English River First Nation ink prosperity agreement

Read more: Centrus Energy to begin producing high-assay low-enriched uranium at Ohio plant

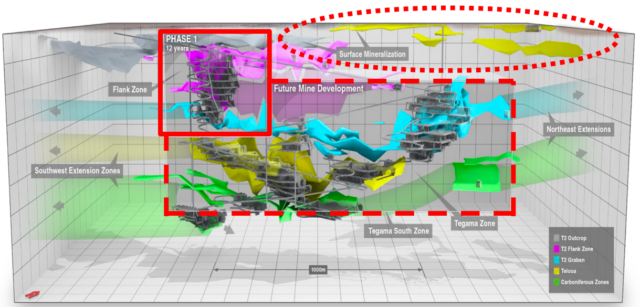

Global Atomic says Dasa is the highest-grade uranium deposit in Africa and that the company’s 12-year Phase 1 development plan only accounts for about 20 per cent of the known deposit. An upcoming feasibility study being released in mid-2024 is expected to double the project’s mineable reserves.

The Republic of Niger is the world’s seventh largest producer of uranium behind Kazakhstan (number one), Canada, Namibia, Australia, Uzbekistan and Russia (number six).

Hypothetical underground infrastructure at the project. Image via Global Atomic

The news follows the price of the commodity ascending above $60 per pound for the first time since 2011, prompting new or renewed interest from investors.

Global Atomic shares have steadily declined by nearly 41 per cent over the past year and are currently trading for $2.19 on the Toronto Stock Exchange. The company currently has a market capitalization of approximately $461 million.

The uranium supplier is also involved in a zinc operation joint venture with Luxembourg’s Befesa S.A (ETR: BFSA).

rowan@mugglehead.com