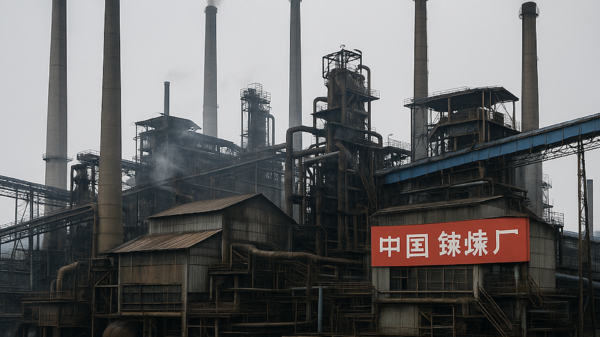

Responding to declining profits and concerns over overcapacity in the international market, China issued rules on Wednesday to regulate its lithium battery market.

According to the Ministry of Industry and Information Technology (MIIT), the proposals are in place to secure the healthy development of the lithium battery sector. These rules would provide guidance for lithium battery farms in order to reduce manufacturing projects that only expand production capacity.

The MIIT is proposing new regulations to guide the future of its booming lithium-ion battery industry. These draft rules, open for public comment until May 13th, aim to propel the industry towards healthy development. The focus will be on innovation and quality control, while discouraging unnecessary production expansion.

Environmental protection is another key concern. These measures are meant to ensure China’s battery industry stays competitive in the face of growing global competition and protectionist policies. Additionally, environmentalists propose shutting down or strictly controlling projects built on farmland and ecological zones, with a gradual phase-out plan.

A plunge in battery and raw material prices is squeezing company profits in the world’s biggest market, driven by the rapid expansion of production capacity along the lithium battery supply chain.

U.S. Treasury Secretary Janet Yellen said that China is flooding global markets with cheap goods, with a specific focus on the clean energy industries. But China, however, has indicated that its industries are more competitive, innovation-driven and possess complete supply chain systems.

Industry experts believe the public consultation proposals will actively promote healthy development within China’s lithium-ion battery industry. These proposals come as the industry in China gains global recognition, and aim to strengthen its competitive edge against rising overseas competition and protectionist measures.

Read more: Is the bottom in sight for lithium price drop?

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Lithium prices dropped over 80% since 2022

The China draft rules are actively pushing companies to invest more in research and development (R&D). Specifically, they mandate lithium-ion companies to dedicate at least 3 per cent of their main business revenue towards R&D and technological advancements. Additionally, the draft establishes specific energy density standards for different lithium-ion battery types.

Experts believe these regulations will further solidify the global competitive edge of China’s lithium-ion industry, which has already gained significant worldwide recognition.

China’s moves aren’t exactly unusual, either. Plenty of companies have elected to curtail their production numbers in response to the supply glut and hopefully bring down the lithium price.

According to marketing firm Fastmarkets, Lithium prices have plunged more than 80 per cent from their record highs in 2022. The report details price declines from over $80,000 per metric ton in 2022 to below $14,000 currently.

The dip has prompted multiple big name lithium companies to back away slowly from production. The biggest among them is North Carolina-based Albemarle Corporation (NYSE: ALB), which pushed the opening date for its Kings Mountain lithium mine off to 2026 last week in response to the price decline. Meanwhile, there are a handful of companies out there that haven’t altered their course.

For example, Chilean lithium giant Sociedad Química y Minera de Chile S.A. (NYSE: SQM) is stockpiling lithium, actively producing the battery metal in anticipation of a market rebound. Additionally, Lithium South Development Corporation (TSXV:LIS) (OTC:LISMF) has also elected to buck the trend by continuing with business as usual.

Lithium South recently bolstered their lithium business by filing a positive preliminary economic assessment (PEA) for their HMN Li Project in Argentina. This PEA projects a promising future, estimating a Net Present Value (NPV) after tax of USD$938 million.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com