Colombia’s National Mining Agency (ANM) has denied Anglogold Ashanti PLC (NYSE: AU) request to suspend its obligations for the USD$1.4-billion Quebradona copper-gold project, deepening uncertainty around one of the country’s most controversial mining ventures.

The agency confirmed this week it had received two petitions from the company earlier this year. The first is to extend its exploration phase and another to pause contractual duties under its mining title. Both were rejected. Officials explained that granting both requests would create a legal contradiction, as suspending obligations while extending exploration rights is incompatible under Colombian law.

The ANM also ruled that AngloGold did not present enough proof to justify the force majeure conditions it claimed. The decision marks another setback for the Quebradona project, which has been stalled since 2021 after the national environmental authority (ANLA) shelved its permit due to technical and environmental concerns.

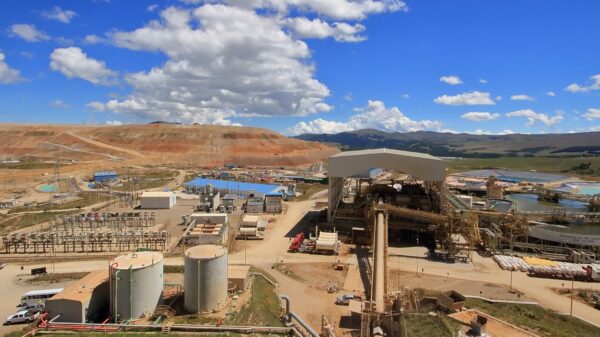

Located in the Cauca Medio region of Antioquia, 60 kilometres southwest of Medellín, the project has faced years of scrutiny. In 2022, ANLA upheld its earlier decision, citing ongoing risks to local ecosystems, including the fragile Jericó watershed. AngloGold has pledged to prepare an environmental impact assessment (EIA). It also said it is gathering hydrological, hydrogeological, and geotechnical data requested by regulators. The miner expects to resubmit the updated study by 2027.

AngloGold’s long-term plan envisions producing 1.4 million tonnes of copper, 1.4 million ounces of gold, and 21.6 million ounces of silver over two decades. However, opposition from residents and environmental groups continues to cast doubt on the project’s future.

Read more: NevGold Expands Gold-Antimony Potential at Limousine Butte in Nevada

Read more: GoldMining chooses to retain its NevGold shares for next 18 months

Colombia has only one large-scale copper mine

Tensions between the company and local communities have worsened in recent years. In late 2023, AngloGold launched a lawsuit against a group of farmers and activists, accusing them of kidnapping, theft, and personal injury during protests.

One demonstration reportedly involved locals halting unauthorized excavations and alerting officials. In another instance, more than 150 farmers entered company property, removed drilling equipment, and handed it over to authorities.

Furthermore, Colombia currently has only one large-scale copper mine, El Roble, operated by Canada’s Atico Mining (CVE: ATY) in Chocó. Although at least eight other copper projects are under development, changing regulations have created new hurdles. New environmental frameworks, agricultural protection zones, and potential resource reserve designations have all complicated future investment decisions.

Globally, analysts estimate that about 6.4 million tonnes of copper output amounting to roughly one-quarter of current global supply is tied up in projects delayed by environmental, social, and governance (ESG) challenges. Consequently, Quebradona’s fate could influence Colombia’s ability to attract further investment in critical minerals.