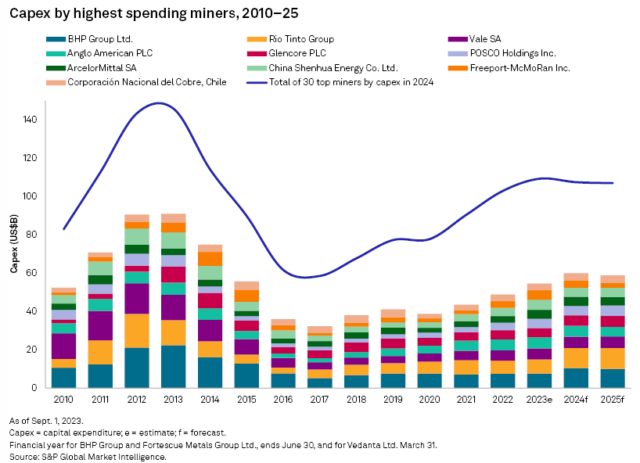

By the end of this year the world’s top 30 mining companies will have had capital expenditures 6.2 per cent higher than 2022 at approximately US$109.2 billion, according to a recent metals and mining analysis report from S&P Global (NYSE: SPGI) Market Intelligence.

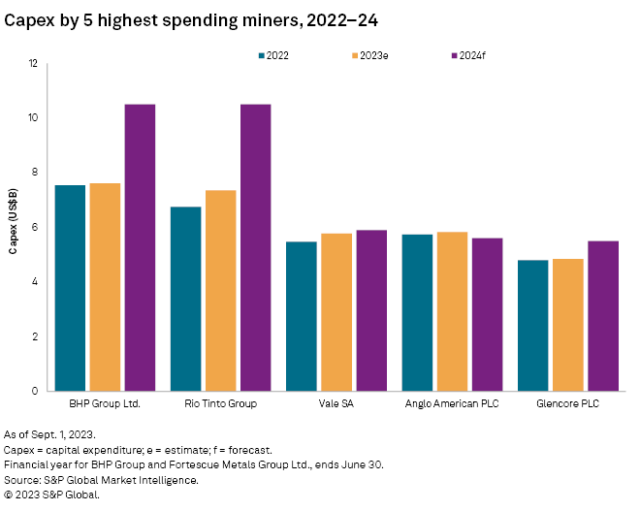

That figure represents a major decrease in expenditures in comparison to the past two years when spending rose by 16.3 per cent and 13.8 per cent in 2022 and 2021 respectively. The biggest spender during the 2023 financial year will be BHP Group Ltd (NYSE: BHP) with a total of US$7.6 billion allocated to its business.

S&P has predicted that investments in the next two years will become more challenging due to rising inflation, high interest rates and slowed economic activity. The market intelligence report estimates that capital expenditures among the top miners will decrease by 1.8 per cent in 2024 and 0.7 per cent the following year.

S&P says the top 10 highest spending mining companies account for 50.8 per cent of the total expenditures of all 30. The world’s largest miners are focused on critical minerals, climate strategy and decarbonization of their operations going forward.

Read more: Calibre Mining Q3 gold production numbers exceed analyst expectations: Canaccord Genuity

Read more: Calibre Mining’s Nicaragua operations will fuel company growth on all fronts: PI Financial

The top five miners discussed in the report

BHP will be primarily focused on funding its Escondida copper mining operation in Chile and iron ore projects in Western Australia, which will account for 71 per cent of the company’s total expenditures during the 2023-2024 fiscal year.

Rio Tinto Ltd (NYSE: RIO) (ASX: RIO) (LON: RIO) will be spending approximately US$7.4 billion this year, with US$1.5 billion allocated to its Salar del Rincon lithium project in Argentina, the Simandou iron ore deposit in Guinea, the Oyu Tolgoi copper-gold mine in Mongolia and other projects.

Rio de Janeiro’s major mining firm Vale S.A. (NYSE: VALE) plans to spend a total of US$6 billion on its projects this year as well and expects its annual costs to remain the same in the next four years.

Anglo American plc (LON: AAL) will spend a total of US$6 billion during 2023, which will include growth spending of US$1.5 billion for an assortment of projects.

Lastly, the Swiss miner Glencore plc (LON: GLEN) (JSE: GLN) will invest US$4.8 billion this year and a total of US$5.6 billion between now and 2025, which will include substantial funding allocated to the the company’s Sudbury nickel operations in Ontario, Canada.

Another report in March from S&P found that global exploration budgets rose by 16 per cent overall in 2022 with non-ferrous metal exploration expenditures totalling approximately US$13 billion, representing a nine-year high. Gold is the driving force behind exploration budgets throughout the globe and copper, nickel and lithium are significant contributors as well, according to S&P.

Certain companies like Calibre Mining (TSX: CXB) (OTCQX: CXBMF) have been increasing their gold exploration budgets in recent days and driving up profitability. Calibre budgeted a substantial sum of $29 million for its exploration endeavours in Nicaragua and Nevada this year and has seen worthwhile returns on its investment.

In Q3 this year, Calibre increased its rate of gold production by 50 per cent year-over-year to 73,485 ounces. The company has increased its cash balance by 72 per cent since the beginning of 2023 and currently has US$97 million on hand.

Calibre’s stock has risen by almost 60 per cent in the past year and is currently trading for $1.46 on the Toronto Stock Exchange. Analysts’ from multiple banks like the Bank of Montreal Financial Group (TSX: BMO), Toronto-Dominion Bank (TSX: TD) and the Bank of Nova Scotia (TSX: BNS) all predict that the company’s stock will be worth between $2.00 and $2.50 within the next 12 months.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com