Big Ridge Gold‘s (TSXV: BRAU) new mineral resource estimate for its Hope Brook project in Newfoundland and Labrador doubles the inferred contained gold estimate from 2015.

The total indicated gold ounces bumped up 43 per cent while the total inferred gold ounces increased 110 per cent since First Mining Gold (TSX: FF) made estimates in 2015. Big Ridge acquired the property from First Mining in 2021.

“Our updated 2023 mineral resource estimate dramatically increases the estimated gold ounces in both the indicated and inferred categories when compared to the April, 2021, mineral resource estimate,” said Mike Bandrowski, Big Ridge’s president and CEO.

The deposit is 75 kilometers east of Port aux Basques.

It’s the site of a former open pit and underground mine which produced 750,000 gold ounces between 1987 and 1997.

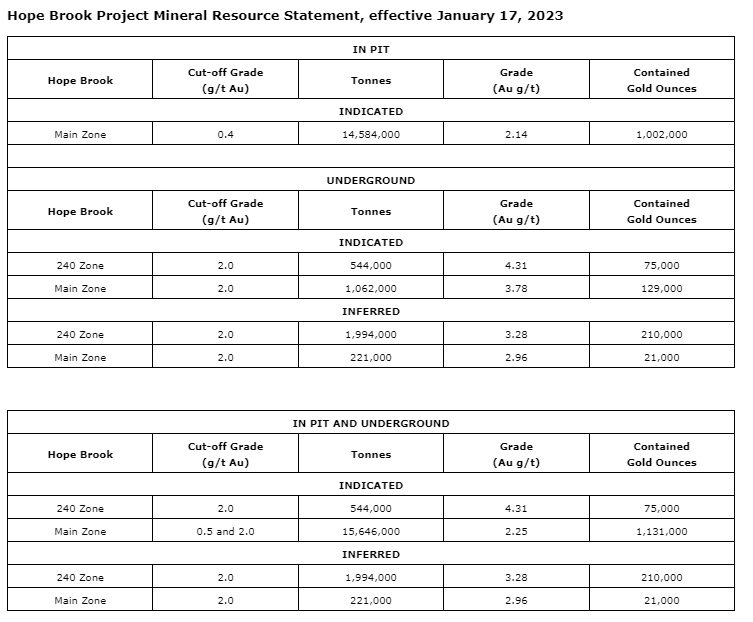

The property sports 1.2 million ounces grading 2.32 grams per tonne of gold in indicated, and 231,000 ounces grading 3.24 g/t Au in inferred categories. The open-pit mineral resource estimate has one million ounces grading 2.14 g/t Au in indicated.

Also, a 43 per cent increase in total indicated ounces and 110 per cent increase in total inferred ounces compared with the mineral resource estimate released April, 2001.

The new resource estimate considers open-pit mining and identifies certain in-pit resources at a cut-off grade of 0.4 g/t Au and out-of-pit resources accessible by underground mining at a cut-off grade of 2 g/t Au.

Read more: NevGold’s oxide gold drill program in Nevada finds positive results

Read more: NevGold submits exploration and expansion plans for gold project in Nevada

Big Ridge plans detailed exploration of several targets

The old 2015 estimate showed Hope Brook held an indicated gold resource of 5.5 million tonnes with a grading of 4.8 g/t for 844,000 ounces. Also, inferred resources showing 836,000 tonnes with grading 4.1 g/t for 110,000 ounces. This was based on a three gram per tonne cut-off grade and a long-term gold price of $1,200.

It took Big Ridge less than two years to make a significant impact at Hope Brook. Subsequently, the company anticipates starting testing some of the regional targets the team identified in 2022.

The next priority involves continued drilling in the Main zone towards the southwest and 240 zone at depth.

“The old resource was based on an underground scenario,” said Bandrowski. “Today’s announcement contemplates both options but the majority as an open pit.”

Chart via Big Ridge.

The difference between inferred and indicated resources are degrees of confidence.

Indicated estimates are more accurate than inferred estimates. Consequently, this is because they’re based on more detailed geological data and more closely spaced drill holes.

Indicated resources are considered to have a reasonable expectation of economic viability given present market conditions and mining technology. Inferred resources, on the other hand, are estimated based on limited geological information and widely spaced drill holes. They therefore come with a lower grade of confidence.

Big Ridge’s future includes detailed exploration of several targets, including Old Man’s Pond, Woodman’s Droke, Phillips Brook and Cross Gulch. It also wants to explore lithium potential along the 30 kilometer Bay d’Est fault structure on Hope Brook’s northern boundary.

The 260 square kilometer project includes a 28 person camp, as well as a 1,100 meter airstrip, an ice-free docking facility and a substation linked to the provincial power grid.

Big Ridge Gold is trading at $0.12 on the TSX Venture Exchange.

Follow Joseph Morton on Twitter

joseph@mugglehead.com