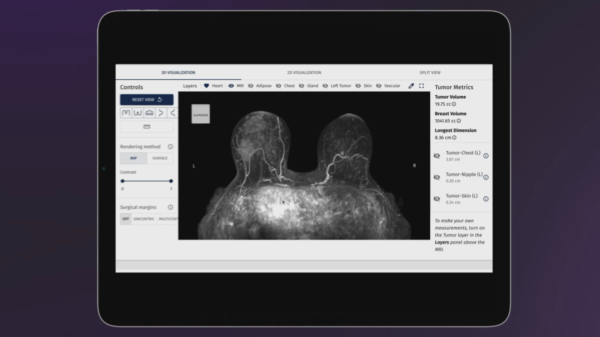

Quantum Corp (NASDAQ: QMCO) announced the development of a highly parallel file system client for their Myriad all-flash file system, designed to fully enable NVIDIA GPUDirect Storage capability, which is expected to enhance data processing speed and efficiency.

The deal resulted in an approximately 150 per cent increase in Quantum’s stock price on Wednesday. Quantum is up the forefront of data management solutions tailored for AI and high-performance computing needs.

The Myriad parallel client design transforms customer servers or workstations with high-performance GPU cards into operational Myriad GPU Nodes. By installing directly on these systems, it leverages NVIDIA’s (NASDAQ: NVDA) Magnum I/O GPUDirect Storage technology to create a direct RDMA data path between storage and GPU memory. This bypasses CPU bottlenecks, enabling exceptional performance.

CPU bottlenecks in artificial intelligence and machine learning (AI/ML) infrastructure are an issue that needs an elegant solution.

Traditionally, data transfer between storage and GPU memory involves the CPU, which can slow down performance due to the limited bandwidth and processing capacity. By bypassing the CPU and establishing a direct RDMA data path using NVIDIA’s GPUDirect Storage, the system enhances data transfer speed, reduces latency, and boosts overall performance, enabling faster and more efficient AI/ML workloads.

“The growing demands of massive data analysis and AI/ML pipelines are driving the need for more agile, on-demand infrastructure solutions that are simple to implement and also ready for advanced technologies like NVIDIA GPUDirect Storage,” said Guy Currier, CTO, Futurum Research. “Organizations are increasingly looking for scalable, high-performance systems that can adapt to evolving workflows without requiring extensive new deployments.”

Read more: Quantum Computing shares spike over 40% on partnership with University of Texas

Read more: Arqit Quantum shares bounce 25% after 25:1 stock split

Quantum Corporation is not a quantum computing company

Quantum Corporation has unveiled the Scalar i7 RAPTOR, a high-density tape storage system designed to meet the growing needs of AI and cloud storage. The system offers storage density up to 200 per cent higher than traditional enterprise tape libraries. Initial units are already undergoing customer testing and certification.

But is this tech deal enough to justify a 150 per cent price swing?

The broader market interest in technology stocks, particularly those associated with data management and AI, could also be playing a role. With the tech sector often experiencing rapid shifts in investor interest, companies like Quantum Corp. that are making strides in data technology might see increased investor attention, especially if there’s broader optimism about AI and data management’s future growth.

However, there’s always room for human error.

Despite revenue growth, quantum firms remain far from profitability, with losses continuing to be a consistent theme across the sector, even as companies achieve technical milestones. A few of these include scaling quantum systems and achieving fault tolerance, and they’re necessary for practical applications. They’re also edging closer but still present significant challenges.

This area may also be subject to some hype and mislabelling, as well.

For example, the Cabot Wealth newsletter lists Quantum Corp. as a quantum computing company, which saw its stock surge 523 per cent, largely due to an earnings report showing adjusted EBITDA breakeven. However, Quantum Corp. is not a quantum computing company and doesn’t appear to have any involvement with the technology.

This shows how sometimes simply adding the label “quantum” to a product can draw attention, but it does not make it a quantum company.

.