Calibre Mining Corp (TSX: CXB) (OTCQX: CXBMF) reported a 96 per cent rise in net income for 2023 at US$85 million and exceeded the high end of its production guidance last year by almost 8,500 gold ounces.

The mid-tier producer released its financial and operating results for the quarter and year ended Dec. 31 on Wednesday.

Calibre had its fourth consecutive year of production growth in 2023, producing 283,494 ounces of gold. The company has now set the high end of its 2024 guidance at 300,000.

Income from Calibre’s mining operations rose by about 64.5 per cent year-over-year (YoY) to approximately US$170 million. Operating profit rose significantly as well to US$135 million, a 69.9 per cent increase from 2022.

The company reported a 37.4 per cent rise in annual revenue at US$561.7 million. Meanwhile, the value of Calibre’s total assets rose by 23.3 per cent from 2022 to US$819.57 million. Calibre’s cash balance at year-end increased 52 per cent YoY to US$86 million.

“Throughout the year, the team delivered many milestones, including bringing two new mines into production, and numerous discovery and resource exploration drill results across the portfolio,” CEO Darren Hall said.

“Year over year, Calibre has reinvested into exploration and mine development setting up for sustainable production and growth.”

Read more: Calibre Mining’s new core samples highlight strong resource expansion potential at Valentine

Read more: Calibre Mining results at Valentine Gold Mine show project’s strong potential

Calibre completes Marathon acquisition, first production from Valentine set for 2025

The mid-tier miner completed its takeover of Marathon Gold last month, thereby creating a company that will have annual cash flow exceeding US$508 million. Calibre expects that the Valentine gold mine acquired through the deal will add 195,000 ounces of gold per year to its production yield.

“The recently completed acquisition of the Valentine Gold Mine in Newfoundland & Labrador is transformational as it will establish Calibre as a quality, mid-tier gold producer in the Americas,” Hall said.

Critical components for the mill at Valentine will be arriving by the end of this month, Hall added. Production at Valentine is expected to commence by the end of June next year.

In early 2024, Calibre reported high-grade core samples at the Newfoundland mine indicating strong potential for resource expansion. An intercept with 46.5 g/t gold over 5.3 metres outside of the site’s currently defined mineral reserves was most notable.

Calibre also reported a bonanza-grade grade intercept in Nicaragua at the end of last month, yielding 111.9 g/t gold over 4.1 metres.

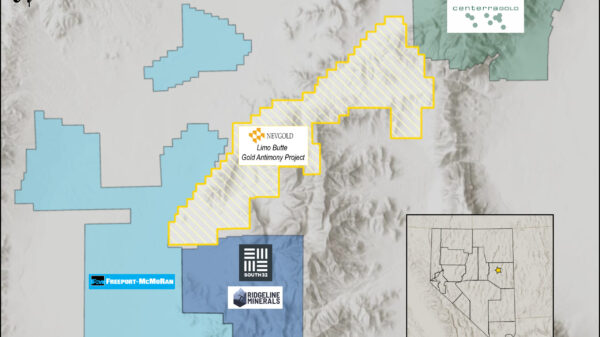

“Particularly exciting is the continued high-grade expansion results along the multi-kilometre VTEM Panteon Gold Corridor within the Limon Complex [Nicaragua],” Hall said.

Calibre has shown consistently favourable financial and operating results from the time it acquired its Nicaraguan assets from B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) in 2019.

The company is proud to have joined the Mining Association of Canada last year.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com