Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) is applying for twelve more drill pads as part of it 2023 drill program at Fondaway Canyon gold project in Nevada.

Announced on Wednesday, the company intends on using the drill pads as part of its bid to expand its Mineral Resource Estimate (MRE) during the campaign.

At present, the Fondaway Canyon gold project is home to a considerable ‘at surface’ MRE, which reports:

- An Inferred Mineral Resource comprising 38.3 million tonnes with an average gold grade of 1.23 grams per tonne (g/t Au), equivalent to approximately 1,509,100 ounces of gold.

- An Indicated Mineral Resource that includes 11.0 million tonnes at an average gold grade of 1.56 g/t Au, which corresponds to an additional 550,800 ounces of gold.

But in gathering this data the company used only 18 of the 27 holes drilled in the Central Area for its Mineral Resource Estimate because of the resource model data inclusion cut off in September. Even such, these holes were responsible for doubling the estimate from historical levels, which demonstrates the consistency of mineralization found in the 18 holes.

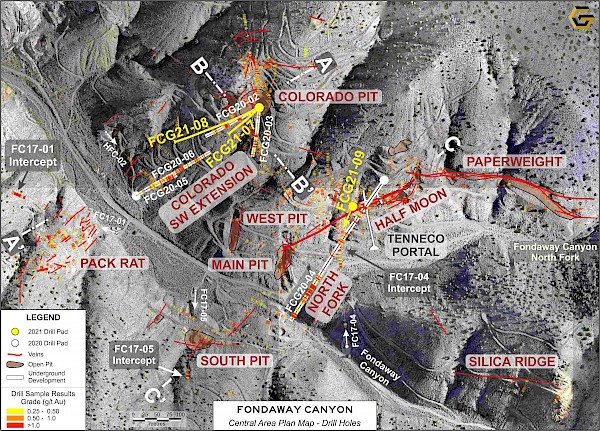

Fondaway Canyon Central Area Plan Map.

Read more: NevGold intercepts quartz veining on the surface of Nutmeg Mountain

Read more: NevGold assays high-grade silver at Ptarmigan, expands copper trend

Remaining nine holes also found mineralization

The majority of the remaining nine holes not used in the MRE intersected significant mineralization. This strongly underscores the potential value and robustness of the Fondaway Canyon gold project.

Eight of the remaining nine holes included:

- FCG22-20: intersected four significant gold mineralized intervals starting from surface including1.7 g/t Au over 56.6 metres extending Colorado SW 35 metres up-dip and remains open to the east

- FCG22-21: 0.9 g/t Au over 74.3 metres extends Colorado SW zone 50 metres along strike and remains open to the west

- FCG22-22: intersected four significant gold mineralized intervals including 8.8 g/t Au over 8.1 metres within a broader 3.0 g/t Au over 56.6 metres interval, and 2.4 g/t Au over 21.7 metres

- FCG22-23: intersected four significant gold mineralized intervals including 3.4 g/t Au over 44.6 metres and 1.8 g/t Au over 12.8 metres

- FCG22-25: intersected four significant gold mineralized intervals including 3.4 g/t Au over 31.4 metres and 1.3 g/t Au over 17.4 metres

- FCG22-26: intersected three significant gold mineralized intervals including 1.8 g/t Au over 29.4 metres and 1.1 g/t Au over 83.8 metres

- FCG22-27: drilled 1.2 g/t Au over 29.9 metres partway through the targeted zone prior to the hole being lost

- FCG22-28: intersected three significant gold mineralized intervals including 0.8 g/t Au over 98.0 metres and 1.3 g/t Au over 58.0 metres

“After three years of drilling and delineating a sizeable Mineral Resource 600 metres down dip from surface and 600 metres along strike, the gold mineralization remains fully open for further expansion,” said Mike Sieb, president of Getchell Gold.

“Exploration of these ample and very evident priority targets requires the company to permit more drill pads than previously anticipated based on the past three years drilling success.”

Read more: NevGold to hit the ground running at Limousine Butte in 2023: Caesars Report

Read more: NevGold should be trading at a premium to peers: Analysis

Nevada ranks number one in top mining jurisdictions: Fraser Institute

Nevada has maintained its premier position as the most favoured jurisdiction for mining and exploration activities. The 2022 Annual Survey of Mining Companies by the Fraser Institute recently reaffirmed this by ranking Nevada as number one in terms of investment attractiveness.

This ranking considers both the jurisdiction’s policy regime and mineral potential. In light of the distinct advantages of the Fondaway Canyon gold project, this high ranking underscores the promising opportunities and potential for project development within the region.

Getchell Gold shares dropped 2.3 per cent on Friday to $0.21 on the Canadian Securities Exchange.

Junior mining research and analysis firm Caesars Report released a report for NevGold Corp. (TSXV: NAU) detailing its strong 2022 drilling campaign at its Limousine Butte property in Nevada and Nutmeg Mountain in Idaho.

The report indicated that NevGold gained a much stronger understanding of the mineralization around Limousine Butte during its 2022 drill campaign.

NevGold shares rose 1.4 per cent to $0.36 on Friday on the TSX Venture Exchange.

Nevgold is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com