China is aggressively expanding its influence in the global lithium market, according to a recent report by S&P Global. With strategic investments, mergers, and acquisitions, Chinese firms are securing critical minerals essential for various high-tech industries.

Despite facing regulatory challenges in developed markets, China’s focus on diversifying investments and expanding its global footprint, particularly in emerging markets like Africa, signals a long-term strategy aligned with the country’s economic and technological goals.

The recent report provides a detailed analysis of how Chinese firms are making strategic moves to secure upstream raw materials essential for their core businesses. Leading the charge in this aggressive expansion are lithium producers Ganfeng Lithium Co. Ltd. (SHE: 002460) and Tianqi Lithium Corp. (SHE: 002466)

These companies are not only focusing on lithium but are also diversifying their portfolios by entering other critical mineral markets. This diversification is part of a broader strategy to tap into the mineral’s growth potential, which has wide-ranging applications in various industries such as electric vehicles (EVs), renewable energy, mobile phones and supercomputing.

Another metal mining giant, Zijin Mining Group Co. Ltd. (SHA: 601899) is also entering the lithium market. The company’s entry signifies the growing importance of lithium and other critical minerals in China’s long-term economic and technological plans.

The report provides a meticulous account of significant lithium mergers and acquisitions (M&A) involving Chinese companies. For example, GFL International Co. (NYSE: GFL) (TSE: GFL), a China-based firm, acquired Lithea Inc. in Canada for a staggering $962 million. In another major deal, Zijin Mining secured a 70 per cent share in the Lakkor Tso Salt Lake Project in Argentina for $741 million.

These acquisitions are not isolated events but are part of a larger strategic focus that China has on lithium as a critical resource. The country recognizes lithium’s importance in various industries, including electric vehicles (EVs), renewable energy, and other high-tech applications.

Read more: Stellantis invests over US$100M in carbon-neutral California lithium project

Read more: Olympio Metals acquires Quebec lithium property from Vision Lithium

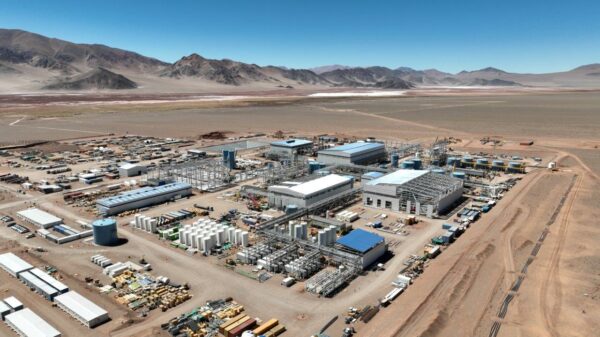

Beyond the domestic sphere, Chinese firms are making their presence felt globally. Companies like Contemporary Amperex Technology Co. Limited (CATL), a leading Chinese battery manufacturer, are spearheading consortiums to invest as much as $1.4 billion in Bolivia to build lithium extraction plants.

This international expansion is indicative of China’s broader strategy to secure a dominant position in the global lithium market. Other firms are also expanding their operations in countries like Argentina, Mali and Mexico, further solidifying China’s global presence in the lithium market.

Africa has emerged as a new frontier for China’s lithium ambitions. The report notes that China has been quick to secure mining assets in Africa, often in conjunction with infrastructure development projects. This is particularly noteworthy as China controls most of the lithium offtake agreements on the continent, positioning it to dominate this emerging market.

This strategic move is significant because other countries may already be too late to enter the African market, given China’s rapid advancements.

However, the road to global dominance is not without its bumps. Chinese firms are facing regulatory challenges in developed markets like Canada and Australia. These countries have introduced stricter foreign investment policies that have led to increased scrutiny of Chinese investments.

Read more: NevGold completes maiden mineral resource estimate for Nutmeg Mountain in Idaho

Read more: NevGold Ptarmigan subsidiary gets five BC exploration assets in option agreement

Despite these challenges, Chinese firms continue to seek opportunities in less restrictive markets and are starting to look for critical minerals elsewhere amid stricter foreign investment policies in developed markets.

China’s active and strategic involvement in lithium mining and acquisitions around the world underscores the country’s focus on securing critical minerals.

While there are regulatory challenges in developed markets, Chinese firms are not deterred. They are diversifying their investments, expanding their global footprint, and particularly focusing on emerging markets like Africa.

The alignment of these corporate strategies with the Chinese government’s policies indicates that China is likely to continue expanding its influence over these critical minerals and the industries that rely on them.