Discovery Silver Corp (TSE: DSV) (OTCMKTS: DSVSF) agreed to buy Newmont Corporation‘s (TSE: NGT) (NYSE: NEM) stake in the Porcupine Operations in Ontario, Canada for USD$425 million.

Discovery said on Monday that it would buy the operations for USD$200 million in cash, USD$75 million in shares and USD$150 million to be paid in four cash payments starting Dec. 31, 2027.

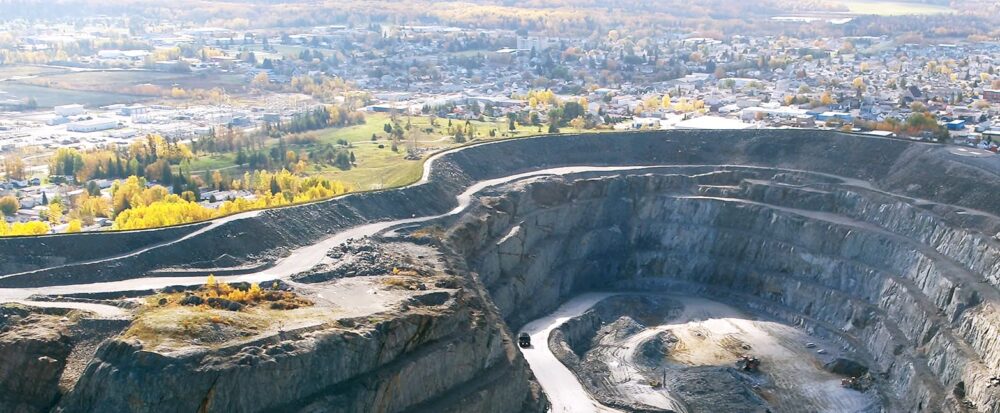

The company secured a USD$555 million financing package to fund the transaction. This includes USD$400 million tied to royalty and debt agreements with mining company Franco-Nevada Corporation (TSE: FNV) (NYSE: FN). The Porcupine Complex, a group of mining operations, produces 260,000 ounces of gold annually.

Discovery Silver’s shares climbed 3 per cent to $1.01 apiece on Monday morning in Toronto, raising its market capitalization to CAD$402 million. Meanwhile, Newmont’s shares dropped 1 per cent to $41.65 apiece in New York, lowering its market cap to $47.4 billion.

The Porcupine Mine came about as part of Newmont’s USD$17.14 billion acquisition of Newcrest, originally announced in February 2024. Further, the company announced in February it would divest its non core assets and cut debt through select workforce reductions.

In recent years, Newmont Corporation has strategically divested several non-core assets. It did this to streamline its portfolio and focus on Tier 1 operations. These divestitures have also generated substantial proceeds, enhancing the company’s financial flexibility.

Specifically, Newmont spent the majority of 2024 sourcing and executing a series of strategic divestments. This started in September when it agreed to sell its Telfer operation and 70 per cent interest in the Havieron gold-copper project in Australia to Greatland Gold plc (LON: GGP) for $475 million.

Read more: Calibre Mining demonstrates gold standard for principled mining

Read more: Calibre Mining beats gold guidance for 2024 in Nevada and Nicaragua

Newmont divestitures allow to focus on core assets

Furthermore, Newmont announced the sale of its Éléonore operation in Northern Quebec in November to Dhilmar Ltd for USD$795 million in cash. This divestiture was part of Newmont’s broader strategy to optimize its portfolio following the acquisition of Newcrest Mining.

Continuing its divestment strategy, in December 2024, Newmont also agreed to sell its Cripple Creek & Victor (CC&V) mine in Colorado to SSR Mining Inc (NASDAQ: SSRM) (TSE: SSRM) for up to USD$275 million. The deal comprised USD$100 million payable upon closing and up to $175 million in deferred contingent payments.

Collectively, these divestitures are expected to generate up to USD$4.3 billion in gross proceeds. Furthermore, Newmont plans to utilize for debt reduction and shareholder returns.

.

joseph@mugglehead.com