B2Gold Corp. (TSX: BTO) (NYSE: BTG) picked up a 9.99 per cent equity position in Canadian junior Prospector Metals Corp. (TSXV: PPP) (OTCQB: PMCOF) (Frankfurt: 1ET) for CAD$900,000.

Announced on Monday, the deal included B2Gold purchasing approximately 5.6 million shares.

Additionally, Troilus Gold (TSX: TLG) has the right to buy approximately 4.77 million shares at the same offer price, allowing it to maintain a 19.9 per cent ownership. This right remains valid for 10 business days.

The company will use the proceeds from the investment for the exploration and development of its ML project in Yukon. The property, covering 47.6 km² of the Tintina gold belt, is located about 80 km from Dawson City and 25 km northeast of the former Brewery Creek gold mine.

According to Prospector’s website, the ML property hosts one of the few remaining Tombstone-style intrusions in the Yukon that has not been systematically explored, with no significant work completed since 2008. Consequently, no one has applied modern intrusion-related gold exploration models to ML, despite the presence of a diagnostic geochemical signature.

Previous exploration focused on well-exposed gold-copper-tungsten skarn mineralization proximal to syenite intrusions, but explorers did little work within the intrusions. The company believes there are over two dozen known high-grade gold surface occurrences that have never been tested.

Prospector has obtained CAD$12 million worth of historical geological data, which includes 6,700 meters of drilling over 117 holes, with results highlighted by 3.53 g/t gold and 0.29 per cent copper over 56.39 meters.

Read more: Calibre Mining shareholders approve all matters at annual general meeting

Read more: Calibre appoints seasoned Senior VP & CFO Daniella Dimitrov

Acquisition is part of a larger strategy

This news comes as part of a larger strategy of investment and divestment for B2Gold.

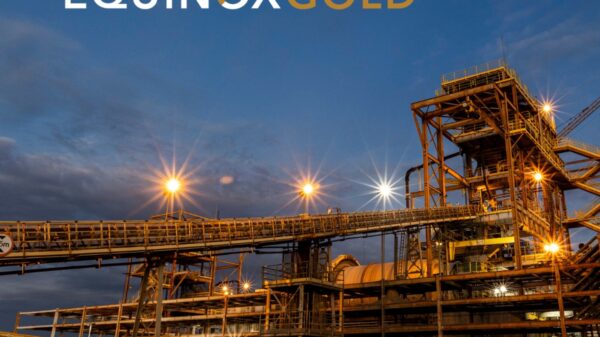

Late last month, the company reduced its ownership stake in Calibre Mining Corp (TSX: CXB) (OTCQX: CXBMF).

B2Gold reduced its percentage stake to under 10 per cent of Calibre’s common shares. This decrease in ownership also reduces B2Gold’s influence on Calibre. Furthermore, B2Gold is no longer bound under insider reporting requirements and is no longer obligated to file reports when buying or selling Calibre securities.

For reference, Calibre Mining acquired its Nicaragua assets from B2Gold on October 15, 2019. The acquisition included the El Limon and La Libertad gold mines, along with the Pavon gold project and other mineral concessions in Nicaragua, for a total of USD$100 million in cash, shares, and a convertible debenture.

Calibre Mining is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com