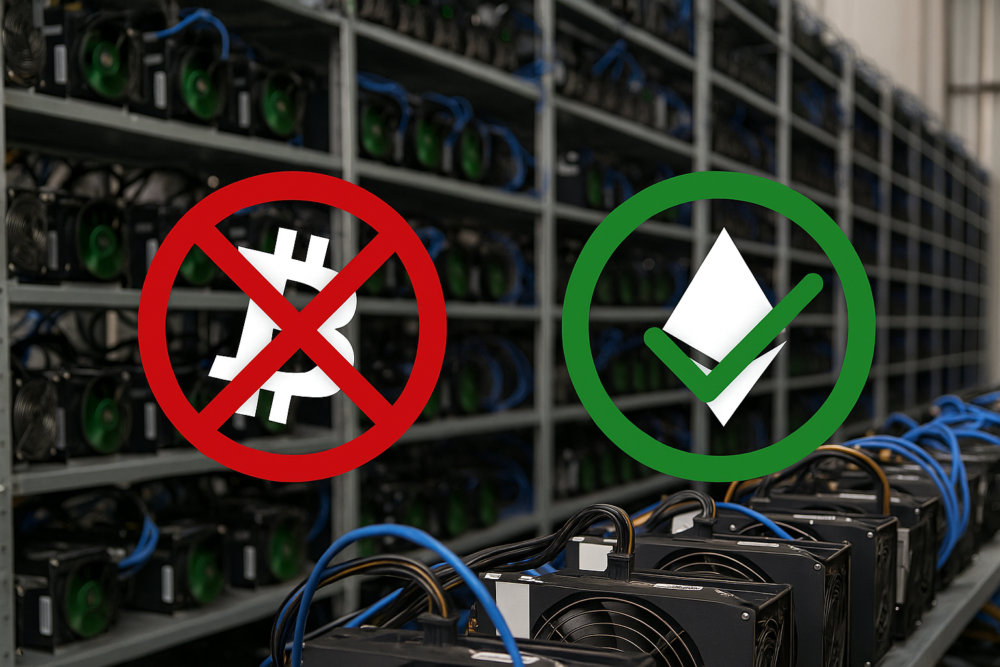

Bit Digital Inc (NASDAQ: BTBT) is transitioning away from Bitcoin mining and moving solely into becoming an Ethereum staking and treasury company.

The company said on Thursday it had priced an underwritten public offering of 75 million shares at $2 each to raise $150 million in proceeds before expenses to help the transition.

The New York-based digital assets firm plans to use net proceeds from the offering to purchase Ethereum. Further, this move aligns with its recent shift to a pure-play Ethereum staking and treasury company.

The firm began accumulating Ethereum and building staking infrastructure in 2022. As of March 31, it held 24,434.2 ETH and 417.6 BTC. The Ethereum was valued at approximately USD$44.6 million. The Bitcoin holdings were worth about USD$34.5 million. Additionally, the company continues to expand its Ethereum-focused strategy.

Bit Digital said it also plans to gradually convert its Bitcoin holdings into Ethereum. It has also launched a strategic alternatives process for its Bitcoin mining operations, which it expects to either sell or wind down. Proceeds from any divestitures will also be reinvested into Ethereum.

Additionally, the company granted underwriters a 30-day option to purchase up to 11.25 million additional shares. The company anticipates the offering to close on or about June 27, subject to customary closing conditions.

Separately, Bit Digital announced that its high-performance computing subsidiary, WhiteFiber Inc., has confidentially submitted a draft registration statement to the US Securities and Exchange Commission. This filing relates to a potential initial public offering. Details on timing, pricing, and share count remain undisclosed.

Read more: Israel based hacker group steals millions from Iran’s largest cryptocurrency exchange

Read more: Hive Digital levels up Bitcoin mining by passing the 10 exahash per second mark

Proof of Stake is more energy-efficient and scalable

The reasoning behind Bit Digital’s shift lies in the consensus mechanisms of the two cryptocurrencies.

Proof of Work (PoW) and Proof of Stake (PoS) are two consensus mechanisms validators use to approve transactions and secure blockchain networks. PoW, used by Bitcoin, requires miners to solve complex mathematical puzzles using high-powered computers. This process consumes large amounts of electricity and hardware resources.

In contrast, PoS, which Ethereum adopted after its 2022 transition known as “The Merge,” allows validators to secure the network by locking up a certain amount of cryptocurrency as collateral. Validators are randomly selected to propose and verify new blocks, making PoS significantly more energy-efficient and scalable than PoW.

Bit Digital’s decision to transition from Bitcoin to Ethereum reflects this fundamental shift. The company began building Ethereum staking infrastructure in 2022, anticipating Ethereum’s move to PoS and the broader market trend toward sustainability. Furthermore, staking presents a cleaner and more flexible alternative.

Additionally, PoS generates a recurring yield in the form of staking rewards, offering Bit Digital a more predictable revenue stream than the volatile returns from Bitcoin mining. The company has launched a strategic alternatives process for its Bitcoin mining operations, which it now plans to wind down or divest.

The company will re-invest proceeds Ethereum, aligning with its new identity as a pure-play Ethereum staking and treasury company. This pivot positions Bit Digital to benefit from Ethereum’s growing ecosystem. It also helps to sidestep the increasing costs and environmental concerns tied to PoW mining.

.