Quebec’s Azimut Exploration Inc. (TSX-V: AZM) (OTCQX: AZMTF) has inked an agreement with the Canadian subsidiary of Rio Tinto Group (LSE: RIO) (ASX: RIO) for a joint venture at two lithium properties in the province valued at $115.7 million.

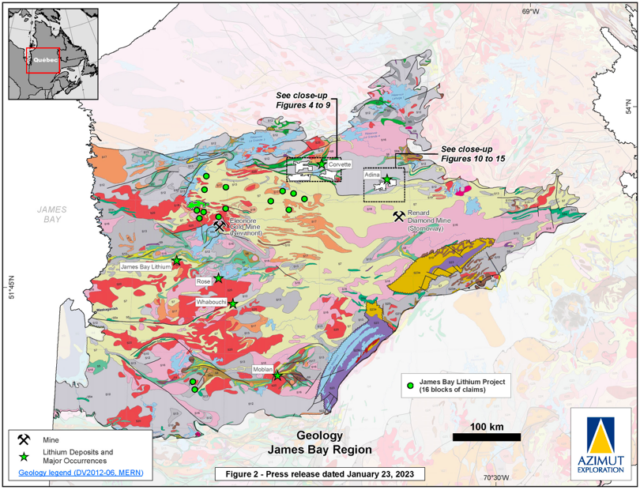

The companies announced the signing of the two option to joint venture agreements for the Corvet and Kaanaayaa properties in Quebec’s James Bay region on Monday, which span a total of 639 square kilometres.

Through the agreements, Rio Tinto has the opportunity to acquire an initial 50 per cent stake in each of the properties from Azimut within a span of four years. To accomplish this, Rio Tinto must finance $7 million in exploration expenses and make cash payments totaling $850,000 per property ($14 million in expenditures and $1.7 million in payments in total).

An upfront payment of $250,000 per property is required upon signing. Azimut will act as the operator during this initial option phase. The start of exploration expenses and cash payments, including a firm commitment of $1.5 million per property in the first 12 months, will occur once the wildfire restrictions in Quebec are lifted.

During a subsequent option phase, Rio Tinto can gain an additional 20 per cent interest over five years by conducting additional work expenditures amounting to $50 million per property, a combined total of $100 million. Rio Tinto will take on the role of operator during this phase.

If Azimut chooses, it has the right to receive funding for production through a secured loan from Rio Tinto. In return, Rio Tinto will be granted an additional 5 per cent interest in the properties, bringing its total interest to 75 per cent.

The primary focus of the exploration program in the first year will be an intensive assessment and testing of the lithium potential of the properties, with a budget of $1.5 million per property.

James Bay map. Photo via Azimut Exploration

Read more: NevGold discovers new untested areas at Limousine Butte

Read more: NevGold discovers oxide gold from the surface at Nutmeg Mountain

The Corvet property encompasses an exploration opportunity characterized by a substantial and prominent lithium anomaly spanning a distance of 26 kilometres in lake sediments. This anomaly is accompanied by significant footprints of cesium, rubidium, gallium and tin.

Detailed analyses of multi-element lake sediment geochemistry have revealed the presence of numerous anomalies containing lithium, cesium, rubidium and gallium at the Kaanaayaa property as well.

The exploration programs being undertaken through the agreements will focus on identifying lithium-cesium-tantalum pegmatites but both of the properties have significant potential for intrusion-related gold, copper, nickel and cobalt mineralization as well.

Azimut is also currently advancing two other lithium projects in the province through a joint venture with SOQUEM.

Toronto’s Avalon Advanced Materials Inc. (TSX: AVL) (OTCQB: AVLNF) acquired an industrial site in neighbouring Ontario last month to establish a lithium processing plant, another significant recent development in the Canadian lithium industry. The company announced Monday that it had signed a partnership agreement for the plant’s development with Metso Corporation.

Other lithium companies operating in Quebec include Vancouver’s Lithium One Metals Inc. (TSX-V: LONE) (FSE: H490) (OTCQB: LOMEF), Piedmont Lithium (Nasdaq: PLL) (ASX: PLL) and Ontario’s Stria Lithium Inc. (TSX-V: SRA).

Azimut shares rose by 4 per cent Monday to $1.30 on the TSX Venture Exchange.

Rio Tinto’s stock dropped by 1.14 per cent to C$97.94 on the Australian Securities Exchange.

rowan@mugglehead.com