Canada replaced China in the top spot as the world’s most promising jurisdiction for lithium-ion battery manufacturing, including those used in electric vehicles.

Research organization, BloombergNEF released a support on Monday which ranked Canada above China even though Canada produces barely any batteries. The organization singled Canada out as the best placed of the 30 countries it monitors for the ability to participate in future global battery supply chains.

Ultimately, it came down to the strength of its raw material sector as well as multiple recently announced large cell manufacturing plants compounded by the domestic demand for batteries.

“That doesn’t mean that Canada is better overall than China: What we’re saying is that within the lens of 2023, Canada performed better than China,” said Kwasi Ampofo, BloombergNEF’s head of metals and mining.

The federal government, along with Ontario and Quebec, announced tens of billions of dollars in subsidies to attract battery manufacturing plants (sometimes referred to as gigafactories) and related suppliers, which reflects Canada’s strong showing.

BloombergNEF highlighted recent investments in Canada by major multinational companies, including Ford Motor Company (NYSE: F), Stellantis N.V. (NYSE: STLA), Volkswagen, LG Energy Solutions, and Umicore. Ampofo emphasized that government policy—whether focusing on critical minerals, fostering local adoption of EVs, promoting innovation, or providing subsidies—powerfully influences countries’ relative standings.

BloombergNEF assigns equal weight to five key areas in its rankings: the state of the country’s stocks of raw materials; its ability to produce battery cells and components; demand for batteries from the local market and friendly foreign markets; innovation and infrastructure; and environmental, social, and governance credentials. BloombergNEF argues that global investors covet all five factors.

Read more: Lithium South and POSCO Holdings ink mutual development agreement

Read more: The most misunderstood metal: a lithium roundup

Canada benefits heavily from the Inflation Reduction Act

On August 16, 2022, President Biden signed into law the Inflation Reduction Act (IRA).

Thanks to its tight integration with the U.S. auto sector, Canada experienced powerful benefits from the IRA. It offers lucrative tax credits for battery-related investments and aims to promote “friendshoring,” the practice of shifting production from geopolitical rivals to allies.

This is a considerable boon for Canadian lithium producers like Patriot Battery Metals (TSXV:PMET) and Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ). These companies can take their products from Quebec and Argentina respectively, and receive supply chain assistance from American producers.

Additionally, the IRA also supported the rankings for Mexico and the U.S., which placed 19th and third, respectively. Environmental, social, and governance factors also played a critical role. BloombergNEF found that China’s credibility has always been weak here, whereas Canada’s has been generally strong.

“Whilst other countries are making progress, unfortunately, we have not seen progress across Asia,” Ampofo said. “And that is really what is hurting them.”

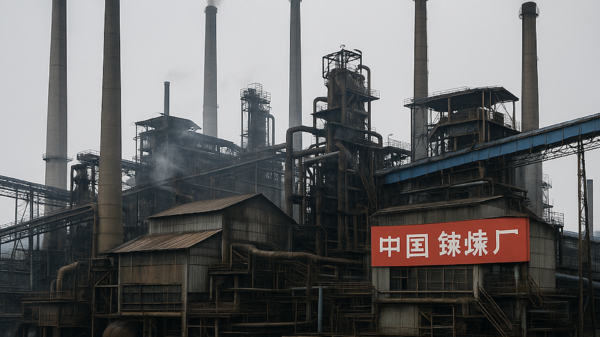

It’s the first time China has been unseated in the four editions for which BloombergNEF has produced the ranking. BloombergNEF found that China’s strained trade relations with important markets such as the U.S. and the European Union, along with policies that thwart international companies from expanding into the Chinese market for electric vehicles, also diminished China’s status this year.

But Ampofo added that the rankings reflect only developments in 2023, and that actions by other countries in this competitive market—or future inaction on the part of Canada—could result in upsets in the years ahead.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com