Cryptocurrency aggregator, CoinGecko, and crypto investment firm 21Shares joined forces today to launch a global standard for classification of cryptoassets.

The Global Crypto Classification Standard (GCCS) creates a uniform way to categorize cryptoassets so investors and regulators can better understand the nuances within the asset class and make better decisions.

Zhong Yang Chan, Head of Research at CoinGecko. Image via Linkedin.

“The GCCS introduces a more granular and comprehensive methodology that accounts for all aspects of cryptoassets,” said Zhong Yang Chan, head of research at CoinGecko in an interview with Mugglehead.

“Based on the classification, users can understand the nature of a crypto project, where it sits in the overall crypto stack, and what the token does.”

This helps users identify tradeoffs and risks associated with different design choices. A uniform classification standard would also give users the ability to compare relative metrics across similar projects, Chan said.

Some cryptoasset projects issue multiple tokens that perform different roles and may actually behave differently than each other.

Chan offers MakerDAO as an example. MakerDAO has two tokens called MKR and DAI. As Terra collapsed earlier this year, investors divested from LUNA and into MKR, which saw price gains while DAI remained at USD$1.

In this case, MKR is a governance coin and DAI is a stablecoin. Having this information at hand would have helped investors make clearer investment decisions during the Terra collapse.

Read more: Hut 8 Mining merges with U.S.-based data and Bitcoin mining group

Read more: Galaxy Digital Holdings inks agreement with Argo Blockchain for Texas mining facility

New classification system helps investors make better decisions

The GCCS separates cryptoassets into three unique categories. First level is for the crypto stack; the second involves market mapping by sectors and industries and the third is a taxonomy of cryptoassets.

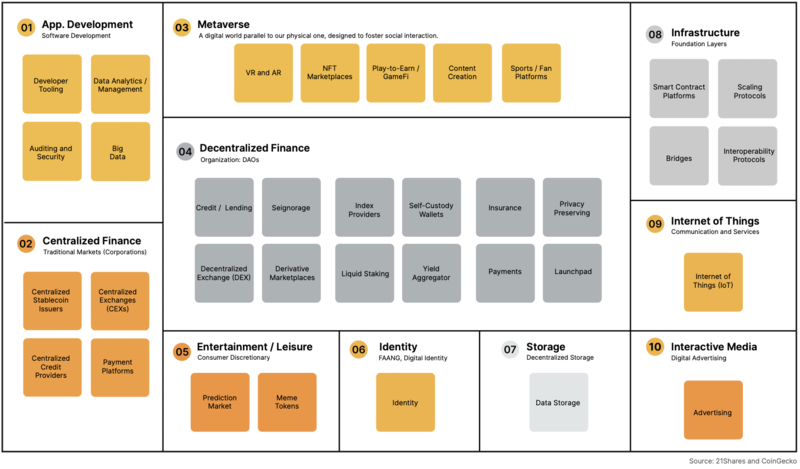

Image via Coingecko

The crypto stack refers to the various layers that encompass a cryptoasset’s infrastructure.

These include cryptocurrencies, smart contract platforms and decentralized applications (d’App). These definitions provide descriptions of the project’s nature and protocol.

Image via Coingecko

The second layer entails classifying protocols by sectors and industries as introduced by Standard & Poor in 1999, and used by the global finance community. In this case, sector describes a large segment of the crypto-economy, while industry refers more specifically to a group of companies or businesses.

For example, both centralized finance and decentralized finance (DeFi) sectors are analogous to the traditional finance sector, while entertainment and leisure are similar to traditional consumer discretionary.

Image via Coingecko

The third layer involves creating a working taxonomy of cryptoassets. In this case, each cryptoasset project may have more than one token. Additionally, at the third level, the GCCS categorizes them according to the asset class to which they belong.

CoinGecko to use GCCS on top 100 cryptos by end of summer

The new GCCS would show MakerDAO is a dApp at level one that fits into the credit and lending industry under the decentralized finance sector for level two. The GCCS would also show MakerDAO has having a two-token model with MKR is a governance token and DAI as an anchored stablecoin.

The system is capable of going deeper and even more granular as well, Chan points out. A deep understanding of the categorizations can give investors the ability to compare tokens in the same category. She compares MKR with FXS, which is the governance token of the FRAX stablecoin project.

“You’ll note that FXS has a larger fully diluted valuation compared to MKR, but that’s probably because in addition to having a stablecoin, Frax also has its own decentralized exchange and liquid-staking derivative, all governed by the FXS token,” Chan said.

The next step is to introduce GCCS categorization for the top 100 cryptoassets by market capitalization on Coingecko. This is anticipated to be available by summer of 2023.

Follow Joseph Morton on Twitter

joseph@mugglehead.com