Calibre Mining (TSX: CXB) (OTCQX: CXBMF) had immense success in 2023, producing a record amount of gold and finishing the year with a stronger balance sheet than it had last January.

The mid-tier gold producer released its production results for the three months and year ending Dec. 31 on Tuesday.

Calibre produced 61,495 more gold ounces in 2023 than the previous year, representing a 27.7 per cent increase. The company reported a 52 per cent increase in its cash balance at the end of the year as well. Calibre produced a total of 283,494 ounces and currently has C$86 million on hand.

For Q4 last year, the company had its fifth consecutive record quarterly gold production, generating 75,482 ounces. Nicaragua produced the majority at 64,963 ounces and Calibre’s Nevada operations yielded 10,519 ounces. More gold ounces will be coming out of Nevada this year with the start of production at the Gold Rock project near the Pan mine.

The miner completed a C$40 million investment in Marathon Gold Corp. (TSX: MOZ) last year and expects to finalize its merger with the Atlantic Canada mining company by the end of the month. Closing the Marathon deal is Calibre’s top priority and once completed the combined company will have an annual cash flow exceeding C$508 million.

“With a healthy balance sheet, strong operating cash flow and available debt, the combined company expects to facilitate seamless construction of the Valentine gold project,” Darren Hall, CEO of Calibre, said. This will be made possible with a continuous flow of exciting discovery and resource-building drill results from Newfoundland & Labrador, Nevada and Nicaragua.

The combination between Marathon and Calibre will create an Americas-focused, high-margin, high-growth, mid-tier gold producer with estimated average annual gold production of approximately 500 koz. $CXB #CalibreMining #GrowingTogether

More information at: https://t.co/sO4vHz5fTy pic.twitter.com/1VYiq5sjHq— Calibre Mining Corp. (@CalibreMiningCo) January 3, 2024

Read more: Calibre Mining’s merger with Marathon Gold deemed ‘tremendous opportunity’

Read more: Calibre Mining joins Mining Association of Canada

High end of 2024 production guidance at 300,000 ounces

Calibre has a series of promising new targets it will be capitalizing on in Nicaragua this year.

“With multiple drill rigs turning across our asset portfolio, our exploration investment continues to yield exciting results in many areas including the discovery of a potential high-grade gold source below the operating Jabali mine and three new target areas near the Libertad mill,” Hall said.

Hall is pleased that the company joined the Mining Association of Canada in 2023. The company has been adhering to the World Gold Council’s responsible mining principles since 2020 as well and has a strong environmental, social, and governance (ESG) framework.

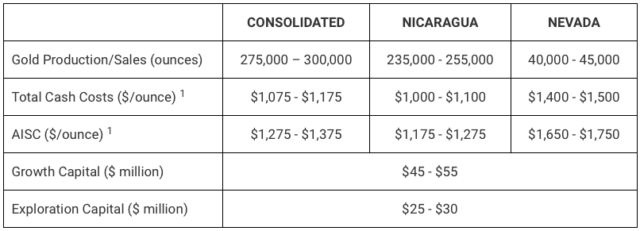

This year, Calibre will produce between 275,000 and 300,000 gold ounces at its Nicaragua and Nevada operations.

“Looking ahead to 2024, we foresee another robust year demonstrated by an increase in annual gold production guidance,” Hall said. He is proud of the company team for its continuous production records and for exceeding last year’s production guidance.

2024 guidance. Table: Calibre Mining

Calibre exceeded production estimates made by analysts from Toronto-Dominion Bank (TSX: TD) in October by almost 10,000 ounces. They predicted that the company would only achieve the high end of its 275,000-ounce production guidance last year.

Calibre will be releasing its 2023 financial results after market close on Feb. 20.

“Given our track record of delivery, production growth, significant high-grade gold discoveries and exploration success, strong cash flow and exciting large-scale open pit development underway with Marathon, I believe Calibre continues to present a compelling gold equity investment opportunity,” Hall said.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com