Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) reported a slight revenue dip in its first quarter of 2022 but it’s positive it will reach US$1.4 billion by the end of this year.

On Monday, the leading cannabis producer released its 2022 first-quarter unaudited financial statements ended on March 31 and reported a net loss drop of 4 per cent to US$21.8 million from US$30 million in the last quarter.

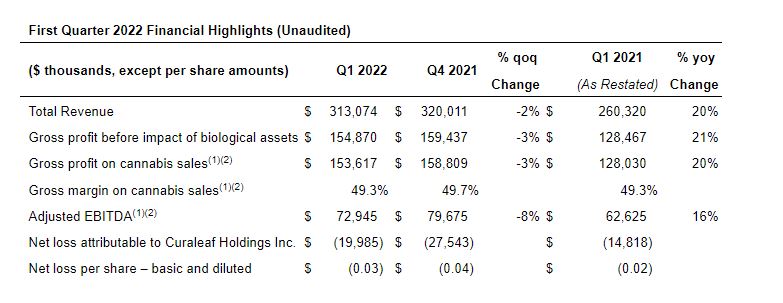

Its total revenue dipped slightly by 2 per cent to US$313 million from US$320 million in the previous quarter.

The company attributes the results to US$12 million of higher income tax expense and US$2 million of higher other expenses, partially offset by an US$8 million increase in operating income.

The company says it invested US$30 million net in capital expenditures attributed to cultivation, processing and retail site development activities.

Total revenue increased by 20 per cent to $313 million during the first quarter of 2022, compared to $260 million in the first quarter of 2021. Operating expenses totalled US$135.3 million in the quarter.

Adjusted earnings before interests, taxes and depreciation (EBITDA) was US$73 million for the first quarter of 2022, compared to US$79.7 million for the last quarter of 2021.

Company stock went down by 6.04 per cent to C$6.85 on the Canadian Securities Exchange.

Graph via Curaleaf

Read more: Curaleaf to enter Caribbean market via agreement with CBD distributor

Read more: Curaleaf posts record US$1.2B in sales for fiscal 2021

Executive chairman Boris Jordan says the company’s national footprint has always been a key advantage of our growth strategy, and despite a tough macro environment during the first quarter, Curaleaf continued to grow its share in several important markets.

“We saw strong month-over-month growth beginning in March and heading into the second quarter, boosting confidence in our ability to hit full-year revenue guidance of US$1.4 billion – US$1.5 billion.”

Jordan added that given renewed optimism surrounding federal banking reform, a record breaking 4/20, the exciting launch last month of New Jersey adult-use sales, and the prospect of New York following suit, 2022 is shaping up to be another milestone year for the company.

Last March, the company reported a record 2021 revenue of US1.2 billion.

Current CEO Joe Bayern said the continued focus on research & development of innovative new products, commercialization, national distribution and brand building were cornerstones of the first quarter.

“From the launch of our proprietary ACE extraction system in Florida – which produces the purest live rosin product in the market – to new products launched in the last 12 months generating 17 per cent of our revenues, our long-term focus on attracting new consumers with highly formulated products backed by science continues to drive growth,” he explained.

Read more: Curaleaf expands Arizona presence with US$211M Bloom acquisition

Read more: Curaleaf to raise US$425M from private placement

On Monday, the company also announced Bayerns is leading the company’s new consumer-packed goods division and being replaced by Matt Darin.

Darin is the founder of Grassroots and joined Curaleaf in 2020 and led the central region which holds the company’s largest footprint and revenue. The company says that last year he added the southeast region to its responsibilities and helped the company increase its revenue by 55 per cent.

During the quarter, Curaleaf added 11 new locations which put its store footprint at 128.

In December, the company acquired the Arizona-based vertically integrated operator Bloom Dispensaries for $US211 million.

The acquisition followed other deals in Arizona including buying Tryke Companies for US$286 million in November and Natural Remedy Patient Center for US$13 million in December.